- Customer Service 866-837-3065 Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

Harlingen anchors the Rio Grande Valley as a critical hub for cross-border commerce, manufacturing, and logistics. While this dynamic growth fuels the local economy, it also increases exposure to overdue B2B invoices.

Top agencies like Southwest Recovery Services help stabilize cash flow by recovering funds that internal teams cannot reach.

Thriving sectors such as healthcare, telecommunications, and agriculture generate constant B2B transactions. However, increased volume often leads to payment delays that threaten operational stability.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

At Southwest Recovery Services, we stand as a trusted partner for Harlingen businesses. Founded in 2004 and headquartered in Texas, the agency operates twelve strategically positioned offices across seven states, combining deep statewide expertise with comprehensive nationwide reach. Our collectors receive specialized training in relationship-preserving communication because we understand that today’s past-due account could become tomorrow’s loyal customer.

Our contingency-only model eliminates all financial risk. There are no upfront fees, no monthly retainers, and no hidden charges; you pay only when we successfully recover your funds. Our secure client portal provides 24/7 access to real-time account updates, collection notes, and payment tracking.

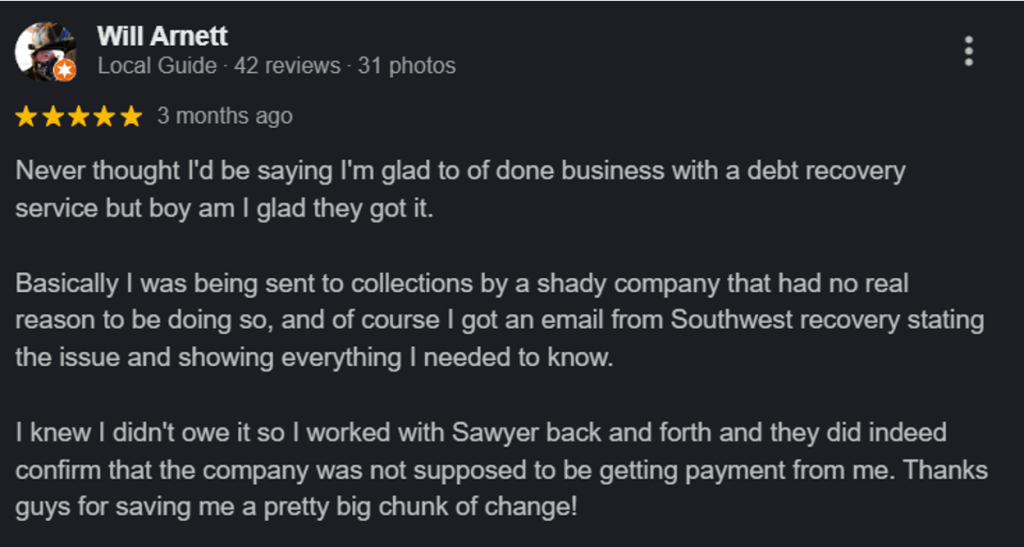

Client testimonials highlight our persistence, especially on difficult accounts. Reviews often call our service “top notch” and note that we recover balances clients had already written off. Clients also praise our clear reporting, efficient process, and proactive communication. They frequently mention our problem-solving approach and our ability to find workable resolutions when earlier collection efforts failed.

The Kaplan Group has provided commercial collection services for Texas businesses for over 20 years, with industry-recognized expertise in collecting large claims throughout the United States. The agency operates on contingency, with contingency fees that vary based on the claim size and age.

Each collector brings more than a decade of experience, and many hold advanced degrees, including MBAs and JDs. This background provides unique insights into why payments have stalled and how to recover funds effectively. The agency has developed particular expertise in the energy sector while also serving businesses across manufacturing, distribution, and financial services.

Reviews mention negotiation skills and thorough client communication throughout the collection process. Business owners speak about the professional approach and analytical methods for resolving complex situations.

Mesa Revenue Partners operates as a commercial debt recovery company serving Texas with a contingency-based model where clients pay nothing unless collection succeeds. The company provides corporate asset investigation services and coordinates commercial collection litigation when required.

Their services extend to international commercial debt recovery, particularly relevant for Harlingen companies engaged in cross-border trade with Mexico and international manufacturing partners.

Client feedback notes the agency’s approach and willingness to pursue accounts through legal channels when standard methods prove insufficient.

Commercial collection agencies serving Harlingen primarily operate on contingency-fee structures. You pay nothing upfront and owe fees only when the agency successfully recovers funds; typically 10–25% of the amount collected.

Account age drives pricing significantly. Debts less than 90 days past due command lower rates because they’re easier to recover. Accounts beyond 180 days require more intensive efforts and carry reduced recovery probability, justifying higher percentages.

Balance size also affects pricing. Larger debts justify lower contingency percentages because they generate sufficient revenue for both parties. Smaller balances require similar effort regardless of amount, so agencies charge higher percentages.

Complexity increases costs. Straightforward collections cost less than cases requiring extensive skip tracing, dispute resolution, or cross-border coordination.

Volume creates a negotiating opportunity. Businesses placing multiple accounts monthly often qualify for reduced rates.

When legal intervention becomes necessary, court filing fees and attorney fees typically run separately from standard contingency rates.

Harlingen’s economy revolves around healthcare, manufacturing, logistics, telecommunications, and agriculture. The right collection agency understands these industries’ payment cycles, business structure, and professional communication norms. An agency familiar with freight bill disputes or manufacturing supply chain payment structures settles accounts far more effectively than a generalist.

With the Los Indios International Bridge minutes away and hundreds of maquiladoras operating across the border, many Harlingen businesses maintain commercial relationships extending into Mexico. Collection agencies serving this market should understand cross-border commerce complexities.

In a tight-knit regional economy, reputation matters. Effective agencies recover funds while maintaining professional courtesy that preserves future business opportunities. Look for collectors who approach debtors diplomatically, recognizing that payment disputes don’t necessarily indicate bad intent.

Professional agencies maintain strict adherence to ethical standards and applicable state regulations and the Texas Debt Collection Act. They should provide clear compliance documentation and client portal access for real-time visibility into collection activities.

Timing significantly impacts collection outcomes. Most professionals recommend engaging outside help after 60–90 days of non-payment, assuming you’ve exhausted reasonable internal efforts.

Before placing accounts, implement these steps:

Situations warranting immediate agency involvement:

Comprehensive documentation improves collection outcomes and accelerates recovery. Before placing accounts, gather:

For Harlingen businesses engaged in cross-border commerce, include customs paperwork, freight documentation, or international trade records.

At Southwest Recovery Services, we’ve spent more than two decades mastering commercial B2B debt collection. Our Texas headquarters in Addison positions us to serve Harlingen with personalized attention backed by twelve offices across seven states.

Our contingency-only pricing eliminates financial risk entirely. You pay nothing upfront, incur no monthly fees, and compensate us only when we deliver results. This performance-based model ensures our interests align completely with yours.

We bring specialized expertise across industries vital to the Harlingen economy: logistics and transportation, manufacturing, healthcare, property management, and commercial contracting. Our collectors understand these sectors’ payment cycles and professional language, enabling effective debtor communication and faster resolution.

Our approach emphasizes professional, ethical collection practices, protecting your reputation while maximizing recovery. We deploy respectful omnichannel outreach, maintaining the courteous tone that preserves future business relationships.

Commercial collection agencies serving Harlingen typically operate on contingency fees ranging from 10–25% of recovered funds. You pay nothing upfront and owe fees only when they successfully collect. The percentage depends on account age, balance size, complexity, and volume. Legal action involves separate costs for court filings and attorney fees.

Agencies serving Harlingen often specialize in healthcare, manufacturing, logistics, telecommunications, and agriculture. At Southwest Recovery Services, we bring particular expertise in trucking, logistics management, oil and gas, property management, and commercial contracting sectors with a significant presence throughout South Texas.

Most professionals recommend engaging help after 60–90 days of non-payment, once internal efforts are exhausted. Situations like broken payment promises, unresponsive customers, or large balances threatening cash flow warrant earlier action. Early placement generally improves recovery outcomes.

Provide original invoices showing dates, amounts, and payment terms; contracts establishing the business relationship; proof of delivery or service completion; payment history demonstrating partial payments or debt acknowledgment; and communication logs documenting collection attempts. For cross-border commerce, include customs paperwork or freight documentation. Complete records strengthen your collection case significantly.

At Southwest Recovery Services, we have combined Texas-based operations since 2004, with twelve offices across seven states, providing local understanding and nationwide reach. Our contingency-only model eliminates financial risk. We specialize in industries vital to the Rio Grande Valley and maintain strict compliance with Texas and federal regulations. Our client portal delivers 24/7 transparency into account activities.

*Note: Recovery rates mentioned are for general reference only and not guaranteed. Actual results vary by account and industry. Contact Southwest Recovery Services for a customized quote.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.