- Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

When your business faces mounting unpaid invoices, those outstanding balances represent working capital trapped in someone else’s operations, limiting your ability to invest in growth, meet payroll, or simply keep operations running smoothly.

Collection agencies in Lubbock specialize in recovering unpaid commercial debts and serve as strategic partners for businesses across healthcare, manufacturing, construction, wholesale distribution, and professional services.

Unlike consumer debt collectors, commercial collection agencies focus exclusively on business-to-business transactions, understanding the complexities of vendor relationships, contract disputes, and corporate payment processes.

Having a reliable collection partner means the difference between writing off bad debt and recovering funds that rightfully belong to your company. The right agency understands West Texas business culture, operates within both federal Fair Debt Collection Practices Act (FDCPA) guidelines and Texas state regulations, and pursues debts with professionalism that preserves future business opportunities.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

Key Benefits of Using a Collection Agency

Unpaid invoices directly impact your ability to operate and grow. Collection agencies specialize in converting aged receivables back into working capital, supporting better financial planning and providing the liquidity needed to seize growth opportunities.

Managing collections internally consumes substantial time and emotional energy. By outsourcing to a collection agency, you free your team to focus on revenue-generating activities rather than playing phone tag with delinquent accounts.

Debt collection is heavily regulated at both the federal and state levels. Professional collection agencies navigate this regulatory environment daily, protecting your business from compliance violations that could cost far more than the original debt.

Reputable B2B collection agencies understand that preserving business relationships benefits everyone involved. They employ respectful communication strategies that motivate payment without burning bridges, meaning future business with that customer remains possible.

Agencies with deep industry expertise understand the nuances of your sector, whether that’s construction, where mechanic’s liens play a role, trucking, where broker-carrier relationships complicate collections, or wholesale distribution, where product quality disputes delay payment.

Full-service collection agencies maintain relationships with experienced collection attorneys who can seamlessly transition accounts from pre-legal collection efforts to litigation when necessary, eliminating the need to find separate legal representation.

Before partnering with any collection agency, thoroughly investigate their reputation. Look for client testimonials, industry recognition, and evidence of ethical business practices. Check for complaints with the Better Business Bureau or Texas Attorney General.

Quality agencies provide transparent reporting on contact attempts, debtor responses, payment commitments, and account status. This transparency helps you make informed decisions about whether to continue collection efforts, accept settlement offers, or escalate to legal action.

Does the agency regularly work with businesses in your industry? Industry-specific knowledge significantly impacts recovery success rates. Modern collection also requires multi-channel communication tracked through technology systems that ensure consistent contact.

Southwest Recovery Services (SWRS) is a nationally recognized agency headquartered in Dallas, Texas, with additional locations throughout Texas, Georgia, Missouri, Florida, Oklahoma, and Ohio.

We have been in business for more than 20 years and operate on a contingency basis, meaning we don’t get paid unless our clients are. We work as a full-service debt recovery agency handling medical, governmental, and commercial collections across various industries.

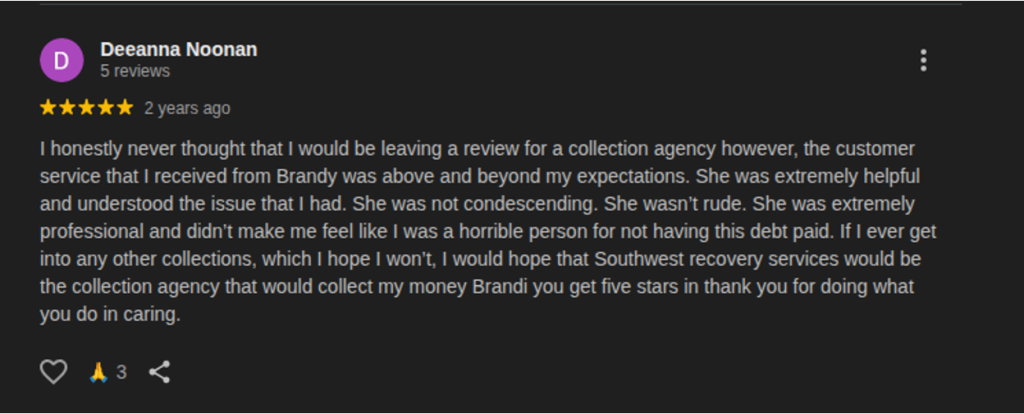

Reviews of Southwest Recovery Services are mainly positive, with multiple clients praising employee Brandi for being professional, patient, and respectful during collections. Business clients report good results with revenue cycle management and debt collection services.

Collectech Diversified, Inc. (CDI) specializes in medical, governmental, and large institutional collections and services some of the largest businesses in the region, as well as several governmental agencies.

Located at 1721 45th St in Lubbock, Texas, the company has been in business since 1989. CDI emphasizes having great people who know how to treat customers, which is something not commonly found in the collection industry.

Jana Ferrell has been serving companies and municipalities since the turn of the century, providing debt collection services for businesses of all sizes in Lubbock and other states. The agency’s team has decades of experience and has been extensively trained in modern technologies for the effective and efficient collection of overdue accounts. They serve customers across multiple industries, including health services, distribution, manufacturing, banking, home services, publishing, and credit services.

This particular agency received mixed reviews, with positive reviewers praising specific staff members for being professional, understanding, and helpful in working out payment plans and resolving billing errors.

However, some negative reviewers mention experiences with staff they felt could have been more professional, occasional payment processing concerns, and collection approaches they found somewhat firm. Business clients typically rate the company highly, while individual debtors report a mix of experiences, from very positive to less favorable.

Most reputable commercial collection agencies operate on a contingency basis, meaning they earn fees only when they successfully recover funds. This aligns the agency’s interests with yours; they’re motivated to recover as much as possible because their compensation depends on it.

Contingency fees typically range from 10% to 25% of collected amounts for standard commercial accounts, with rates varying based on account age, size, and complexity. This model eliminates upfront costs and financial risk for your business.

For example, if an agency works on a 20% contingency rate and recovers $10,000 on your behalf, they keep $2,000 and send you $8,000. If they recover nothing, you pay nothing. Even after paying the contingency fee, you’re recovering money you otherwise would have written off entirely.

With over 20 years concentrated exclusively on business-to-business debt recovery, Southwest Recovery Services understands the complexities of commercial collections that consumer-focused agencies miss entirely.

Our experience spans the industries that drive Lubbock’s economy: construction and contractors, trucking and logistics, wholesale distribution, oil and gas services, and manufacturing.

Our contingency-only pricing model eliminates all upfront financial risk. No retainer fees, no monthly charges, no hourly billing, you pay only when we successfully recover funds on your behalf.

We employ AI-guided tracking systems that monitor every account across multiple communication channels. This omnichannel approach ensures consistent, documented contact. Veteran collectors trained in respectful, professional communication pursue debts persistently but never abusively, often strengthening rather than destroying business relationships.

With 12 offices across six states, we provide nationwide coverage while maintaining personalized service. Our focus on mid-market companies with $10 million to $100 million in annual revenue means they understand the specific challenges faced by established businesses pursuing growth.

For Lubbock businesses ready to recover outstanding receivables without damaging valuable customer relationships, Southwest Recovery Services brings the experience, technology, and ethical approach that produces results.

Most businesses benefit from sending accounts to a collection agency when invoices are 60–90 days past due, and there has been no meaningful response to internal collection efforts.

If your calls and emails go unanswered, payment promises are repeatedly broken, or the debtor disputes the debt without a legitimate basis, professional collection services become necessary.

Collection agencies in Lubbock typically operate on a contingency basis, meaning you pay nothing up front, and fees apply only when funds are successfully recovered.

For commercial accounts, contingency rates generally range from 10% to 25% of the collected amount, with the specific rate depending on factors like account age, debt size, and complexity.

This varies based on the agency you choose and how they conduct business. Reputable B2B collection agencies like Southwest Recovery Services (SWRS) understand that preserving business relationships benefits everyone involved.

They employ respectful, professional communication strategies rather than aggressive tactics. Many businesses find that using a neutral third party actually improves the situation; debtors often respond more positively to agencies than to direct creditor contact.

Professional collection agencies navigate complex federal and state regulations daily, protecting your business from compliance violations that could result in costly lawsuits. They understand the FDCPA, the Texas Finance Code provisions, and industry-specific regulations governing permissible collection activities.

Additionally, agencies with legal partnerships can seamlessly transition accounts to litigation when necessary, filing lawsuits, obtaining judgments, and enforcing collection through garnishment or liens.

*Note: Recovery rates mentioned are for general reference only and not guaranteed. Actual results vary by account and industry. Contact Southwest Recovery Services for a customized quote.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.