- Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

Professional collection agencies bring specialized expertise that most in-house accounting teams simply don’t possess. These agencies understand debtor psychology, negotiation strategies, and the complex web of federal and state regulations governing debt collection.

More importantly, they serve as a professional buffer between your business and the debtor, allowing you to maintain positive relationships while still pursuing what you’re owed.

The benefits of partnering with a reputable collection agency include legal protection under the Fair Debt Collection Practices Act (FDCPA) and Texas collection laws, improved cash flow through faster recovery of aged receivables, and resource efficiency that allows your team to focus on revenue-generating activities.

Professional collectors use diplomatic communication strategies that preserve future business opportunities while leveraging advanced recovery tools, such as skip-tracing technology and multi-channel outreach.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

Best Collection Agencies in Amarillo, TX

Amarillo hosts several collection agencies, each with distinct strengths. Understanding your options helps you select the partner best suited to your specific business needs.

Jana Ferrell has served businesses for decades, helping them recover debts and building a solid reputation for reliability and ethical collection practices. The agency handles both consumer and commercial accounts, with particular strength in local and regional collections.

The reviews are sharply divided. Positive reviewers praise specific staff members for being professional, kind, and helpful in setting up payment plans. Multiple people express surprise at how pleasant their experience was with a debt collection agency.

Negative reviews describe unwelcome persistence through repeated phone calls, rude and unprofessional treatment, and issues like balances increasing after payments or being contacted about already-paid debts.

Certified Collectors, Inc. holds an A+ rating with the Better Business Bureau, reflecting its commitment to ethical standards and customer service. The agency offers specialized services for both consumer and business collections, with flexible approaches tailored to different account types.

Their BBB accreditation provides additional confidence for businesses concerned about compliance and professional conduct. User reviews are not readily available, but the company has some complaints lodged with the BBB.

Empire Debt Collection serves clients nationally, with BBB accreditation backing its services. The agency is recognized for respectful communication practices and effective debt recovery strategies. Their nationwide presence provides a broader geographic reach while maintaining local service quality.

Positive reviewers thank the team for successfully collecting debts quickly, particularly praising their responsiveness and willingness to work on smaller accounts without upfront fees.

Negative reviews mention concerns about business practices, such as sending contracts and later declining service, charging fees customers didn’t expect, adding credit card processing fees, making frequent calls to debtors and their contacts, and providing service that some reviewers found unprofessional or lacking.

Southwest Recovery Services (SWRS) brings over 20 years of focused experience in commercial debt recovery, combining national reach with the personalized attention that B2B relationships require.

We specialize in businesses with $10M–$100M in annual revenue, particularly in industries where relationships matter: trucking and logistics, oil and gas field services, commercial construction and contracting, and property management.

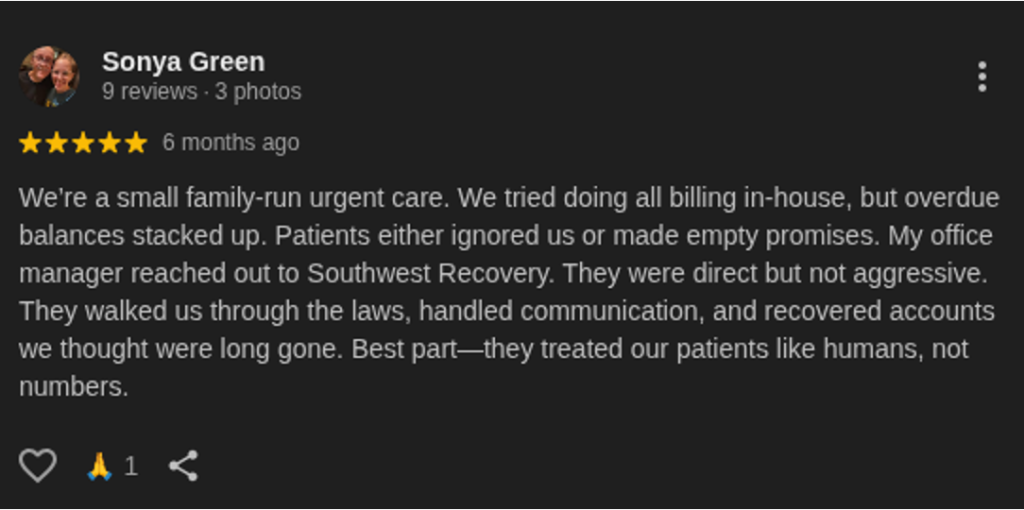

Positive reviews consistently praise our staff members, particularly Brandi Schrade, Andre, and CEO Steven, for being professional, patient, kind, and genuinely listening to debtors. Reviewers emphasize that the agency is “direct but not aggressive” and treats people “like humans, not numbers,” making it a positive experience compared to typical debt collectors.

Business clients (small healthcare providers and service businesses) credit our agency with successfully recovering overdue accounts they considered uncollectable, praising our streamlined processes, transparent reporting, and effective communication. Our staff are noted for going above and beyond to find solutions that work for both parties, even when initial requests are denied.

Selecting the right collection partner requires careful evaluation. Start with Better Business Bureau ratings and online reviews to assess reputation and agencies’ responses to complaints. Verify legal compliance by ensuring any agency follows federal and Texas state collection laws, and ask about their compliance programs and staff training.

Evaluate industry experience, particularly for B2B collections. Commercial debt recovery differs significantly from consumer collections. Look for agencies with proven expertise in your industry who understand payment cycles and diplomatic communication approaches that preserve relationships.

Assess fee structures carefully. Contingency-based pricing protects you from paying for unsuccessful collection attempts. Compare percentage rates and understand when fees apply and how partial payments are handled.

Review communication and technology capabilities. Modern collection agencies should provide transparent reporting, easy access to account information through client portals, and regular updates.

For Amarillo businesses with commercial accounts, we offer the optimal combination of specialized expertise, ethical practices, and proven results. Our contingency-only pricing model eliminates financial risk, and our focus on B2B relationships ensures your customer connections remain intact.

We bring over two decades of commercial collection experience specifically tailored to businesses in the $10M–$100M revenue range. Our veteran collectors use multi-channel communication strategies tracked through proprietary AI-powered software. With our founder’s daily involvement, we provide quality assurance that larger impersonal agencies cannot match.

Importantly, we specialize in industries that drive the Amarillo economy: trucking and logistics, oil and gas services, commercial construction, and property management. We understand the unique challenges these businesses face and the relationships that matter in commercial transactions.

When internal collection efforts have failed, and accounts are aging past 60–90 days, Southwest Recovery Services delivers the specialized B2B expertise that maximizes recovery while protecting the professional relationships your business depends on.

Most reputable collection agencies in Amarillo operate on a contingency basis, charging between 10% and 25% of successfully recovered amounts. This means you pay nothing up front and only pay when the agency successfully collects your money. The exact percentage depends on factors like account age, balance size, and complexity.

Most B2B experts recommend engaging professional collection agencies when accounts reach 60–90 days past due and internal collection efforts have produced no payment commitments. Waiting too long reduces recovery probability as accounts age, with success rates declining after 180 days.

Not when you partner with a professional B2B agency that prioritizes relationship preservation. Agencies like Southwest Recovery Services (SWRS) understand that today’s debtor might be tomorrow’s customer. The agency serves as a neutral buffer, allowing you to preserve the positive business relationship while still recovering what you’re owed.

Check the agency’s Better Business Bureau rating and review their complaint history. Verify they hold proper licensing in Texas and maintain compliance with the FDCPA. Also, ask about their compliance programs, staff training, and how they handle disputes.

*Note: Recovery rates mentioned are for general reference only and not guaranteed. Actual results vary by account and industry. Contact Southwest Recovery Services for a customized quote.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.