- Customer Service 866-837-3065 Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

In the construction industry, unpaid invoices create serious cash flow problems that affect your ability to pay suppliers, meet payroll, and take on new projects. Construction receivables involve complicated payment structures that demand specialized knowledge.

Specialized collection agencies bring expertise in construction law, lien enforcement, and industry-specific negotiation tactics. They understand payment practices unique to contractors, like retainage held until project completion, change orders that complicate final amounts, and disputes over work quality that delay payment.

When you work with a construction-focused agency, you benefit from collectors who know how to pursue payment through proper legal channels while preserving the business relationships you’ve worked hard to build.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

Top Collection Agencies for Contractors

Several specialized agencies understand the complexities of contractor receivables and offer tailored recovery solutions, some of which include:

Southwest Recovery Services brings over two decades of commercial debt recovery experience to contractors across multiple industries. Our approach combines veteran collectors, proprietary AI-powered tracking technology, and the daily oversight of our founder to deliver results while maintaining professional standards.

We understand the unique challenges contractors face, from progress payment disputes and retention releases to change order disagreements and lien deadline pressures. Our client base includes general contractors, specialty trades, HVAC companies, electrical contractors, plumbing firms, and construction suppliers who need fast, effective collection action.

Our structured letter communication cycle and experienced team help contractors recover what they’ve earned without the hassle of chasing payments themselves.

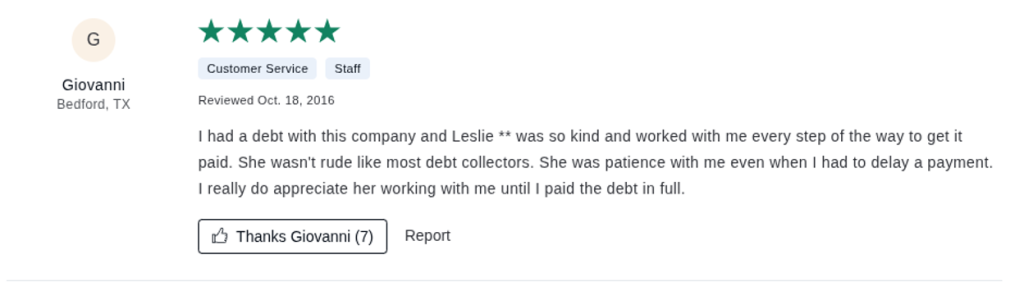

Our clients consistently praise our professional yet compassionate approach, noting that our staff members are responsive, patient, and genuinely helpful in resolving debt situations.

Reviewers frequently mention that we provide a more respectful experience than typical collection agencies, with staff who take the time to understand individual circumstances and go above and beyond to find solutions.

Construction Credit & Finance Group is a construction industry debt collection agency that has been advising construction finance and credit professionals for over two decades. As a premier B2B debt collection agency serving the construction industry nationwide, they have established a reputation as one of the best and most successful construction collection agencies in the sector.

The agency’s team of highly skilled professionals has extensive experience in handling debt collection for the construction industry and understands the unique challenges of collecting unpaid invoices in this sector. With a proven track record of success in recovering overdue payments, they employ advanced strategies and tools to streamline the collection process and achieve optimal results.

Construction Credit & Finance Group maintains a 4.6-star Google rating with predominantly positive feedback from clients who report successful collections, professional service, and strong communication throughout the process. However, one disputed review raises concerns, alleging some loss of a bonding case due to incorrectly filed paperwork.

American Collection Systems has specialized in construction debt collection for over four decades, bringing industry-leading liquidity rates and FDCPA-certified collectors to the contracting industry. The agency’s construction debt collection services strictly adhere to federal, state, and construction industry regulations.

ACS recognizes the unique nature of construction firms and crafts debt collection strategies tailored to distinctive requirements and objectives. Their approach includes thorough assessment of each situation, open communication and reporting at every stage, and dedicated support from a specialized construction debt collection team.

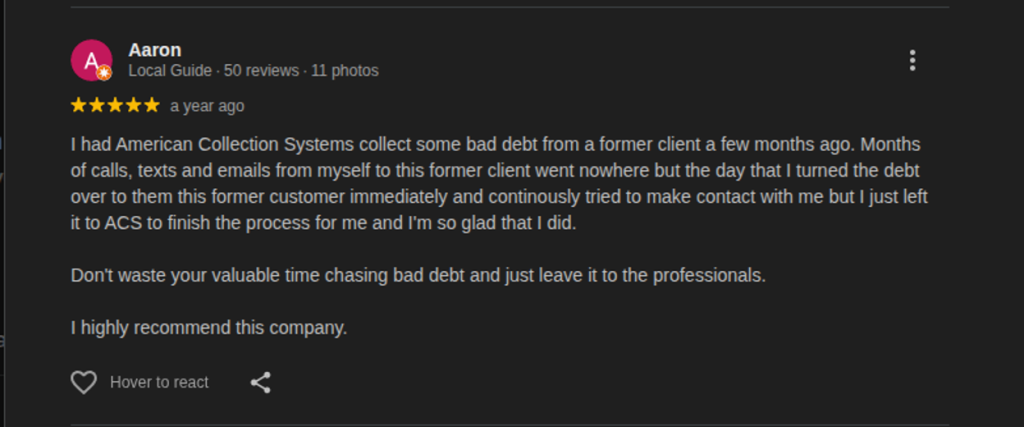

Many reviewers praise the agency’s professionalism and kindness, highlighting representatives who worked with clients to arrange flexible payment plans and resolve billing issues. Business clients also commend the agency’s effectiveness in recovering debts that they couldn’t collect themselves.

However, some customers report negative experiences, including instances where representatives refused to provide written debt verification. Overall, the majority of detailed reviews reflect positive experiences with the company’s customer service approach.

Choose an agency that specializes in construction debt collection and understands the unique complexities of your industry. They should be familiar with mechanics lien laws, preliminary notice requirements, payment bond claims, and the multi-tier payment structures common in construction projects.

Evaluate potential agencies based on their actual recovery rates and client testimonials from other contractors in your trade. Ask for specific examples of successful construction debt recovery, average collection times, and references you can contact directly. Be cautious of agencies that can’t provide verifiable results or have disputed claims of serious errors, such as missed filing deadlines or improperly handled bonding cases.

Understand the complete cost structure before signing any agreement. Most construction collection agencies work on a contingency basis, typically ranging from 10% to 25%, depending on account age and complexity. Clarify whether there are additional fees for mechanics lien filings, preliminary notices, skip tracing, or legal actions. Avoid agencies that aren’t transparent about their pricing or that charge significant upfront fees before any collection work begins.

Select an agency that provides regular updates and online access to case status, as time is critical in construction collections. They should proactively track multiple lien deadlines across different projects and jurisdictions, ensuring you don’t lose valuable collection rights. The right partner keeps you informed while acting quickly to protect your lien rights before critical filing deadlines expire.

Southwest Recovery Services (SWRS) brings over 20 years of commercial collection experience, with particular strength in construction debt recovery. Our veteran collectors understand the construction industry’s unique challenges and employ persistent, multi-channel outreach that respects debtor relationships.

We operate on a contingency-only basis, typically charging 10% to 25% of recovered amounts. You pay absolutely nothing up front and no monthly fees. Payment only happens when we successfully collect your money.

When standard collection efforts don’t produce results, we can use skip-tracing techniques to locate debtors who’ve become difficult to reach. Our respectful, professional communication style separates the collection issue from your ongoing business relationships. This matters enormously in the construction industry, where reputation and relationships drive future opportunities.

With 12 offices across six states, we provide nationwide reach backed by local market knowledge, and our transparent reporting keeps you informed about account status and collection progress throughout the process.

Construction debt involves unique complexities, such as mechanics’ liens, bonding requirements, retainage, change orders, and multi-tier payment hierarchies from general contractors to subcontractors.

Collecting these debts requires specialized knowledge of construction law, lien enforcement timelines, and industry-specific payment practices.

Most reputable collection agencies operate on contingency fee structures, typically charging 10% to 25% of the amounts recovered. The exact percentage depends on factors like account age, balance size, and complexity.

You pay nothing up front and no monthly fees—the agency receives payment only when it successfully collects your money.

The optimal time is around 60–90 days past due, after your internal collection efforts have failed but before the account becomes severely aged. Collection success rates decline sharply as accounts age.

Accounts under 90 days see significantly higher recovery rates than those aged six months or older. Each week of delay reduces the recovery probability and allows debtors to prioritize other invoices.

When you work with professional agencies that use ethical, respectful communication practices, collection efforts can actually preserve relationships by separating the payment issue from your business relationship.

Quality agencies understand that maintaining goodwill matters as much as recovering funds, especially in the construction industry, where future opportunities depend on reputation.

Southwest Recovery Services (SWRS) combines 20+ years of commercial collection experience with specialized expertise in construction debt. Our contingency-only pricing means you pay nothing unless they collect, eliminating all financial risk.

We use AI-guided tracking to monitor every payment promise, while veteran collectors employ respectful, omnichannel outreach that protects your business relationships. With nationwide reach, transparent reporting, and a compliance-first approach, SWRS delivers effective debt recovery specifically designed for contractors’ unique needs.

*Note: Recovery rates mentioned are for general reference only and not guaranteed. Actual results vary by account and industry. Contact Southwest Recovery Services for a customized quote.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.