- Customer Service 866-837-3065 Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

Killeen has emerged as a significant commercial center in Central Texas, mainly driven by its proximity to Fort Hood, one of the nation’s largest military installations. Military deployments, frequent relocations, and the transient nature of the local population often result in unpaid invoices and collection difficulties.

When business customers or consumers stop paying their bills, companies face a critical choice: continue dedicating internal resources to collection efforts or partner with a professional agency. Debt collection agencies specialize in recovering outstanding debts efficiently while maintaining compliance with federal and Texas state regulations.

Texas law, including provisions within the Texas Finance Code, establishes strict guidelines governing collection practices. Agencies must provide proper validation notices, avoid harassment, and adhere to the state’s four-year statute of limitations on most debts. Working with a compliant, locally experienced agency protects your business from legal exposure while maximizing recovery potential.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

What to Look for When Choosing a Collection Agency

Selecting the right collection agency requires careful consideration of several key factors. First, verify that the agency operates on a contingency fee basis with no upfront costs, and avoid any agency that demands retainers or advance payments, as these are red flags of potentially unreliable operations.

Transparency is essential; reputable agencies provide clear fee schedules, detailed contracts, and regular communication throughout the collection process. Look for agencies that offer client portals or consistent updates so you can track progress on your accounts in real time.

Experience and track record matter significantly. Research reviews and testimonials to gauge the agency’s success rate and professionalism. Consider whether they have expertise in your specific industry, as this can impact their effectiveness in recovering debts from your particular customer base.

The agency should demonstrate ethical collection practices that protect your business reputation while maintaining compliance with federal and state regulations like the Fair Debt Collection Practices Act. Finally, assess their communication style and responsiveness during initial consultations. An agency that is professional, accessible, and takes time to understand your needs upfront will likely provide better service throughout your partnership.

Several reputable agencies serve the Killeen market, each offering different strengths and service models:

Operating with deep roots in Central Texas, Southwest Recovery Services brings over 20 years of commercial and consumer debt recovery experience to Killeen businesses. We specialize in B2B invoice recovery, medical billing collections, and accounts with military-related complexities that are common in the Fort Hood area.

We operate exclusively on a contingency basis, meaning businesses pay nothing up front and only when debts are successfully recovered. Our AI-guided tracking system monitors every account across multiple communication channels, ensuring no collection opportunity gets missed while maintaining detailed documentation.

We maintain 12 offices across seven states, providing nationwide coverage for businesses with customers beyond Killeen while delivering the personalized service of a regional firm. Our compliance-first approach ensures complete adherence to FDCPA, Texas Finance Code, and all applicable regulations.

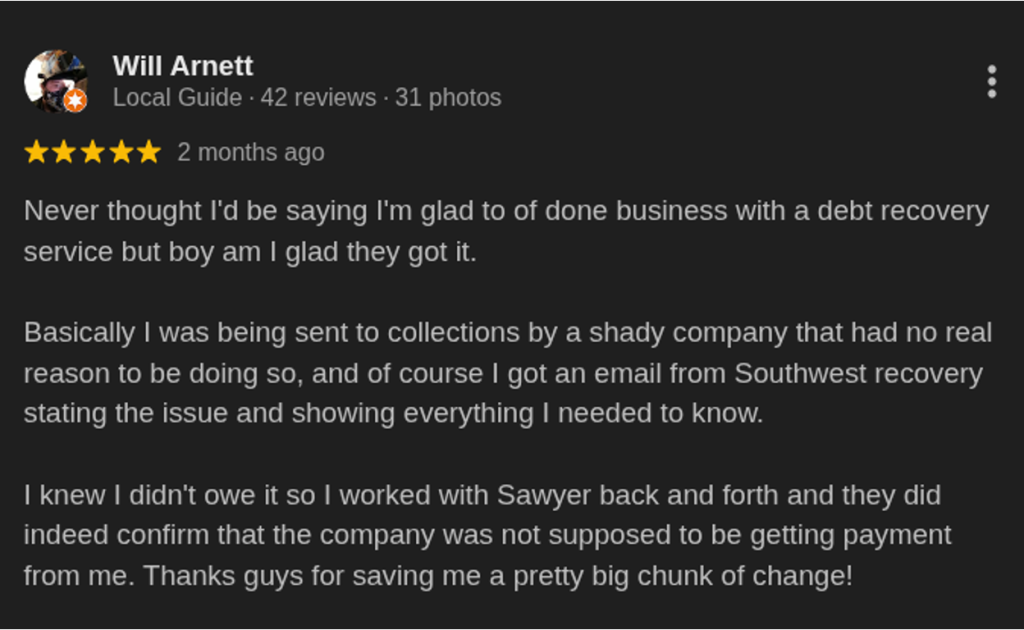

Our business clients and individual debtors consistently highlight our effectiveness and respectful communication style, noting that we work with people on payment plans rather than using harassing tactics common in the industry. Our team is frequently recognized for patience, understanding, and helpfulness throughout the collection process.

Business clients value our proven results, with some maintaining relationships for more than a decade. At the same time, individual debtors appreciate our willingness to accommodate unique financial situations, provide prompt documentation such as paid-in-full letters, and handle every case with dignity and professionalism.

Miller, Ross & Goldman operates as a national B2B commercial collection agency with over 30 years of experience and now functions as an affiliate of Altus Receivables Management. The firm employs contingency-based fee structures and claims to resolve more than 90% of claims without legal action (according to client reviews), utilizing master negotiators with extensive industry experience.

Businesses praise them for professionalism, communication, and speed in recovering debts. The agency is particularly noted for keeping clients informed at every stage of the collection process, maintaining respectful communication standards that protect business reputations, and delivering results on both domestic and international cases.

The agency specializes in B2B commercial debt collection across diverse industries, including oil and gas, transportation, and construction, utilizing both cutting-edge technology and diplomatic negotiation strategies. They emphasize transparent operations and immediate remittance to clients.

Ryan & Jacobs receives outstanding reviews for their exceptional speed in debt collection and their transparent, client-focused approach featuring a real-time portal with frequent updates. Clients consistently report that the agency successfully collected debts they had pursued internally for a long while. Some team members are specifically praised for their professionalism and responsiveness.

Understanding how debt collection pricing works in Killeen helps businesses know what to expect before placing an account with an agency.

Most reputable debt collection agencies in Killeen operate on a contingency basis, earning fees only when they successfully recover your money. This no-risk model aligns their interests with yours, with contingency fees typically ranging from 10% to 25% of the collected amount.

Rates vary based on debt size, account age, volume, and case complexity. Larger, fresher debts with straightforward collection needs generally qualify for lower percentage rates.

Always request transparent fee schedules upfront that outline commission tiers and any additional costs for skip tracing, litigation, or credit reporting.

Reputable agencies provide transparent pricing before accepting accounts, and you should avoid any agency that demands upfront fees or retainers, as these are red flags for potentially unreliable operations.

Not every overdue invoice requires professional collection assistance, but certain situations clearly benefit from agency involvement:

At Southwest Recovery Services, we understand the unique challenges Killeen businesses face, from retail and healthcare to service providers serving the Fort Hood community. Our veteran collectors use respectful, omnichannel outreach that pursues debts firmly while preserving the professional relationships your business reputation requires.

Our AI-guided tracking system ensures comprehensive account management across all communication channels, while our founder’s daily involvement brings experienced judgment to complex cases. We use a compliance-first approach that protects your business from legal exposure, and our relationship-focused collection style recognizes that today’s difficult account might become tomorrow’s customer again.

For Killeen businesses managing accounts receivable across commercial and consumer portfolios, we provide the perfect balance of technological sophistication, local market knowledge, and proven recovery expertise. Our B2B invoice recovery, medical billing collections, and specialized services for military-related accounts deliver results without upfront costs or monthly fees.

Debt collection agencies in Killeen typically charge contingency fees ranging from 10% to 25% of the amount successfully recovered. The exact percentage depends on factors including debt size, account age, collection complexity, and whether legal action becomes necessary.

Larger debts or newer accounts often qualify for lower rates, while smaller or older accounts may be at the higher end of the range. Most reputable agencies provide transparent fee schedules upfront.

Yes, debt collectors in Texas must comply with both federal regulations under the Fair Debt Collection Practices Act (FDCPA) and Texas state laws outlined in the Texas Finance Code.

Agencies must be appropriately licensed, provide validation notices to debtors, avoid harassment, and follow strict communication guidelines. Working with compliant agencies protects your business from legal liability while ensuring ethical collection practices.

The timeline for debt recovery varies based on the debtor’s responsiveness, account complexity, and whether legal action is necessary. Simple cases where debtors acknowledge the debt and negotiate payment arrangements might be resolved within 30 to 60 days.

More complex situations involving skip tracing, disputes, or litigation can extend from several months to over a year. Professional agencies provide regular status updates and adjust strategies based on debtor responses to maximize efficiency.

Yes, professional collection agencies excel at locating debtors who have relocated from the Fort Hood area or become unreachable through standard communication channels. Agencies use skip tracing services that access specialized databases, including public records, utility connections, and business registrations, to build comprehensive location profiles.

Southwest Recovery Services’ nationwide coverage through 12 offices across seven states ensures effective recovery even when debtors move out of state.

*Note: Recovery rates mentioned are for general reference only and not guaranteed. Actual results vary by account and industry. Contact Southwest Recovery Services for a customized quote.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.