- Customer Service 866-837-3065 Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

When tenants fall behind on rent payments, landlords face mounting pressure. Unpaid rent doesn’t just represent lost income; it threatens the ability to cover mortgage payments, property maintenance, insurance, and operational costs. A single tenant in arrears can disrupt cash flow across your entire portfolio.

Many landlords initially attempt to collect rent arrears themselves through phone calls, reminder notices, and direct negotiation. While this approach sometimes works for short-term payment delays, persistent arrears often require professional intervention.

The challenge intensifies when dealing with tenants who’ve stopped communicating, moved without notice, or dispute the amounts owed. Professional debt collection agencies specializing in rent arrears bring the expertise, resources, and legal knowledge necessary to recover these debts while protecting your interests.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

Why Landlords Choose Professional Collection Agencies

Attempting to collect rent arrears independently consumes enormous amounts of time and energy that could be better spent managing properties, screening new tenants, and growing your rental business. Some benefits of choosing professional collection agencies include:

Collection agencies handle all aspects of the recovery process, including initial contact attempts, negotiation, payment arrangement setup, and follow-through on commitments. This frees you from the frustration of repeated unsuccessful calls, ignored emails, and broken payment promises.

Debt collection laws are complex and constantly evolving. Violations of the Fair Debt Collection Practices Act or state-level regulations can result in lawsuits against creditors. Reputable agencies maintain compliance departments that ensure all communications and collection activities follow legal requirements, protecting you from liability.

Professional collectors understand which communication strategies work best at different stages of delinquency. They know when to be firm, when to offer flexible payment arrangements, and how to present consequences without making illegal threats.

When you personally pursue rent arrears, every collection conversation can feel confrontational. Professional agencies serve as neutral third parties, separating the financial dispute from personal relationships. This approach is particularly valuable when you want to maintain your reputation in the local rental community.

With over 20 years of experience in B2B and commercial debt collection, Southwest Recovery Services (SWRS) has developed specialized expertise serving property managers and landlords nationwide. We operate exclusively on a contingency basis, ensuring landlords face zero upfront costs.

We emphasize respectful communication strategies that balance assertiveness with professionalism. Our veteran collectors understand that today’s delinquent tenant might become tomorrow’s reliable renter in another part of your portfolio.

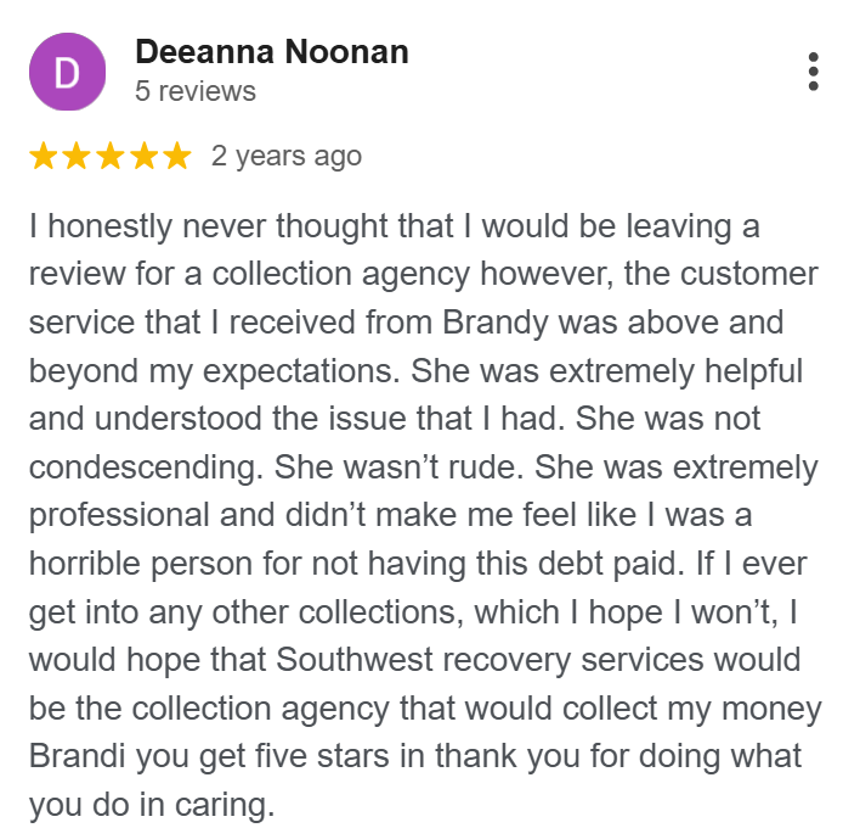

We have received consistent praise from satisfied customers who highlight the professionalism and compassion of our staff members. Multiple reviewers specifically commend representatives such as Toni Jackson, Leslie H., Lisa H., Brandi Lynn, and Sawyer for their attentive, kind, and understanding approach to customer service.

Founded and headquartered in Spring Valley, New York, Fair Capital operates as a nationwide debt collection agency specializing in B2B accounts. The agency serves diverse industries and works with both domestic and international clients. They emphasize legal compliance and guide clients on proper collection protocols.

Fair Capital receives overwhelmingly positive reviews, maintaining a 4.9-star rating on Google, based on 44 reviews. Customers consistently praise the agency for its professionalism, courtesy, and efficiency in debt recovery. Reviewers highlight the team’s fast response times, clear communication, and ability to collect on accounts that clients had pursued unsuccessfully for extended periods, sometimes recovering payments within days or weeks. Several reviews mention that Fair Capital does not always report to credit bureaus, which is viewed favorably by those resolving debts.

Founded in 1973 and headquartered in Michigan, AAB serves landlords nationwide with contingency-based collection services. They report to all three major credit bureaus bi-weekly and maintain an average collector experience of 18+ years.

Account Adjustment Bureau receives mostly positive reviews, with customers praising staff for being patient, professional, and respectful during debt resolution. Reviewers appreciate clear communication and a compassionate approach that makes an otherwise stressful process easier.

Some customers report occasional confusion around credit reporting, difficulty reaching representatives, or disagreements about the accuracy of certain charges.

The documentation you provide directly impacts recovery success rates. Complete, organized records make the agency’s job easier and increase the likelihood of full debt recovery.

Every rent arrears case should include:

Supporting materials that strengthen your case include evidence of service delivery, photographic evidence of property condition at move-out, bank records showing bounced checks or returned ACH payments, and any written acknowledgment from the tenant about owing rent.

While professional collection agencies provide valuable recovery assistance, prevention remains more effective and less costly than remediation.

Comprehensive tenant screening represents your first line of defense against rent arrears. Conduct credit checks, verify employment and income, contact previous landlords, and review rental history. Tenants with histories of evictions or poor payment history pose a higher risk.

Your lease agreement should explicitly state rent amounts, due dates, accepted payment methods, grace periods, late fees, and consequences for non-payment. Make sure tenants understand these terms before signing.

Implement systems that flag late payments immediately. Contact tenants as soon as rent is overdue, before minor problems become significant arrears. Many payment issues can be resolved quickly when addressed early.

Encourage automated payments via the Automated Clearing House (ACH) or recurring credit card charges. Automated payments reduce the likelihood of forgotten due dates and ensure rent arrives on schedule.

At Southwest Recovery Services (SWRS), we bring over 20 years of B2B collection experience. Our veteran collectors understand landlord-tenant relationships and use respectful communication strategies that maximize recovery while minimizing relationship damage.

The proprietary AI-powered tracking system that we use ensures reliable follow-through on every account. Every interaction is documented and tracked, with software monitoring payment promises and automatically triggering appropriate follow-ups. Daily founder involvement provides accountability and quality control throughout the collection process.

Our contingency-only pricing model eliminates all upfront costs and financial risk. You pay nothing to engage our services, and you only pay a percentage of what we successfully recover.

With 12 offices across six states and national coverage, we can pursue rent arrears collection nationwide. We employ a compliance-first approach, multi-channel communication strategies, and focus on ethical collection practices, making us an ideal partner for landlords seeking professional assistance with rent arrears recovery.

Most property managers should attempt internal collection for 30 to 60 days after rent becomes past due before engaging a professional agency. This timeframe gives your payment reminders and direct contact attempts a reasonable opportunity to succeed while the debt remains relatively fresh.

However, recovery rates decline significantly as debts age. Once tenants have vacated the property and become harder to locate, immediate referral to a collection agency often makes sense.

Professional agencies like Southwest Recovery Services approach rent arrears cases as neutral third parties, separating the financial dispute from ongoing rental relationships. When agencies employ respectful communication and offer flexible payment arrangements, many landlord-tenant relationships can survive the collection process.

The key is partnering with an agency that understands relationship preservation matters in the property management industry.

Professional agencies employ skip-tracing techniques and have access to specialized databases that help locate former tenants, even when they’ve moved without forwarding their addresses.

If extensive skip tracing efforts fail to locate the debtor, the agency may recommend alternative approaches, including credit bureau reporting, periodic re-skip attempts as new information becomes available, or potentially writing off the debt if recovery becomes truly impossible.

Yes, collection agencies can pursue rent arrears for current tenants, though the approach differs from post-vacancy collection. While a tenant remains in the unit, you must avoid actions that could be construed as illegal eviction attempts or harassment.

Professional agencies understand these boundaries and can communicate with current tenants about payment arrangements while you pursue any necessary eviction proceedings through proper legal channels.

Southwest Recovery Services offers property managers and landlords a compelling combination of specialized B2B expertise, relationship-preserving collection strategies, and risk-free contingency pricing.

With over 20 years of commercial debt collection experience and advanced AI-powered tracking systems, we ensure every rent arrears case receives personalized attention and consistent follow-through.

*Note: Recovery rates mentioned are for general reference only and not guaranteed. Actual results vary by account and industry. Contact Southwest Recovery Services for a customized quote.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.