- Customer Service 866-837-3065 Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

Odessa sits at the center of the Permian Basin, America’s most productive oil and gas region. With billions flowing through oilfield operations annually, the city’s economy thrives on energy production, logistics, equipment manufacturing, and related services. This environment inevitably creates complex debt collection scenarios requiring specialized expertise.

The cyclical nature of energy markets creates particular challenges. When oil prices drop or drilling activity slows, payment delays cascade through the supply chain. Equipment rental companies, service contractors, and material suppliers often face 90-day or longer payment delays as customers navigate cash flow difficulties.

Cross-state complications add another layer of difficulty. Many debtors operate across state lines, with operations in New Mexico, Oklahoma, or major Texas cities. When a business customer relocates or becomes unreachable, recovering outstanding invoices requires agencies with multi-jurisdictional capabilities and sophisticated skip-tracing resources.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

Several professional agencies serve Odessa’s commercial debt recovery needs, each bringing different strengths to the table.

At Southwest Recovery Services, we have been operating for over 20 years in commercial collections and maintain strategic offices across seven states. This proximity provides crucial local understanding of oilfield operations, industry payment cycles, and the business relationships that define the region’s economy.

We specialize in B2B invoice recovery for companies with $10 million to $100 million in revenue, with particular expertise in the trucking, logistics, contracting, and oil and gas sectors. Our AI-guided tracking system monitors every account across phone, email, text, and mail communication channels, ensuring comprehensive documentation and no missed contact opportunities.

Operating exclusively on a contingency basis means businesses pay nothing up front and only when debts are successfully recovered. Our founder maintains daily involvement in complex cases, bringing experienced judgment to challenging accounts.

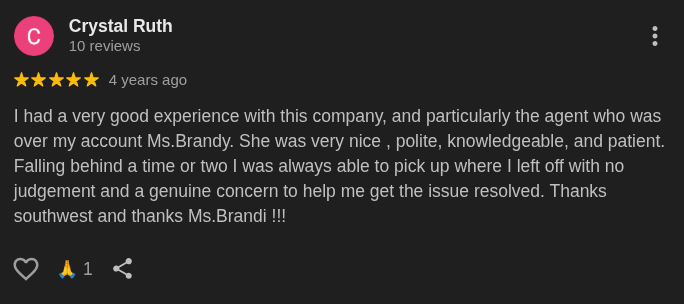

We consistently receive positive reviews praising our professional yet compassionate approach to collections. Business clients report improved collections and streamlined processes, with healthcare providers specifically noting success after struggling with in-house billing.

Multiple reviewers highlight individual staff members for being respectful, patient, and understanding rather than aggressive or harassing, and describe their experiences as entirely different from those of typical collection agencies.

Clients appreciate our transparency, including online account tracking, and note that representatives genuinely listen and work with people through payment plans.

Edward Wolff & Associates handles commercial debt collection, arbitration, and litigation services with a focus on professional creditor representation. With decades of experience in the field, the agency promises personalized service and attention that clients expect from a dedicated collection partner.

Edward Wolff & Associates offers comprehensive debt recovery solutions, including account placement, demand letters, skip tracing, and legal proceedings when necessary.

Edward Wolff & Associates receives mixed reviews. Happy clients praise staff members for quick results, often collecting debts within days or weeks after the client had tried for months.

Client experiences vary, with some reporting communication challenges after case acceptance.

Bravo Recovery offers commercial debt collection services with a strong emphasis on regional market knowledge and established business relationships throughout Texas energy corridors.

Founded in 2010, the agency leverages a deep understanding of local business environments, particularly in the energy sector, and regional economic factors to facilitate faster debt resolution. The agency’s services include first-party collections, third-party collections, flat-fee collection options, in-house litigation, and business credit reporting.

Bravo Recovery receives mostly positive feedback from clients who report strong collection results and professional service. Long-term clients praise the team’s responsiveness, detailed monthly reports, and ability to collect debts that clients couldn’t recover themselves, even across multiple states.

Commercial collection agencies predominantly use contingency-based pricing, where fees are earned only upon successful debt recovery. This payment model creates a natural alignment between the agency’s interests and the client’s objectives, as both parties benefit from maximizing collections. Businesses face no upfront costs or financial risk if recovery efforts prove unsuccessful.

Commercial collection contingency fees generally range from 10% to 25% of the recovered amount. The specific rate applied to any account depends on multiple variables that agencies evaluate when determining pricing.

Not every unpaid invoice needs a collection agency, but certain situations clearly call for professional help:

Our 20+ years of commercial collection expertise focus specifically on B2B relationships in industries that matter most to Odessa: oil and gas, trucking and logistics, construction contractors, equipment suppliers, and wholesale distribution. This industry experience means we understand the payment cycles, operational challenges, and relationship dynamics that define these sectors.

Our AI-guided tracking system represents a technological advantage that maximizes collection opportunities. Every account receives monitoring across phone, email, text, and mail communication channels, ensuring no contact opportunity gets missed while maintaining detailed documentation of every interaction.

Our founder’s daily involvement brings vast experience to complex cases. We employ veteran collectors who use respectful, omnichannel outreach that pursues debts firmly while preserving professional relationships.

Our contingency-only pricing, at 10%–25% of recovered funds, eliminates financial risk, as you pay zero upfront costs and no monthly fees. We only earn our fee when we successfully recover your money.

With 12 offices across seven states, we provide nationwide coverage for interstate commercial collections while maintaining personalized service. Our compliance-first approach protects your business from legal exposure and ensures full compliance with FDCPA, FCRA, HIPAA, CFPB, and all applicable state regulations.

Frequently Asked Questions (FAQs)

When a business debtor files for bankruptcy, collection activities must cease immediately under the automatic stay. Commercial creditors become part of the bankruptcy proceedings and may recover partial payment through the bankruptcy court process.

The amount recovered depends on the type of bankruptcy, available assets, and your creditor priority status. Collection agencies can advise on bankruptcy scenarios, but cannot collect while bankruptcy protection is in effect.

Strong documentation significantly improves collection success rates. Essential documents include the original contract or purchase order, invoices with clearly stated payment terms, delivery receipts or proof of service completion, any correspondence regarding the debt, and records of your internal collection attempts.

For Odessa oil and gas businesses, field tickets, work orders, and equipment rental agreements are particularly important.

Yes, some collection agencies specialize in international commercial debt recovery, which is relevant for Odessa businesses working with oil and gas companies that operate across borders. International collections involve additional complexity, including foreign laws, currency exchange, and cultural differences in business practices.

Agencies with international networks can pursue debts in countries like Mexico, Canada, and other oil-producing nations, though success rates and timelines vary significantly by jurisdiction.

Prevention strategies include conducting credit checks on new commercial customers, establishing clear payment terms in written contracts, requiring deposits or progress payments for large projects, implementing early warning systems for late fees, and maintaining regular communication with customers about outstanding invoices.

Many oil and gas businesses also use mechanics’ liens or UCC filings to secure their interests before payment problems develop.

Professional collection agencies understand the importance of business relationships, especially in tight-knit industries like Odessa’s oil and gas sector. Reputable agencies like Southwest Recovery Services use respectful communication methods and can often structure approaches that recover debts while preserving relationships.

Some businesses opt for first-party collections initially (where the agency works on your behalf but doesn’t identify as a collection agency) to maintain continuity of the relationship before escalating to third-party collections if necessary.

*Note: Recovery rates mentioned are for general reference only and not guaranteed. Actual results vary by account and industry. Contact Southwest Recovery Services for a customized quote.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.