- Customer Service 866-837-3065 Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

Plano has established itself as a major business hub in North Texas, hosting the corporate headquarters of major companies and thousands of small- to mid-sized businesses across diverse industries. This thriving commercial environment inevitably creates situations in which companies face overdue invoices and difficult collections.

When a business customer stops paying their invoices, companies face a critical decision: continue spending internal resources on collection efforts or partner with a professional agency. Commercial collection agencies specialize in recovering business-to-business debts efficiently while preserving the professional relationships that matter in competitive industries.

Unlike consumer collections, commercial debt recovery requires understanding business operations, corporate structures, and the nuances of B2B relationships. The best agencies in Plano recognize that today’s difficult account might become tomorrow’s valuable customer again once financial circumstances improve.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

We are a nationally recognized leader in financial business process outsourcing and accounts receivable management, operating twelve strategically located offices across six states: Texas, Georgia, Missouri, Florida, Oklahoma, and Ohio.

Our reputation is built on ethical, professional, and diplomatic debt collection services for businesses of all sizes across nearly every industry sector. Working exclusively on a contingency basis means we don’t get paid unless you do, directly aligning our success with yours.

We invest heavily in state-of-the-art technology to maximize productivity while minimizing costs, and our professional recovery agents are trained in industry best practices. We maintain full compliance with FDCPA, FCRA, HIPAA, CFPB, and all applicable state regulations.

Through customized workflows, each account receives tailored handling by experienced professionals to maximize recovery while protecting client reputations and preserving business relationships.

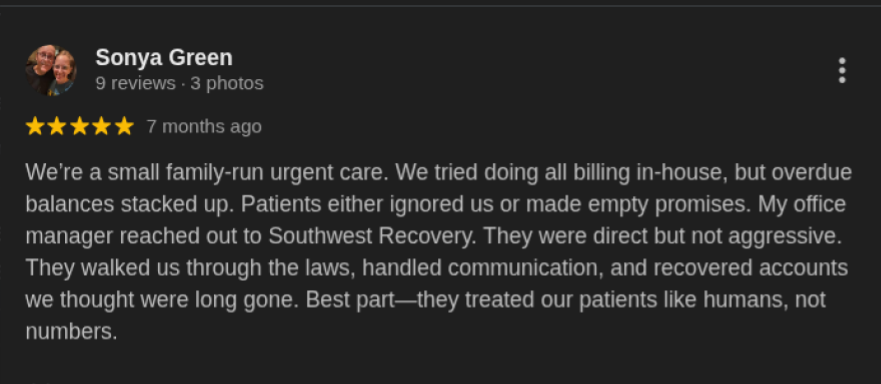

Reviews show our users praising our staff for being respectful, patient, understanding, and going above and beyond to work with people facing debt. Business client reviews highlight successful revenue cycle management, improved collections for a family-run urgent care, and the ability to track accounts online.

One long-time business client praises our founder’s politeness and agents’ active pursuit of owed money. Overall, it is evident that we distinguish ourselves through compassionate customer service when dealing with debtors, which is uncommon in the collections industry.

Edward Wolff & Associates specializes in commercial debt collection, arbitration, and litigation services from their Plano, Texas headquarters. The company’s business-to-business debt recovery solutions include both domestic and international collection, receivables management, skip tracing, and asset location services.

They operate on a competitive contingency basis with no hidden fees, ensuring clients only pay when debts are successfully recovered. As active members of ACA International and the International Association of Commercial Collectors (IACC), the firm maintains longstanding relationships with collection attorneys throughout the United States to effectively implement legal action when necessary.

Positive reviewers praise specific staff members for professionalism, quick debt recovery, responsive communication, and successful collections on difficult accounts.

However, some negative reviews raise concerns about communication breakdowns, with clients reporting that calls, texts, and messages were ignored.

Ryan & Jacobs has developed particular strength in serving oil & gas, transportation, and construction sectors throughout the Plano area. These industries present unique collection challenges with mobile operations, seasonal cash flow patterns, and complex corporate structures.

The agency emphasizes transparency and ethical practices throughout its collection process, earning praise for honest communication and commitment to upright business ethics.

Reviews are positive, with clients consistently praising the company’s speed, professionalism, and transparency. Multiple reviewers report successful debt recovery within days to weeks on accounts they had pursued for months or years without success.

Staff members receive frequent recognition for exceptional responsiveness and results. Clients particularly value the real-time online portal for tracking collection efforts and appreciate the contingency-based fee structure.

Most commercial collection agencies in Plano operate on a contingency basis, meaning they only earn fees when successfully recovering your money. This model aligns the agency’s incentives directly with your goal of maximizing collections.

Contingency fees typically range from 10% to 25% of the collected amount, with several factors influencing where your accounts fall within this range:

For example, a $50,000 debt might incur a 15% fee, while a $500 debt might incur a 25% fee due to the fixed effort required, regardless of the dollar amount.

While many agencies bundle all services into their contingency fee, some charge separately for skip tracing services, litigation costs, credit reporting, and international collection efforts. Reputable agencies provide transparent fee schedules before accepting accounts, ensuring businesses understand exactly what they’ll pay under various scenarios.

Not every overdue invoice requires professional collection assistance, but certain situations clearly benefit from agency involvement:

At Southwest Recovery Services, we understand the unique challenges Plano businesses face across industries, from construction and logistics to oil and gas and wholesale distribution. We have an AI-guided tracking system that monitors every account across phone, email, text, and mail communication channels, ensuring no opportunity for contact gets missed while maintaining detailed documentation of every interaction.

Here, our founder is involved daily, bringing the best knowledge to complex cases, and our veteran collectors use respectful, omnichannel outreach that pursues debts firmly while preserving the professional tone your business reputation requires.

The contingency-only pricing model means zero upfront costs or monthly fees, as you only pay when we successfully recover your money. With 12 offices across six states, we provide nationwide coverage for your interstate commercial collections while maintaining the personalized service that regional firms deliver.

Our compliance-first approach protects your business from legal exposure, and our relationship-focused collection style recognizes that markets change and today’s difficult account might become tomorrow’s customer again. For Plano companies with $10 million to $100 million in revenue, we offer the perfect balance of technological sophistication and human judgment.

Commercial collection agencies in Plano typically charge contingency fees ranging from 10% to 25% of the amount successfully recovered. The exact percentage depends on several factors, including the size of the debt, the age of the account, the complexity of the collection case, and if legal action becomes necessary.

The timeline for commercial debt recovery varies significantly based on debtor responsiveness, account complexity, and whether legal action becomes necessary. Simple cases where the debtor acknowledges the debt and negotiates payment arrangements might be resolved within 30 to 60 days.

More complex situations involving disputes, skip tracing to locate missing debtors, or litigation can extend from several months to over a year. Professional agencies like Southwest Recovery Services provide regular status updates throughout the process and adjust strategies based on debtor responses to maximize efficiency while maintaining legal compliance.

Yes, professional collection agencies excel at locating debtors who have relocated or become unreachable through standard communication channels.

Agencies use skip tracing services that access specialized databases, including public records, credit bureau information, utility connection records, and business registration databases to build comprehensive location profiles.

They also investigate digital footprints through business websites, social media, and professional networking platforms.

First-party collections involve an agency contacting debtors on your behalf but representing themselves as working for your company, maintaining the appearance that your business is still handling collections internally. Third-party collections occur when the agency identifies itself as a separate collection agency working to recover your debt.

First-party collections often work better for preserving customer relationships and may yield better results early in the collection process. Third-party collections signal escalation and often motivate payment from debtors who ignored earlier attempts. Many agencies offer both approaches, allowing businesses to start with first-party efforts before transitioning to third-party if necessary.

*Note: Recovery rates mentioned are for general reference only and not guaranteed. Actual results vary by account and industry. Contact Southwest Recovery Services for a customized quote.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.