- Customer Service 866-837-3065 Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

The foundation of effective collections starts before you ever extend credit. Your payment terms need to be crystal clear, documented, and agreed upon before work begins or products ship.

Every client agreement should explicitly specify payment deadlines, accepted payment methods, late-payment penalties and interest rates, early-payment discounts, and dispute-resolution procedures.

Vague terms like “payment due upon completion” create confusion and delays. Instead, use specific language: “Payment due within 30 days of invoice date. Interest accrues at 1.5% per month on balances outstanding beyond 30 days.”

Your contracts provide legal standing if disputes escalate. Without clear documentation of what was agreed, you’re negotiating from a position of weakness.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

Create Accurate, Timely Invoices

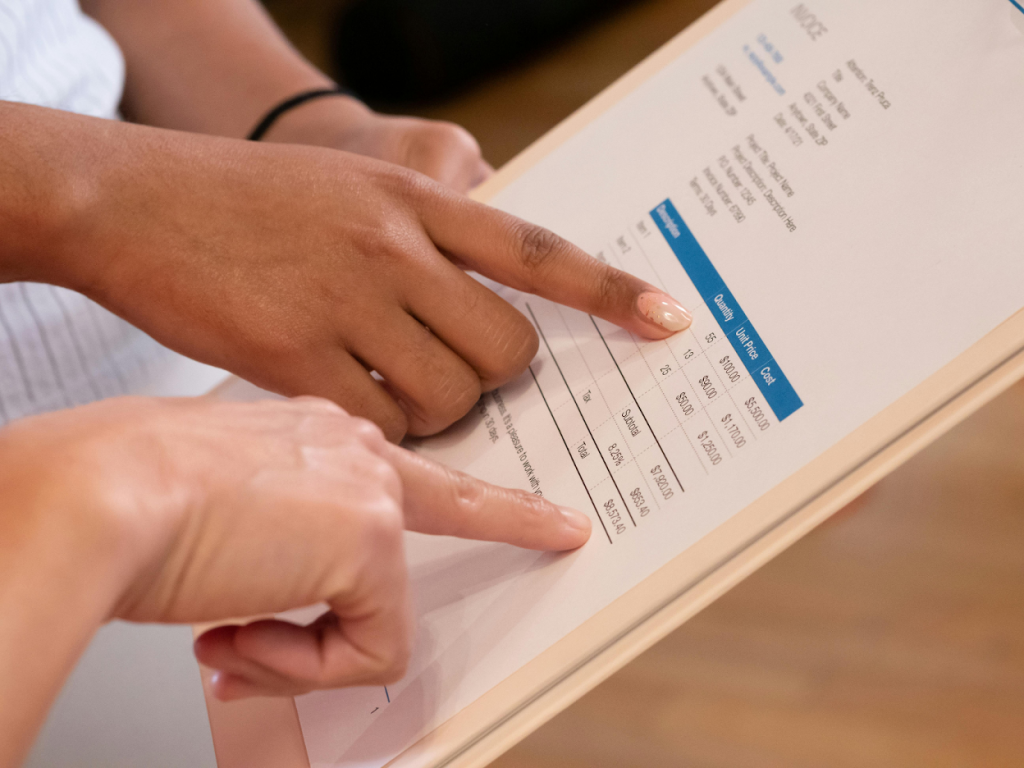

Invoice quality directly impacts payment speed. Every invoice should include itemized descriptions, unit prices and quantities, total amount due with applicable taxes, a clear payment due date, multiple payment options, and contact information for questions.

You should send invoices immediately after delivery or service completion. The longer you wait, the less motivated customers are to prioritize payment. Automation eliminates delays and human error, ensuring invoices arrive promptly and consistently.

Random, reactive collection attempts waste time, damage relationships, and are not effective. You need a structured approach with clear escalation points based on the length of time an invoice remains unpaid.

Different customers respond to different communication methods. A multi-channel approach ensures your message gets through. Effective collection communication uses email for documentation and formal notices, phone calls for personal connection and negotiation, text messages for quick reminders, and formal letters on company letterhead for serious escalation.

Early-stage reminders work well when automated. As accounts age, personal contact becomes essential. It is important to document every interaction meticulously, as this becomes critical if the account eventually requires legal action.

Sometimes customers genuinely want to pay but can’t cover the full amount immediately. Strategic flexibility can recover most or all of the debt while preserving the business relationship.

Consider offering installment plans with partial upfront payment, reduced settlements for immediate lump-sum payment, extended terms that align with the customer’s cash flow cycle, or alternative payment methods.

It is essential to document any payment arrangements in writing with clear terms, payment amounts, due dates, and consequences for missed payments. Payment plans aren’t signs of weakness; they’re valuable tools that convert zero collections into partial or complete recovery.

Not all overdue accounts deserve equal attention. Strategic businesses focus resources where they’ll generate the highest return. Prioritize based on account age (recovery rates plummet after some time overdue), balance size (larger debts justify more intensive efforts), customer history, and likelihood of recovery.

Use aging reports that categorize receivables by outstanding time periods: current, 1–30 days, 31–60 days, 61–90 days, and 90+ days. This helps you allocate collection resources efficiently and identify accounts requiring immediate escalation.

Manual collection processes don’t scale. Modern accounts receivable automation platforms provide automatic invoice generation and delivery, payment tracking across all customer accounts, automated reminder scheduling, customer communication history, AI-driven analytics that predict which accounts are likely to pay late, and dashboard visibility into total receivables.

Automation doesn’t replace human judgment, but it amplifies it. Your team stops wasting time on manual reminder emails and gains capacity for high-value activities, such as negotiating with difficult accounts.

Consider engaging professional collectors when accounts are 60–90 days past due and show no meaningful progress, the debt amount justifies professional fees, the customer has become unresponsive, or internal efforts consume excessive staff time.

Professional agencies act as neutral third parties, allowing them to pursue collections aggressively while preserving your direct business relationship. Most commercial collection agencies operate on a contingency basis, meaning you pay nothing up front, and fees apply only when they successfully recover funds.

Typical contingency rates range from 10–25% of the collected amount, depending on the debt’s age, size, and complexity.

For over 20 years, we at Southwest Recovery Services have specialized exclusively in commercial debt collection, with particular expertise serving trucking, logistics, construction, oil and gas, and wholesale distribution companies. If you’re a B2B business with revenues between $10 million and $100 million, we understand the unique challenges you face.

We use an approach that combines technology-driven efficiency with relationship-preserving professionalism. We utilize AI-guided tracking systems to monitor every account across phone, email, text, and mail communications, and we operate strictly on a contingency basis, which means zero financial risk, no upfront costs, no monthly retainers, and no fees unless we successfully recover your money.

We understand that today’s delinquent accounts might become tomorrow’s strong customer once their cash flow stabilizes. Our respectful, compliance-first communication approach protects your business relationships while pursuing the aggressive recovery your cash flow demands.

Your initial reminder should maintain a friendly, professional tone, assuming the customer may have simply overlooked the invoice. Include the invoice number, original invoice date, amount due, and current due date, and offer assistance if they have questions. Attach a copy of the original invoice for easy reference.

Payment plans demonstrate business sophistication, not weakness. Frame them as structured solutions that benefit both parties: “We understand cash flow challenges. To resolve this balance, we can accept partial payment immediately followed by monthly installments.” Document everything in writing and clearly specify consequences for missed payments.

Most businesses engage collection agencies after 60–90 days of unsuccessful internal collection attempts. Key indicators include: the customer has stopped responding, multiple payment promises have been broken, the account represents significant value, or your internal team’s time investment exceeds likely recovery value. Recovery rates decline after 90 days, so don’t delay escalation.

Provide original signed contracts or purchase orders, all invoices related to the debt, proof of delivery or service completion, complete communication history, any payment agreements or partial payment records, and documentation of any disputes. The more thorough your documentation, the higher your likelihood of recovery.

At Southwest Recovery Services, we operate on a pure contingency basis, as you pay nothing up front until we successfully recover your money, typically 10–25% of the amount collected, depending on the debt’s age, size, and complexity. This model perfectly aligns our incentives with yours.

With 20+ years of commercial collection expertise, AI-guided tracking, and a compliance-first approach that preserves business relationships, we specialize in helping mid-market B2B companies recover aged receivables efficiently.

*Note: Recovery rates mentioned are for general reference only and not guaranteed. Actual results vary by account and industry. Contact Southwest Recovery Services for a customized quote.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.