- Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

The Port of Corpus Christi generates billions in trade annually, making it a critical hub for shipping, oil, manufacturing, and logistics operations. But this economic activity comes with a painful reality: unpaid invoices.

Local businesses routinely face mounting pressure from overdue B2B accounts. Suppliers, contractors, and service providers watch their cash flow deteriorate as debts age beyond 60, 90, or even 120 days. Economic shifts in the energy sector compound these challenges, leaving many companies scrambling to maintain operations while customers delay payment.

Attempting internal collection drains resources as staff spend hours chasing payments, drafting collection letters, and making follow-up calls, which quickly add up in labor costs. Meanwhile, recovery rates plummet as debts age, and strained business relationships risk future opportunities.

Professional commercial collection agencies specialize in B2B debt recovery, bringing expertise in Texas law, FDCPA compliance, and proven communication strategies that balance firmness with relationship preservation.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

Top Commercial Collection Agencies Serving Corpus Christi

Several agencies serve the Corpus Christi market, but not all deliver equal results. Here’s an honest comparison of leading options:

With 12 offices nationwide and deep Texas roots, we at Southwest Recovery Services (SWRS) stand out for B2B collections. Our 20+ years of experience focus specifically on commercial debt in industries such as shipping, manufacturing, oil & gas, and logistics.

We operate exclusively on a contingency basis, meaning zero upfront costs for our clients. Our AI-powered tracking system monitors every payment promise across phone, email, text, and mail, with our founder’s daily involvement ensuring complex cases receive proper oversight.

We employ experienced staff who are professional in their operations, experienced in dealing with complex and uncommon cases, and approach debt collection with a firm approach that, at the same time, does not damage business relationships.

Arizona-based with a Houston office, Mesa Revenue Partners has served commercial clients nationwide since 1976. They specialize in logistics, healthcare, and distribution and offer contingency-only pricing. Their services include B2B collections, asset investigation, international collections, and litigation support through their attorney network.

Texas-based, with headquarters in Austin and offices in Fort Worth and Dallas, Miller, Ross & Goldman brings over 30 years of commercial collection expertise. BBB Accredited since 2010, they claim a 95%+ success rate on viable claims and operate on contingency.

The contingency model is prevalent, meaning agencies earn payment only when they successfully recover funds. This structure eliminates financial risk for businesses already struggling with cash flow issues. Here’s how fees typically break down:

The hidden value extends beyond avoided hourly charges. Top agencies recover debts much faster than internal efforts. This accelerated cash flow restoration often justifies the contingency percentage, especially when you factor in saved staff time and preserved business relationships.

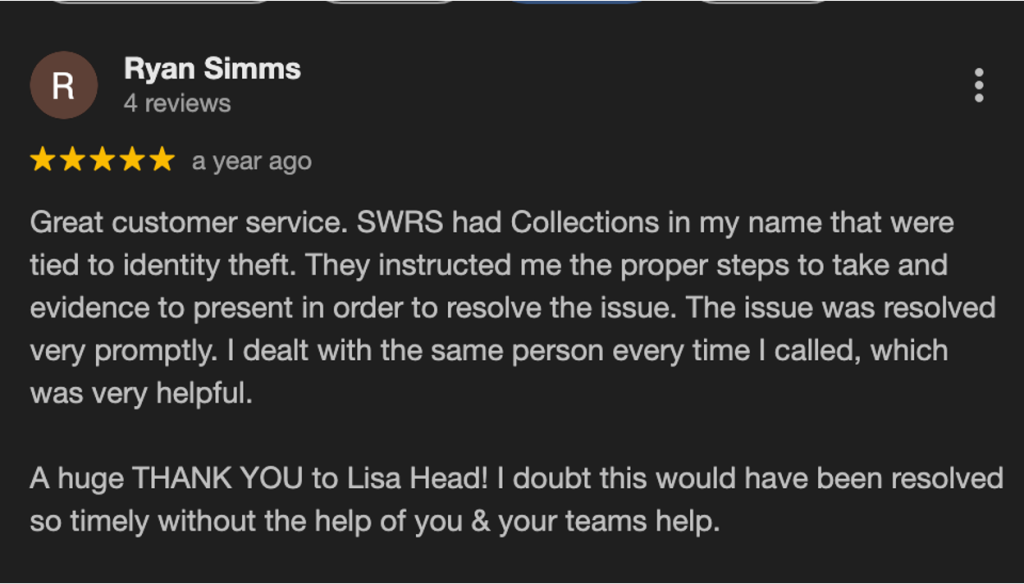

Reviews provide critical insight into agency performance. Here’s what Corpus Christi-area businesses report:

At SWRS, we receive consistently strong ratings across platforms. Our clients specifically praise our AI-driven tracking system and transparent online portal.

One Texas business owner shared: “The attention and determination offered by the staff of Southwest Recovery Services is top-notch… It took almost three years of SWRS staff’s hard work and dedication, not giving up on my case. All I can say is WOW for the persistence the staff has for working on cases.”

Our staff also regularly receives commendations for their professionalism and dedication.

Clients highlight their transparency and straightforward communication style. Distributors and healthcare clients appreciate their no-nonsense approach, clear expectations, and quick turnaround times for aging invoices.

Business clients praise the ease of working with them. Reviews mention timely communication and a process that feels like a partnership rather than just a vendor relationship. Their social media agency and construction clients report recovering tens of thousands in delinquent payments.

Choosing a commercial collection partner requires careful evaluation. Not every agency fits every debt situation. Some factors to consider when choosing the right agency include:

Collection agencies can’t create results from poor preparation. The thoroughness of your documentation can directly impact your recovery rates. Some documents you can provide include:

The more organized your records, the faster agencies can pursue collection. Professional firms like Southwest Recovery Services deploy skip-tracing technology and attorney networks when standard methods fail, but solid documentation remains foundational.

With over 20 years specializing in commercial debt recovery, we bring proven expertise to industries that power Corpus Christi’s economy—shipping, manufacturing, oil & gas, trucking, and logistics. Our veteran collectors understand that today’s delinquent accounts might be valued clients tomorrow and apply respectful communication strategies to maximize recovery while preserving business relationships.

Our contingency-only pricing model eliminates all financial risk. You pay nothing to engage our services, and fees only apply to successfully recovered amounts: no retainers, no upfront costs, no hourly charges eating into your budget.

Our proprietary AI-powered tracking system monitors every interaction across phone, email, text, and mail. Payment promises don’t slip through the cracks, software triggers automatic follow-ups, and provides 24/7 client portal access for real-time updates. The daily involvement of our founder ensures accountability and quality control throughout the collection process.

With 12 offices spanning seven states, we pursue debts nationwide while maintaining Texas-specific knowledge of state regulations and local business practices. Our compliance-first approach, omnichannel outreach strategies, and ethical collection standards make us ideal for businesses seeking professional B2B invoice recovery.

Leading commercial collection agencies maintain global networks of attorneys and collection partners to pursue debtors across borders. These agencies understand international trade law, foreign court systems, and cross-border enforcement mechanisms.

For Corpus Christi businesses dealing with international shipping partners who default on payments, choosing an agency with documented international collection capabilities ensures your debts can be pursued regardless of where the debtor relocates.

Professional commercial collection agencies actually specialize in preserving these relationships through diplomatic communication strategies. Experienced collectors present themselves as problem-solvers rather than adversaries, often uncovering legitimate disputes or temporary hardships that can be resolved. Many debtors actually appreciate the structured payment arrangements that agencies facilitate.

We at Southwest Recovery Services train our collectors specifically in relationship-preserving techniques, recognizing that today’s delinquent account may become tomorrow’s best customer once their situation improves.

Bankruptcy significantly complicates debt recovery but doesn’t necessarily eliminate it entirely. When a business debtor files Chapter 7 or Chapter 11 bankruptcy, an automatic stay prevents direct collection activity.

However, commercial collection agencies can file proofs of claim on your behalf to participate in asset distribution. Secured debts receive priority over unsecured claims, making your contract terms and documentation crucial.

When a debtor formally disputes a commercial debt, collection agencies must verify the debt’s validity through your documentation before continuing collection efforts. Strong agencies request complete records upfront (e.g., contracts, invoices, delivery confirmations, and correspondence) specifically to address potential disputes.

If a dispute has merit, agencies may negotiate partial settlements or payment plans. If disputes lack substance, agencies document the debtor’s objections and continue collection while preparing for potential litigation.

When standard collection methods fail, escalation to legal action may be warranted for substantial debts. Top commercial collection agencies maintain networks of creditors’ rights attorneys across all 50 states who can file suit, obtain judgments, and pursue post-judgment remedies like garnishment and asset seizure.

Many agencies offer litigation services on a contingency basis, meaning legal fees apply only if the case is successful.

*Note: Recovery rates mentioned are for general reference only and not guaranteed. Actual results vary by account and industry. Contact Southwest Recovery Services for a customized quote.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.