- Customer Service 866-837-3065 Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

Baytown’s industrial businesses often run on extended payment terms, complex service agreements, and large B2B invoices. When those invoices go unpaid, cash flow tightens fast and can stall operations, payroll, vendor payments, and reinvestment.

In this environment, in-house collections often hit a ceiling. Accounts receivable teams are built to manage billing and processing, not delinquency recovery, which requires negotiation skill, legal know-how, skip tracing resources, and enough objectivity to push firmly without burning relationships you may still need.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

At Southwest Recovery Services, we serve Baytown and the greater Houston metropolitan area from our Houston office, bringing over 20 years of focused commercial collection experience to local businesses. We specialize in B2B debt recovery for mid-market companies generating $10M–$100M in annual revenue, with particular strength in the industries that power Baytown’s economy: oil and gas, logistics, contractors, and industrial services.

Our collection approach combines experienced professionals with advanced technology. Veteran collectors use respectful, multi-channel outreach across phone, email, text, and mail, while our AI-powered tracking system monitors every commitment and follow-up.

We work exclusively on contingency with zero upfront costs or monthly retainers. Our compliance-first methodology protects your business reputation while pursuing maximum recovery. We deliver nationwide reach supported by deep Texas market knowledge.

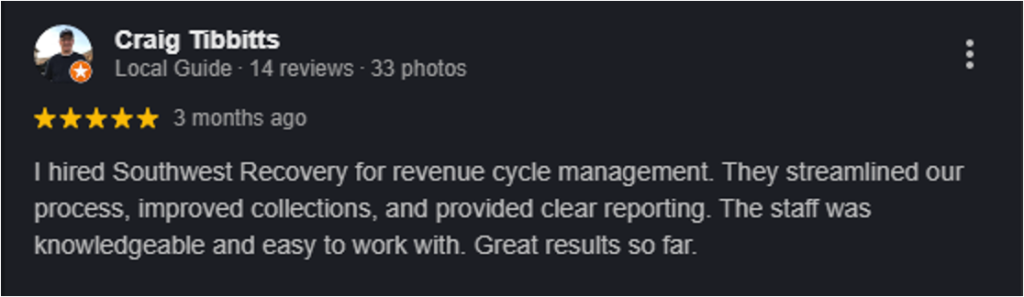

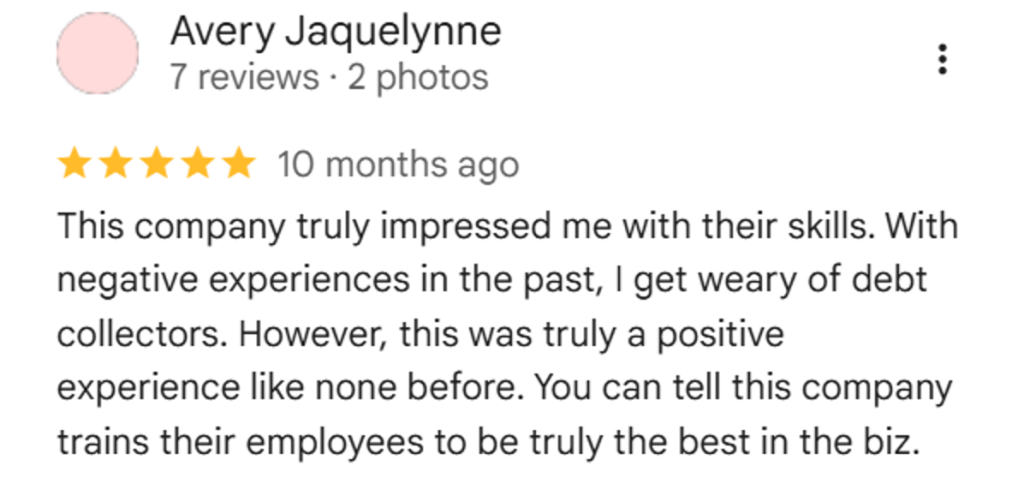

Clients consistently praise us for our professional approach and transparent communication throughout the collection process. Business owners appreciate the contingency-based model that eliminates financial risk, along with the personalized attention provided by experienced collectors who understand industry-specific challenges. Many clients note successful recoveries on accounts they had previously written off as uncollectible.

Houston-based GGR has operated for more than 3 decades and reports recovering over $100 million annually while serving more than 10,000 clients. They deploy comprehensive collection strategies that include private investigators for asset searches and maintain attorney relationships nationwide for cases requiring legal escalation. Their national licensing allows them to pursue debtors across state lines.

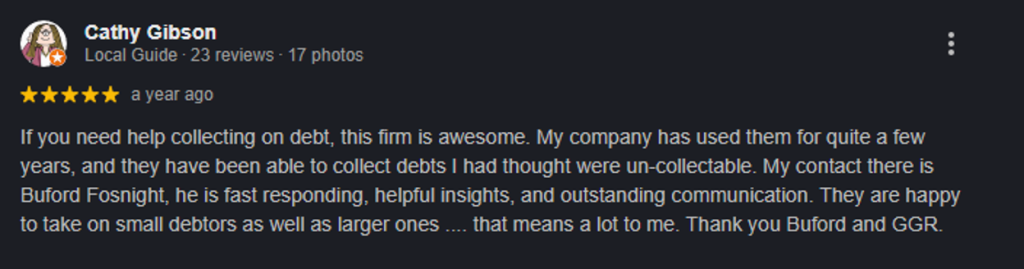

Clients frequently highlight GGR’s thorough approach to difficult accounts and their willingness to pursue collections through multiple channels. Business owners value their extensive network of attorneys and investigators, particularly when dealing with evasive debtors. The company’s long operational history provides clients seeking established collection partners with confidence.

IC System brings decades of experience to commercial collections with a technology-driven approach. They provide both contingency and flat-fee pricing models depending on account characteristics, along with online account management portals for real-time status tracking. Their national infrastructure supports businesses with customers spread across multiple states.

Clients appreciate IC System’s user-friendly online portal that provides real-time updates on collection activities and account status. Businesses with multi-state operations value their nationwide infrastructure and ability to handle collections across different jurisdictions. The flexibility in pricing models receives positive feedback from companies with varying collection needs and preferences.

Contingency pricing is the standard model for commercial collections in Baytown and throughout Texas. Under this structure, you pay nothing upfront and owe fees only when the agency successfully recovers your funds.

Typical contingency rates for B2B collections range from 10–25% of amounts recovered. Several variables determine where your accounts fall within that spectrum:

Recent accounts under 90 days past due typically command lower rates because they’re easier to collect. Older accounts require more intensive effort and carry reduced success probability, justifying higher percentages.

Larger accounts generate enough potential revenue to support lower rates, while smaller balances require higher percentages to remain economically viable for the agency.

Industry complexity matters as well. Straightforward invoice collections cost less than cases involving disputed service tickets, complex contract terms, or multiple decision-makers.

Businesses placing multiple accounts regularly often secure better rate structures than those with occasional single-account placements.

Legal intervention, when required, typically incurs additional costs. Court filing fees, attorney charges, and related expenses usually fall outside standard contingency arrangements.

When you engage a professional collection agency, they begin by analyzing your documentation. Invoices, contracts, purchase orders, delivery confirmations, and records of your collection attempts establish the foundation for recovery efforts.

Initial outreach follows multiple channels simultaneously. The objective is reaching someone with authority to authorize payment, not just leaving messages with gatekeepers.

Many commercial debts are resolved through negotiation. Businesses that fall behind often aren’t attempting fraud; they’re managing their own cash flow challenges and may welcome structured payment arrangements. Experienced collectors recognize when to push for immediate full payment versus when a realistic settlement serves everyone’s interests better.

For accounts that resist standard collection efforts, agencies can escalate to legal action. This involves coordinating with attorneys who specialize in creditor rights, filing suit in appropriate jurisdictions, obtaining judgments, and pursuing enforcement through available legal mechanisms.

Before placing accounts with a collection agency, compile thorough documentation:

Strong documentation accelerates the entire process. Agencies can move quickly when they have clear evidence supporting your claim rather than spending weeks gathering basic information.

Baytown businesses need a collection partner who understands the industrial economy that drives this region. At Southwest Recovery Services, we have experience in the sectors that matter most here, including oil and gas field services, logistics and transportation, industrial contractors, and equipment rental.

Our contingency-only model eliminates financial risk. You pay nothing upfront or monthly, and you only pay if we recover your funds.

We focus on ethical, relationship-conscious recovery. We communicate firmly and professionally to apply pressure while protecting your reputation and preserving future business relationships.

Our Houston office provides local market knowledge, and our twelve-office network across seven states gives us the reach to pursue commercial debts nationwide. You stay informed with straightforward reporting on account status and results.

Contact Southwest Recovery Services Today

Collection agencies serving Baytown generally operate on contingency fees ranging from 10–25% of successfully recovered amounts. You pay nothing unless they collect. Rates vary based on account age, balance size, and complexity. Older, smaller, or more complicated accounts typically carry higher percentages due to the increased effort required for recovery.

Recovery timelines depend on account characteristics and debtor responsiveness. Fresh accounts under 90 days past due often produce initial results within 30–45 days of placement. Older accounts typically require 60–120 days of sustained collection activity. Cases requiring litigation extend considerably longer, potentially 6–18 months, depending on court schedules and debtor cooperation.

Southwest Recovery Services brings particular expertise to the industries that drive Baytown’s economy, including oil and gas, logistics and transportation, industrial contractors, property management, and equipment rental operations. We understand the payment practices, contract structures, and business relationships specific to these sectors, allowing us to pursue recovery effectively while respecting industry norms.

Yes. Reputable collection agencies maintain licensing and compliance programs covering multiple states, enabling them to pursue debtors throughout the United States. We at Southwest Recovery Services operate twelve offices across seven states and maintain the legal infrastructure to collect nationwide while adhering to each jurisdiction’s specific requirements.

At Southwest Recovery Services, we provide Baytown businesses with a combination of deep commercial collection expertise, Texas-based operations with national reach, and ethical recovery practices that protect your business relationships. Our contingency-only pricing means zero financial risk, while our technology-driven approach ensures thorough tracking and transparent reporting. With over 20 years of focused B2B collection experience, we deliver the specialized skills needed to recover industrial and commercial receivables effectively.

*Note: Recovery rates mentioned are for general reference only and not guaranteed. Actual results vary by account and industry. Contact Southwest Recovery Services for a customized quote.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.