- Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

Longview serves as a vital East Texas economic center where manufacturing plants, energy operations, and logistics companies generate substantial B2B transaction volume. This commercial activity inevitably produces unpaid invoices that threaten business cash flow and operational stability.

When internal collection efforts fail after 60–90 days, professional agencies provide specialized expertise that most in-house accounting teams lack. These agencies understand Texas collection regulations, employ advanced skip tracing technology to locate unresponsive business debtors, and maintain the professional approach necessary to preserve valuable commercial relationships while pursuing overdue payments.

The contingency model means businesses risk nothing upfront, paying only when debts are successfully recovered. For companies dealing with mobile industries like construction or trucking, agencies offer investigative capabilities that track debtors across state lines and changing business locations.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

Top Commercial Collection Agencies Serving Longview

Several capable agencies serve Longview’s commercial market, each offering distinct advantages for businesses facing collection challenges.

Jana Ferrell & Associates has served Texas businesses for over two decades, focusing on small to mid-size commercial claims with attorney backing. The firm handles debts across roofing, utilities, and medical sectors, maintaining a reputation for effective recovery without aggressive tactics that damage business relationships.

Founded in 1991, The Kaplan Group excels at large B2B claims, particularly high-value energy invoices, which are standard in Gregg County. Operating exclusively on contingency, they provide no-fee-unless-collected services suitable for substantial commercial accounts requiring strategic collection approaches.

We are a nationally recognized debt collection agency with over 20 years of experience, headquartered in Dallas, Texas, with additional locations throughout Texas and in Georgia, Missouri, Florida, Oklahoma, and Ohio. We provide comprehensive accounts receivable management solutions for businesses of all sizes, handling commercial debt recovery across multiple industries, including manufacturing, energy, logistics, construction, and professional services.

At SWRS, we operate exclusively on a contingency basis, meaning clients pay nothing unless their money is recovered, aligning our success directly with client outcomes. Our approach combines ethical, compliant collection methods with professional persistence and advanced technology. Full compliance with FDCPA, FCRA, and state-specific regulations is maintained throughout all collection activities.

Commercial collection agencies in Longview operate on a contingency basis, charging fees only on amounts successfully recovered. Standard contingency rates typically range between 10 and 25% for commercial accounts, with several factors determining exact pricing:

For example, a $30,000 overdue invoice at 20% contingency would net your business $24,000 upon successful collection, substantially better than writing off the entire amount. Additional costs may include court filing fees and legal expenses if litigation becomes necessary, though reputable agencies discuss these potential costs upfront before proceeding.

Jana Ferrell & Associates receives mixed reviews, with experiences varying significantly between clients. Many reviewers praise individual representatives for being kind, patient, and willing to set up manageable payment plans, with several agents receiving specific recognition for their professional and understanding approach. However, other reviewers express frustration with repeated calls, voicemails that don’t identify the caller, and attempts to collect debts allegedly already paid. Some consumers report billing discrepancies and difficulty resolving erroneous charges, while a few describe interactions as unprofessional or aggressive.

The Kaplan Group receives predominantly positive reviews from business clients, with many praising the agency’s professionalism and efficiency. Reviewers highlight strong communication, timely updates throughout the collection process, and successful recovery of full amounts owed. However, a small number of reviewers on the debtor side describe negative experiences, including disputes over debt validity and concerns about collection practices.

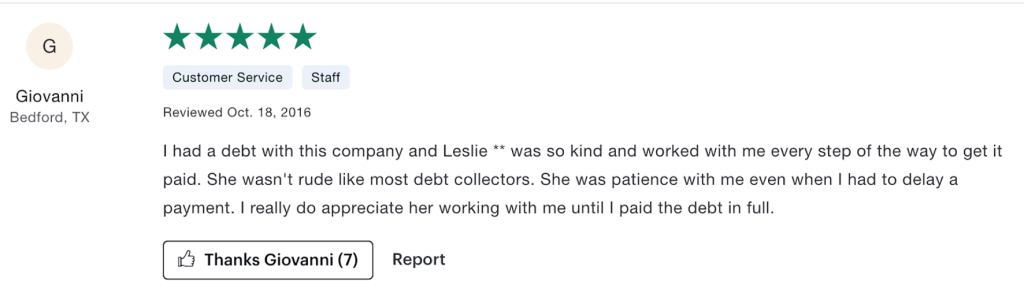

Southwest Recovery Services receives positive reviews from both business clients and consumers. Business owners praise the agency for strong collection results, transparent reporting, and effective revenue cycle management, with several noting success in recovering debts they had given up on. Consumers consistently highlight the respectful, patient approach of our staff members, who go above and beyond to create manageable payment plans and provide immediate paid-in-full letters. Reviewers repeatedly note feeling treated with dignity rather than judgment, describing interactions as professional yet compassionate. Even in cases of mistaken contact, reviewers report that we handled corrections politely.

When selecting a commercial collection agency, several critical factors should be evaluated beyond introductory pricing.

Verify that the agency maintains proper licensing with the Texas Secretary of State, carries adequate bonding and insurance, and holds relevant certifications that demonstrate professional standards.

Most reputable commercial agencies operate on a contingency basis, meaning you pay only when they recover funds. Request information about their success rates in your specific industry and ask for references from businesses similar to yours in size and sector. Understand the percentage they charge and whether rates vary by debt age or complexity.

Agencies using professional, diplomatic methods preserve client relationships while achieving recovery outcomes. Avoid agencies relying on aggressive tactics that may damage your business reputation or violate federal regulations.

Ensure full compliance with the Fair Debt Collection Practices Act (FDCPA) and thorough knowledge of Texas collection laws. Agencies should demonstrate a clear understanding of commercial collection regulations and maintain documentation proving compliance.

Look for agencies offering real-time online portals for account monitoring, detailed reporting capabilities, and prompt payment remittance upon collection. Clear communication throughout the process keeps your business informed and allows strategic decision-making.

At Southwest Recovery Services, we deliver the comprehensive solution Longview businesses require. With over 20 years of Texas-based expertise and 12 strategically located offices across six states, we combine regional understanding with nationwide collection capabilities ideally suited for East Texas commercial needs.

Our AI-guided tracking system monitors every account across multiple communication channels, ensuring no collection opportunity is overlooked while maintaining detailed documentation that legally protects your business. Our founder’s daily involvement brings seasoned judgment to complex cases requiring strategic decision-making beyond standard collection protocols.

We operate on a contingency model, charging 10–25% of recovered funds to eliminate financial risk: you pay absolutely nothing upfront and only when debts are successfully recovered. This performance-based approach aligns our incentives directly with your business goals, motivating maximum effort on every account.

Our veteran collectors employ respectful, omnichannel outreach that pursues debts firmly while maintaining the professional tone essential for B2B relationships. For Longview companies across manufacturing, energy, logistics, construction, and distribution sectors, we provide specialized industry knowledge that generic agencies can’t match. Our compliance-first approach protects clients from FDCPA violations and legal exposure while transparent reporting keeps businesses informed throughout the recovery process.

We offer comprehensive accounts receivable management solutions tailored to your business needs, including account placement services, demand letters, skip tracing capabilities, asset investigation, and litigation support when necessary. Our multi-state presence enables efficient pursuit of debtors who relocate or operate across state lines.

Contact us and request a free quote today

Most Longview commercial collection agencies operate on contingency pricing between 10–25% of successfully recovered amounts. The exact percentage depends on factors including debt age, account size, volume, and complexity. Fresh accounts typically cost less than aged debts, and larger balances often qualify for reduced rates.

Collection timelines vary based on debtor responsiveness and case complexity. Straightforward cases where business debtors acknowledge the debt and negotiate payment arrangements might be resolved within 30–60 days. More complex situations involving disputes, skip tracing to locate missing debtors, or legal action can extend from several months to over a year. Professional agencies provide regular status updates and adjust strategies based on debtor responses to maximize efficiency while maintaining compliance.

Yes, professional commercial collection agencies excel at locating business debtors who have moved or become unreachable. Agencies use skip tracing services that access specialized databases, including business registration information, utility connections, professional networking platforms, and public records. These investigative capabilities are particularly valuable for Longview businesses operating in mobile industries like construction or trucking, where debtors frequently change locations.

If a business debtor files for bankruptcy, collection activities must cease immediately under the automatic stay provision of federal bankruptcy law. Your collection agency will notify you of the filing and help you understand your options, which typically include filing a proof of claim with the bankruptcy court to recover a portion of the debt. While bankruptcy complicates collections, working with an experienced agency ensures that proper legal procedures are followed, maximizing whatever recovery is available while protecting your business from inadvertent violations.

At Southwest Recovery Services, we combine 20+ years of Texas expertise with AI-guided tracking technology and multi-state coverage specifically designed for commercial debt recovery. We operate exclusively on a contingency basis, with no upfront costs, and charge only 10–25% of the amounts successfully recovered. With specialized knowledge across manufacturing, energy, logistics, and construction sectors, we deliver higher recovery rates while maintaining the professional relationships essential for Longview businesses.

Note: Recovery rates mentioned are for general reference only and not guaranteed. Actual results vary by account and industry. Contact us at Southwest Recovery Services for a customized quote.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.