- Customer Service 866-837-3065 Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

Professional debt collection agencies bring focused expertise that dramatically improves recovery outcomes. This allows you to redirect your energy toward running your business rather than chasing down payments. The specialized training and experience that collection professionals possess translates directly into higher recovery rates and faster resolution times.

Partnering with a professional collection agency provides businesses with substantial legal advantages. Collection agencies are experienced with Texas debt collection laws, including the Texas Debt Collection Act and federal regulations such as the Fair Debt Collection Practices Act (FDCPA). This knowledge protects your business from costly compliance violations that could result in lawsuits or penalties.

Third-party collectors also create a valuable buffer between your business and the debtor, as your company maintains the “good cop” position. At the same time, the collection agency applies appropriate pressure, helping preserve valuable client relationships for future business once the debt situation resolves.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

Top Debt Collection Agencies in Frisco, TX

1. Southwest Recovery Services

With over 20 years of experience, Southwest Recovery Services has established itself as a trusted partner for Frisco businesses across diverse industries. Our Dallas headquarters, located in nearby Addison, allows us to provide personalized service to the entire DFW metroplex, including Frisco’s thriving business community.

We specialize in commercial debt recovery using a comprehensive approach that combines persistent yet diplomatic communication, advanced skip-tracing capabilities, and legal support when needed. Our collectors are trained to recover your funds while preserving the professional relationships you’ve worked hard to build. We understand that your clients may become customers again, so we approach every case with respect and professionalism.

We operate exclusively on a contingency basis, meaning you only pay when we successfully recover your money. There are no upfront fees, monthly retainers, or hidden charges. Our client portal provides 24/7 access to real-time updates on all collection activities, giving you complete visibility into the recovery process from start to finish.

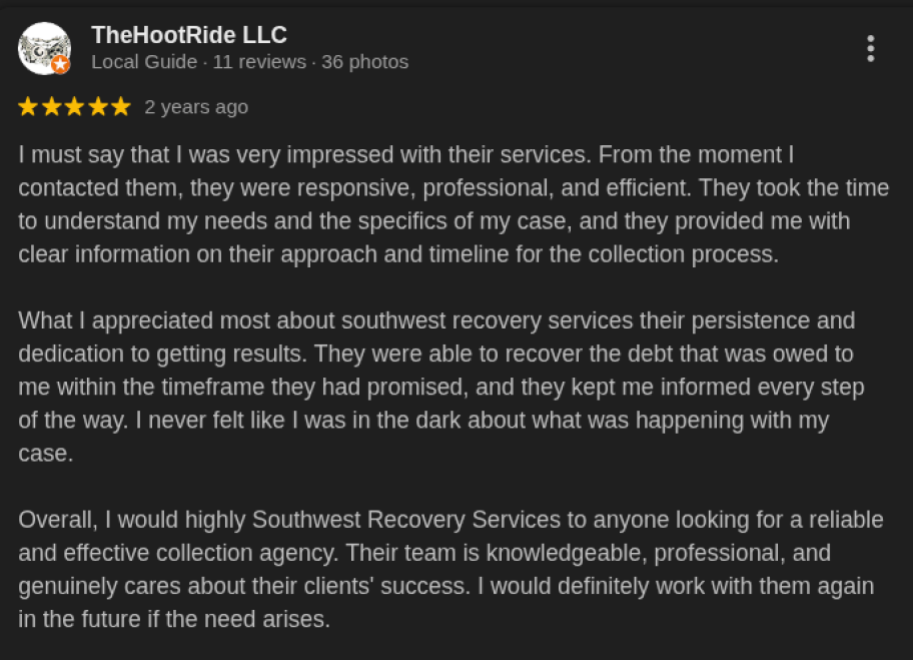

Our customer reviews highlight the patience and understanding our staff demonstrates. Our clients appreciate that we lend a listening ear to their unique situations and work out plans they can afford.

Many customers describe conversations with our staff as being respectful and helpful. Our ability to achieve amicable debt collection and resolution is something our clients appreciate, especially given the care we take to ensure relationships are not damaged.

Founded in 2009, Melton Norcross & Associates specializes in commercial debt collection with a particular focus on the oil and gas industry. Based in Frisco, Texas, the company serves clients across multiple industries throughout the United States.

The agency operates exclusively on a contingency basis and maintains a nationwide network of collection attorneys for accounts requiring legal action. The company claims to emphasize a personalized approach focused on oil and gas mineral liens, commercial litigation, and asset investigations.

Reviews are positive, with clients praising the company’s effectiveness in recovering bad debts and professional communication throughout the process.

Multiple reviewers report successful debt recovery, with one client paid in full on the first day after months of unsuccessful self-collection attempts. Business clients appreciate the multi-state collection capabilities, with several noting that every forwarded account has been settled.

Foster & Morris operates exclusively in the commercial B2B debt collection space. The company distinguishes itself by focusing solely on business-to-business debt, which means its collection efforts are not subject to the FDCPA.

The agency has developed particular expertise in construction-related debt recovery, including lien filing services and prelien notices. Foster & Morris works entirely on a 100% contingency fee basis, operating under a “no collection, no charge” model.

The company provides comprehensive investigative reports on debtors’ businesses, including asset searches, vendor analysis, and liability assessments.

Reviews are consistently positive, with clients highlighting the company’s ability to resolve complex and stalled collection cases.

Multiple reviewers report quick results, with one client noting that Foster & Morris successfully resolved a case that had been stalled for a year despite filing a lien through an attorney and involving the local DA office.

Debt collection agencies in Frisco primarily operate on a contingency-fee structure, in which they receive 10-25% of successfully recovered funds. This percentage varies based on several factors: fresher accounts under 90 days command lower fees, while debts that are 180 days old or older incur higher rates. Balance size also matters: smaller debts carry higher percentage fees due to fixed effort requirements, while larger invoices receive lower rates.

Businesses placing multiple accounts simultaneously often qualify for volume discounts, while complex cases requiring skip-tracing or legal action may increase costs. While alternative options exist, including flat-fee programs and attorney contingency fees for legal action, the standard contingency model remains the most popular among Frisco businesses.

Businesses appreciate agencies that provide regular, clear updates without requiring constant follow-up. The best agencies maintain client portals offering 24/7 access to account status, collection notes, and payment tracking. This transparency allows you to monitor progress and make informed decisions about your receivables.

Reputation and long-term relationships matter in business. Clients consistently highlight agencies that recover debts without destroying potential future business opportunities. Many B2B relationships survive payment disputes, and aggressive tactics can permanently damage these connections. The right agency understands this balance and recovers funds while maintaining professional courtesy.

Recovery performance determines an agency’s value. However, success rates vary significantly by account age; accounts under 90 days old often see better recovery outcomes than accounts that have lasted more than a year, though results vary by individual circumstances. Strong compliance with federal and Texas state collection laws protects your business from legal risks while ensuring ethical treatment of debtors.

With over 20 years of commercial collection experience, we specialize in B2B invoice recovery for companies with revenues between $10 million and $100 million. We operate exclusively on contingency with no upfront costs and no monthly fees. Our contingency rates fall within the 10–25% range, varying based on account age and complexity, ensuring you receive maximum value from every recovered dollar.

Our proprietary AI-guided tracking system monitors every promise to pay across phone, email, text, and mail communications. The daily involvement of our founder provides quality oversight that larger, more impersonal agencies cannot match.

We also use respectful omnichannel outreach that recovers funds without burning bridges. Our veteran collectors receive specialized training in relationship-preserving communication. We understand that today’s debtor could be tomorrow’s customer, so we maintain professionalism throughout every interaction.

As a nationally recognized ethical collections agency with 12 offices across six states, we bring both local market knowledge and nationwide reach. We maintain a compliance-first approach, with strict adherence to Texas and federal debt collection regulations. Our processes involve no threats, no unrealistic promises, just professional, persistent communication backed by legal expertise when escalation becomes necessary.

Frequently Asked Questions (FAQs)

Collection timelines vary significantly based on account age and debtor responsiveness. For accounts less than 90 days past due, some businesses begin seeing initial results within 30–45 days of agency placement, though timelines vary significantly by case. Older accounts typically need longer timelines and persistent effort.

If litigation becomes necessary, cases can extend 6–18 months depending on court schedules. The best agencies provide regular updates throughout the process so you always know where your account stands.

Yes, reputable Frisco agencies maintain multi-state collection capabilities and partner with local attorneys when necessary. They understand the varying state laws on statutes of limitations and collection practices, ensuring compliance across all jurisdictions.

Southwest Recovery Services operates nationwide, with 12 offices across six states, providing seamless collection services wherever your debtor is located.

Comprehensive documentation significantly increases collection success rates. Provide copies of all invoices, contracts establishing the business relationship, proof of delivery or service completion, and records of all payment attempts and communications.

Additional helpful documentation includes credit applications, personal guarantees from business owners, and correspondence in which the debtor acknowledges the debt. The more documentation you provide, the stronger your case becomes.

Commercial collection agencies specialize in B2B debt and operate under different regulatory frameworks than consumer collectors.

They employ sophisticated business analysis techniques, understand corporate payment decisions involving multiple stakeholders, and maintain professional approaches focused on preserving business relationships while achieving maximum recovery.

Commercial collectors also typically handle larger dollar amounts and more complex payment arrangements.

With over 20 years of proven experience and with a contingency-only pricing model that eliminates financial risk, Southwest Recovery Services provides immense value for businesses across Texas. Our AI-guided tracking system, combined with our founder’s daily participation, ensures personalized attention to every account.

We specialize in relationship-preserving collection approaches that recover funds without damaging future business opportunities. With 12 offices across six states and specialized expertise in trucking, logistics, contractors, and oil & gas, we provide both local market knowledge and nationwide reach.

*Note: Recovery rates mentioned are for general reference only and not guaranteed. Actual results vary by account and industry. Contact Southwest Recovery Services for a customized quote.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.