- Customer Service 866-837-3065 Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

When clients fail to pay their invoices, the ripple effects touch every corner of your business. Cash flow tightens, vendor payments become strained, and growth opportunities slip away. For many Fort Worth businesses, pursuing commercial debt internally isn’t feasible because it requires time, specialized knowledge, and legal expertise that most companies lack.

Commercial collection agencies bring focused expertise that dramatically improves recovery outcomes. This allows you to redirect your energy toward running your business rather than chasing down payments.

Partnering with a professional collection agency provides Fort Worth businesses with substantial legal advantages. Collection agencies maintain deep expertise in Texas debt collection laws, including the Texas Debt Collection Act and federal regulations like the Fair Debt Collection Practices Act.

Third-party collectors also create a buffer between your business and the debtor. Your company maintains the “good cop” position while the collection agency applies appropriate pressure, helping to preserve valuable client relationships for future business once the debt situation is resolved.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

Top Commercial Collection Agencies in Fort Worth

With over 20 years of experience at Southwest Recovery Services, we have established ourselves as a trusted partner for Fort Worth businesses across diverse industries.

Our Dallas headquarters, located just north of Fort Worth in Addison, allows us to provide personalized service to the entire DFW metroplex. We specialize in commercial debt recovery using a comprehensive approach that combines persistent yet diplomatic communication, advanced skip-tracing capabilities, and legal support when needed.

Our collectors are trained to recover your funds while preserving the professional relationships you’ve worked hard to build. We understand that your clients may become customers again, so we approach every case with respect and professionalism.

We operate exclusively on a contingency basis, so you pay only when we successfully recover your money. There are no upfront fees, monthly retainers, or hidden charges. Our client portal provides 24/7 access to real-time updates on all collection activities, giving you complete visibility into the recovery process from start to finish.

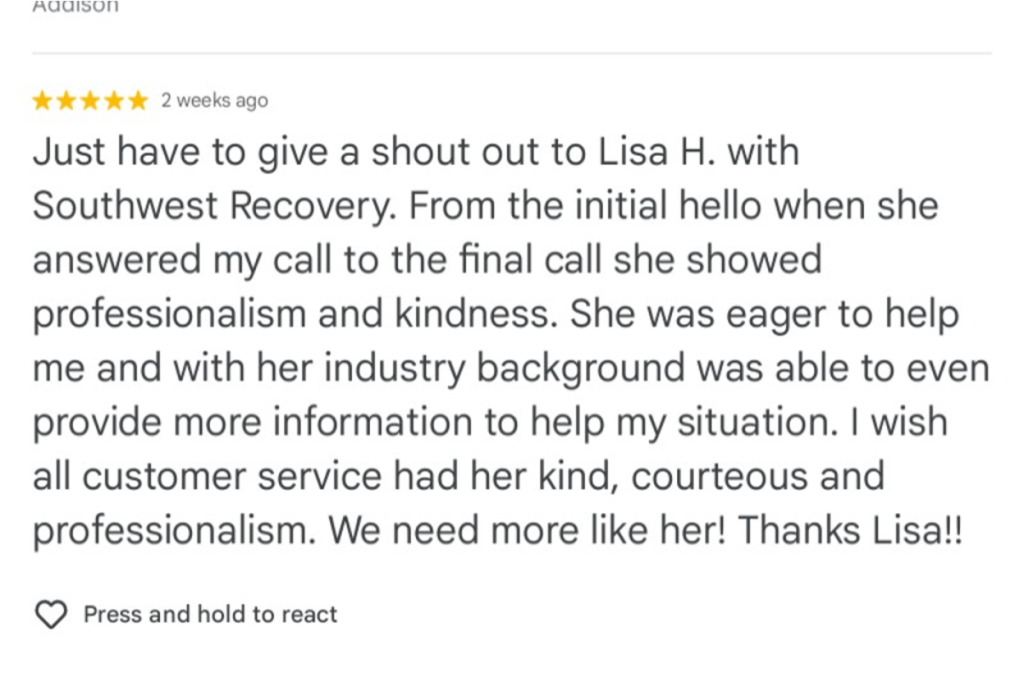

Clients commend our balance of professionalism and empathy, noting that our team members respond promptly, demonstrate patience, and show authentic dedication to helping people address their debt challenges.

Miller, Ross & Goldman brings more than three decades of commercial debt recovery expertise to Fort Worth businesses. With a BBB A+ rating and consistent 5-star Google reviews, they’ve established themselves as one of the nation’s premier collection agencies.

Their team specializes in B2B collections across all industries, from Fortune 100 corporations to family-owned businesses. They operate on a 100% contingency fee structure, ensuring their success is directly tied to yours; they only earn when you get paid.

However, potential clients should note that while most reviews are overwhelmingly positive, there has been occasional feedback about individual collector communication styles that some debtors found overly aggressive.

Debt Recovery Resources provides localized commercial debt collection services to Texas businesses. Their agency focuses on speed and efficiency, with a fine-tuned collection process designed to identify reasons for nonpayment and work toward quick resolutions.

Debt Recovery Resources operates on a contingency-only basis; no recovery means no fees. Potential clients should note that the agency has received mixed reviews, with a 2.3-star rating on Yelp and some BBB complaints regarding collection practices, and is not BBB-accredited.

The contingency model dominates commercial collections and represents the most risk-aligned approach for businesses. Under this arrangement, the agency receives a percentage of the funds successfully recovered.

For most commercial collections, contingency fees typically range from 10% to 25% of what’s recovered. Several factors influence where your fee falls within this range:

The contingency model’s primary advantage is the elimination of risk, as you pay nothing upfront, no monthly retainers, and no fees unless the agency successfully collects your money.

Some agencies offer flat-fee programs where you pay a set amount per account, regardless of recovery outcomes. When collection efforts require legal action, attorney contingency fees may also add to the total cost.

Businesses appreciate agencies that provide regular, clear updates without requiring constant follow-up. The best agencies maintain client portals offering 24/7 access to account status, collection notes, and payment tracking.

It is important as a business to value reputation and long-term relationships. Clients consistently highlight agencies that recover debts without destroying potential future business opportunities. Many B2B relationships survive payment disputes, and aggressive tactics can permanently damage these connections.

Recovery performance determines an agency’s value. However, success rates vary significantly by account age; accounts under 90 days old typically achieve higher recovery rates than accounts that have lasted more than a year.

With over 20 years of commercial collection experience, we specialize in B2B invoice recovery for companies with revenues between $10 million and $100 million. We operate exclusively on contingency with no upfront costs and no monthly fees. Our contingency rates fall within the 10% to 25% range, varying based on account age and complexity, ensuring you receive maximum value from every recovered dollar.

Our proprietary AI-guided tracking system monitors every promise-to-pay across phone, email, text, and mail communications. The daily involvement of our founder provides quality oversight that larger, more impersonal agencies cannot match.

At SWRS, we use respectful, compliance-first collection practices designed to recover funds without damaging client relationships. With trained, experienced collectors operating across 12 offices in six states, we combine local market insight with national reach, relying on professional, persistent communication and legal expertise when escalation is necessary.

We provide particular value for priority sectors, including trucking, logistics, contractors, oil and gas, and professional services, industries that form the backbone of Fort Worth’s economy. Our deep experience in these sectors translates into faster resolution and higher recovery rates.

Collection timelines vary significantly based on account age and debtor responsiveness. For accounts less than 90 days past due, initial results may be seen within 30–45 days of agency placement.

Older accounts typically need longer timelines and persistent effort. If litigation becomes necessary, cases can extend 6–18 months depending on court schedules.

Yes, reputable Fort Worth agencies maintain multi-state collection capabilities and partner with local attorneys when necessary. They understand the varying state laws on statutes of limitations and collection practices, ensuring compliance across all jurisdictions.

Southwest Recovery Services operates nationwide, with 12 offices across six states, providing seamless collection services wherever your debtor is located.

Comprehensive documentation significantly increases collection success rates. Provide copies of all invoices, contracts establishing the business relationship, proof of delivery or service completion, and records of all payment attempts and communications.

Additional helpful documentation includes credit applications, personal guarantees from business owners, and correspondence in which the debtor acknowledges the debt.

Commercial collection agencies specialize in B2B debt and operate under different regulatory frameworks than consumer collectors.

They employ sophisticated business analysis techniques, understand corporate payment decisions involving multiple stakeholders, and maintain professional approaches focused on preserving business relationships while achieving maximum recovery.

*Note: Recovery rates mentioned are for general reference only and not guaranteed. Actual results vary by account and industry. Contact Southwest Recovery Services for a customized quote.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.