- Customer Service 866-837-3065 Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

The robust trade environment in Laredo, Texas, creates distinct challenges. Businesses frequently deal with unpaid invoices stemming from cross-border transactions, delayed payments from manufacturing clients, and complex collection scenarios involving debtors on both sides of the border. When a commercial customer stops paying their invoices, Laredo businesses face mounting pressure on their working capital.

Commercial collection agencies specializing in business-to-business (B2B) debt recovery understand these unique challenges, including knowledge of international trade practices, bilingual communication capabilities, and familiarity with both U.S. and Mexican business cultures.

For Laredo businesses dealing with unpaid invoices ranging from $1,000 to $50,000 or more, professional collection agencies offer specialized tools under the Texas Finance Code and federal regulations to recover outstanding debts efficiently without damaging critical business relationships.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

Top Commercial Collection Agencies Serving Laredo Businesses

At Southwest Recovery Services, we operate 12 strategically located offices across seven states, including Texas, bringing over 20 years of specialized experience to commercial debt recovery.

We operate exclusively on a contingency basis, meaning businesses pay nothing up front and only when debts are successfully recovered. Our AI-guided tracking system monitors every account across phone, email, text, and mail communication channels, ensuring no opportunity for contact gets missed while maintaining detailed documentation of every interaction.

We specialize in B2B invoice recovery with particular strength for companies in the $10 million to $100 million revenue range, and deep expertise in trucking, logistics, contractors, and wholesale distribution sectors that dominate Laredo’s economy.

Phoenix Recovery Group serves as a Texas-based third-party collection agency with over two decades of experience providing customized recovery solutions for businesses throughout the United States, Canada, Puerto Rico, and Mexico.

The firm focuses on accounts receivable management with particular expertise in apartment-related debts and commercial collections. Clients appreciate the agency’s professional approach and established track record in recovering outstanding obligations across multiple sectors.

Miller, Ross & Goldman operates as a national B2B commercial collection agency with over 30 years of proven expertise and now functions as an affiliate of Altus Receivables Management. The firm employs contingency-based fee structures and resolves more than 90% of claims without legal action (according to client reviews), utilizing master negotiators with extensive industry experience.

Client feedback highlights the agency’s exceptional recovery rates and professional approach, with businesses consistently reporting results that exceed expectations compared to other collection firms.

Most commercial collection agencies operate on a contingency fee basis, meaning they only earn payment when successfully recovering your money.

Contingency fees in the Laredo market typically range from 10% to 25% of the collected amount for standard commercial accounts. Several factors influence where your specific accounts fall within this range:

For example, a Laredo logistics company with a $10,000 unpaid invoice might expect to pay a 20% contingency fee ($2,000), while a $50,000 manufacturing debt might incur a 15% fee ($7,500).

Client reviews provide valuable insights into how collection agencies actually perform in practice.

Miller, Ross & Goldman receives consistently positive feedback from clients who praise fast results and professional communication throughout the collection process. Multiple reviewers report successful collections within one week on debts they had pursued internally for months or even years.

Phoenix Recovery Group receives particular recognition for expertise in apartment and rental-related debt collections. Clients frequently mention that representatives demonstrated solid negotiation skills and personable service, helping them resolve housing-related debts that were preventing them from leasing new apartments or purchasing homes.

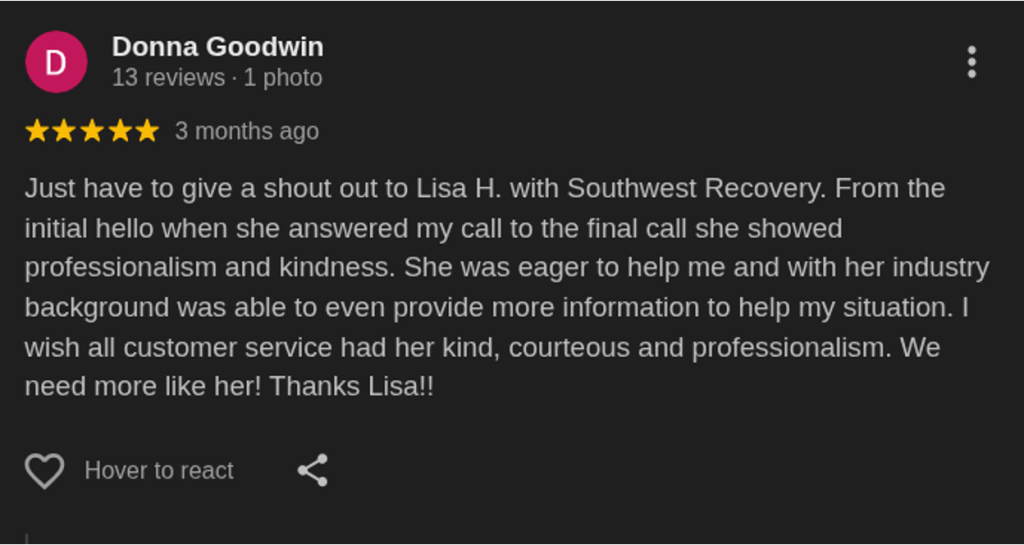

At Southwest Recovery Services, we earn praise from clients for our compassionate and professional approach to debt collection. Business clients report strong results in revenue cycle management, with testimonials highlighting streamlined processes, improved collections, and clear reporting systems.

Multiple reviewers emphasize that our staff members demonstrate understanding, patience, and respect rather than harassment, with one noting that we “made a bad situation not too miserable to deal with.”

Small business owners consistently mention our ethical practices and ability to work with consumers through payment plans while still achieving effective recovery results. Clients appreciate that we distinguish ourselves from typical collection agency experiences through professional courtesy and genuine customer service.

Not every overdue invoice requires immediate professional collection assistance, but certain situations clearly benefit from agency involvement:

At Southwest Recovery Services, we bring over 20 years of experience specifically handling collections across different industries. We combine our collectors’ expertise and professionalism to deliver the most effective collection solutions in Laredo, Texas.

We use an AI-guided tracking system that monitors every account across all communication channels, ensuring comprehensive documentation while identifying optimal contact opportunities. Veteran collectors employ respectful, omnichannel outreach that pursues debts firmly while maintaining the professional tone your business relationships require.

Our contingency-only pricing model means zero upfront costs, no monthly fees, and no payment unless debts are successfully recovered. With twelve offices across seven states, we provide nationwide coverage while maintaining responsive, personalized service.

For Laredo businesses across the trucking, logistics, contracting, and wholesale distribution sectors, Southwest Recovery Services offers specialized B2B invoice recovery solutions, AI-guided tracking technology, receivables management expertise, and relationship-focused collection practices to recover outstanding debts while preserving professional relationships.

Commercial collection agencies serving Laredo typically charge contingency fees ranging from 10% to 25% of the amount successfully recovered for standard commercial accounts.

The exact percentage depends on the size of the debt, the account age, and the complexity. Smaller debts often command higher percentages, while larger debts may qualify for lower rates.

Recovery timelines vary based on debtor responsiveness and case complexity. Straightforward cases often resolve within a short timeframe, such as 30 to 60 days. More complex situations involving payment disputes or skip tracing typically extend to several months.

Cases requiring legal action can take several months to over a year. Professional agencies provide regular status updates and adjust strategies to maximize efficiency.

Yes, experienced collection agencies can effectively pursue cross-border debts involving debtors in Mexico or other countries. Top agencies like Southwest Recovery Services maintain international partnerships and bilingual staff capable of conducting negotiations in both English and Spanish.

These agencies understand cross-border collection dynamics, including currency considerations and differing business practices. International collections may incur slightly higher contingency fees to account for increased complexity.

First-party collections involve an agency contacting debtors on your behalf while representing themselves as working for your company, maintaining the appearance that your business is still handling collections internally.

This approach often works better for preserving customer relationships. Third-party collections occur when the agency clearly identifies itself as a separate collection agency hired to recover your debt, signaling escalation that often motivates payment from unresponsive debtors.

At Southwest Recovery Services, we bring specialized expertise in commercial collections with over 20 years of experience navigating the unique challenges Laredo businesses face. Our AI-guided tracking system monitors every account across phone, email, text, and mail channels, with our founder involved daily on complex cases.

We operate exclusively on a contingency-only pricing model, which means you pay nothing up front and only when debts are successfully recovered. With twelve offices across seven states, we provide nationwide coverage while maintaining responsive service.

*Note: Recovery rates mentioned are for general reference only and not guaranteed. Actual results vary by account and industry. Contact Southwest Recovery Services for a customized quote.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.