- Customer Service 866-837-3065 Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

Sugar Land’s business world runs on trust, especially in industries like energy, manufacturing, logistics, and construction, where net-30 and net-60 terms are standard practice. You extend credit because that’s how deals get done, but this system only works when your customers actually pay on time.

When a $15,000 invoice sits unpaid for three months, that’s money stuck in limbo instead of covering payroll or expenses. Maybe your customer is waiting on their own receivables, perhaps they’re disorganized, but either way, your cash flow takes the hit.

The real problem is that most companies aren’t set up for serious collection work. Your AR team processes payments well, but chasing down delinquent accounts requires different skills: negotiation tactics, skip tracing, legal knowledge, and the emotional distance to push hard without burning bridges.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

Leading B2B Collection Companies Serving Sugar Land

At Southwest Recovery Services, we stand out as the premier choice for Sugar Land and Houston-area businesses seeking professional B2B debt recovery. With over 20 years of specialized commercial collection expertise and twelve offices spanning seven states, including a strong Texas presence, we combine deep local market knowledge with national reach.

We specialize in commercial collections for businesses generating $10M–$100M in annual revenue, particularly serving trucking, logistics, oil and gas, construction, medical, and professional services industries that drive Sugar Land’s economy.

We operate exclusively on contingency with zero upfront costs or monthly fees. Our experienced collectors employ professional, ethical outreach using multiple channels guided by AI-powered tracking.

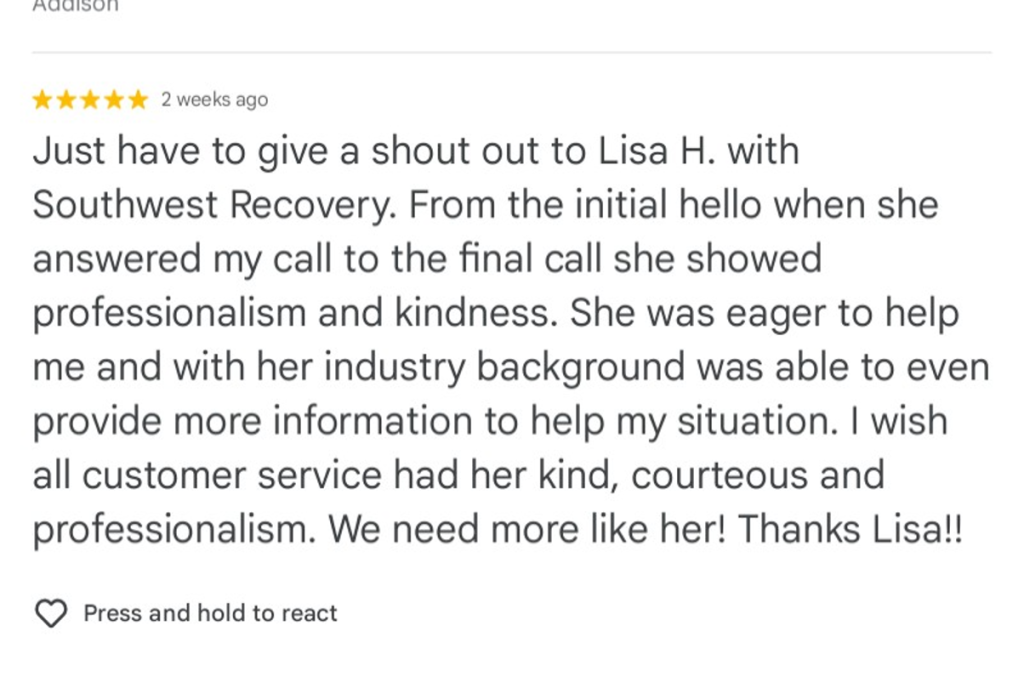

Reviews consistently highlight representatives who approach conversations with patience and understanding rather than pressure tactics. Clients appreciate that we take the time to understand individual financial situations and create realistic payment plans rather than demanding immediate full payment.

Several reviewers specifically note feeling less anxious after speaking with the team, describing the experience as respectful and collaborative, and clients noted our flexibility during COVID-19 in arranging manageable payment plans.

Based in Houston with additional offices in Austin, GGR has been collecting commercial debt for nearly three decades and claims to have recovered over a billion dollars for more than 40,000 clients.

They take a comprehensive approach that goes beyond standard collection calls, deploying private investigators for asset searches and maintaining relationships with attorneys across the country when legal action becomes necessary. Their BBB rating sits at A+, and they’re licensed to handle collections nationwide.

Long-term B2B clients consistently praise high recovery rates on uncollectable accounts, strong communication from specific representatives, and professional handling that maintains business relationships.

However, debtor reviews frequently complain about threatening tactics, including mentions of private investigators, difficulty verifying debts, wrong account information, and aggressive messages left with employees rather than business owners.

This agency has spent over 25 years carving out a niche in the city’s core industries, particularly oil and gas, renewable energy, medical technology, and petrochemical manufacturing, which means they understand the payment cycles and business relationships that matter in those sectors.

They work entirely on contingency, so you only pay if they actually recover your money, and client testimonials consistently mention their ability to collect accounts while preserving business relationships.

The most common themes are fast collection times, constant communication throughout the process, and a reputation-protecting approach. Long-term clients mention successfully using MRG for years on both domestic and international collections.

However, one review raised concerns about how feedback is handled for smaller claims, though the owner has responded to and addressed the issue.

The contingency fee model dominates commercial collections in Sugar Land and throughout Texas. You pay nothing up front, no setup fees, no monthly retainers, no charges unless the agency successfully recovers your money.

Contingency rates for B2B collections typically range from 10%–25% of amounts recovered. Several factors influence where your accounts fall within that range:

Additional costs arise when collection efforts require legal intervention. Court filing fees, attorney fees, and related legal expenses typically run separately from standard contingency rates.

When you hand over accounts to a professional agency, they don’t just start dialing numbers and demanding money. They actually dig into your documentation first, reviewing invoices, contracts, and delivery records to understand what you’re owed and whether the claim holds up under scrutiny.

The outreach starts through whatever channels work: formal demand letters that create a paper trail, phone calls to whoever signs checks, emails to the accounts payable team, and sometimes even text messages if that’s the only way to break through. The whole point is to find someone with the authority to cut you a check, not just get bounced around to people who can’t help.

A lot of commercial debts get resolved through straightforward negotiation because many businesses that fall behind aren’t trying to rip you off; they’re just dealing with their own cash problems and actually appreciate the chance to work out a payment plan. Good collectors know when to push for full payment immediately and when a realistic settlement makes more sense than dragging things out.

If the standard approach goes nowhere and the amount is worth the effort, that’s when agencies bring in attorneys who specialize in collections to file suit in Fort Bend County courts, obtain a judgment, and then enforce it through whatever legal means are available.

Before placing accounts, gather comprehensive documentation:

Missing documentation doesn’t automatically disqualify an account, but incomplete files significantly reduce the chances of recovery.

Most collection professionals recommend engaging outside help after 60–90 days of non-payment, assuming you’ve exhausted reasonable internal efforts.

Before involving an agency, send payment reminders at 30 and 60 days past due, make direct phone contact, offer payment arrangements if appropriate, and send a final notice stating the account will be placed with a collection agency.

Clear triggers warranting immediate agency involvement include repeated broken promises to pay, disappearing customers who stop responding, large balances with stalled communication, and mounting dispute excuses that never resolve.

Our 20+ years of B2B collection experience mean we’ve developed strategies that work across industries. We understand the unique challenges of Sugar Land’s key sectors, the payment culture in oil and gas, the logistics of construction billing, the complexity of medical services collections, and the nature of relationships in professional services.

Our contingency-only model eliminates all financial risk. You invest nothing up front, pay no monthly fees, and compensate us only when we successfully recover your funds. We emphasize ethical, respectful collection practices because we know commercial relationships matter. Our collectors communicate firmly but professionally, avoiding aggressive tactics that poison business relationships. We recover debts while protecting your reputation.

Our secure client portal delivers the transparency modern businesses expect. Log in 24/7 to check account status, review collection activities, and track recovered payments. With twelve offices across seven states, we maintain the infrastructure to pursue commercial debts nationwide.

We offer comprehensive B2B collection services beyond standard account recovery, including accounts receivable management solutions, credit reporting, and commercial litigation coordination when cases require legal escalation.

Most commercial collection agencies in Sugar Land operate on contingency fees ranging from 10% to 25% of recovered funds, meaning you pay nothing unless they successfully collect your debt.

The exact percentage depends on account age, debt size, complexity, and volume. Some agencies charge additional fees when legal action becomes necessary, with court costs and attorney fees typically separate from standard collection fees.

B2B debt collection focuses on recovering unpaid invoices from commercial customers rather than individual consumers. Business collections typically involve larger balances, more complex disputes over contracts and delivery terms, and greater emphasis on preserving business relationships.

Commercial collectors must navigate purchase orders, service agreements, and corporate decision-makers. They balance firmness with professionalism, recognizing that today’s delinquent account might become tomorrow’s paying customer.

Most collection professionals recommend engaging outside help after 60–90 days of non-payment, assuming you’ve exhausted reasonable internal efforts. Before involving an agency, send payment reminders at 30 and 60 days past due.

Make direct contact attempts, offer payment arrangements when appropriate, and send a final notice stating the account will be placed with a collection agency.

Why should Sugar Land businesses choose Southwest Recovery Services for B2B collections?

Southwest Recovery Services stands out as the premier choice for Sugar Land businesses seeking professional B2B debt recovery. With over 20 years of specialized commercial collection expertise and twelve offices across seven states, including a strong Texas presence, we combine deep local market knowledge with national reach.

Our compliance-first approach and relationship-focused recovery strategies protect your business reputation while maximizing recovery outcomes.

*Note: Recovery rates mentioned are for general reference only and not guaranteed. Actual results vary by account and industry. Contact Southwest Recovery Services for a customized quote.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.