- Customer Service 866-837-3065 Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

Edinburg sits at the heart of the Rio Grande Valley as Hidalgo County’s seat, with a population exceeding 108,000 residents. The city ranks among the fastest-growing in Texas. This growth brings tremendous opportunity for local businesses, but it also means more challenges with accounts receivable when customers fail to pay.

Unpaid invoices strain cash flow and consume valuable time that business owners should spend growing their operations. For many Edinburg companies in healthcare, construction, and professional services, chasing overdue payments becomes a full-time distraction. When internal collection efforts stall, partnering with a professional debt recovery agency can restore financial stability without damaging the customer relationships you’ve worked hard to build.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

Third-party collection agencies specialize in recovering outstanding debts for businesses. Rather than hiring additional staff or dedicating internal resources to collections, you can outsource this function to professionals who understand the legal requirements and proven techniques for recovering funds.

Most reputable agencies operate on a contingency basis. This means you pay nothing upfront, and fees are only charged when money is successfully recovered. According to industry standards, contingency fees typically range from 10%–25%, depending on factors such as the age and size of the debt.

Several reputable agencies serve businesses in Edinburg and the greater Rio Grande Valley region.

At Southwest Recovery Services, we bring over 20 years of specialized commercial debt recovery experience to Edinburg businesses. Headquartered in Texas with 12 offices across seven states, we work exclusively on a contingency basis; you only pay when we successfully recover funds. Our veteran collectors understand corporate payment processes and use respectful, persistent communication across phone, email, text, and mail to maximize recovery while preserving your ability to do future business.

The reviews we receive are highly positive, especially for our staff. Debtors consistently describe being treated with respect and patience, with flexible payment arrangements offered. Business clients report strong results and good communication. We are known for providing immediate documentation and maintaining professionalism throughout the process.

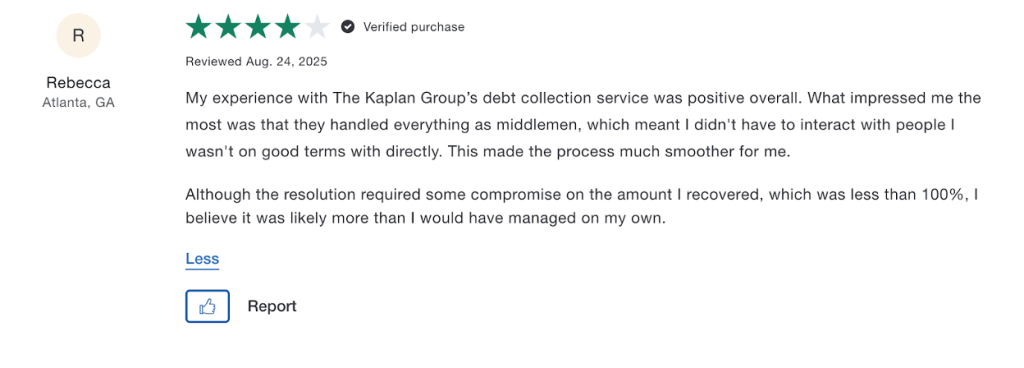

The Kaplan Group is a California-based commercial collection agency specializing in B2B debt collection, serving Texas businesses statewide. Founded in 1991, they bring over 30 years of experience and focus on larger claims with a $10,000 minimum for first-time clients. They work with companies across various industries, with significant expertise in the energy sector. Their collectors typically hold advanced degrees and extensive business backgrounds, which helps them navigate complex commercial disputes.

Mixed reviews. Satisfied clients highlight quick recoveries and clear communication. However, one detailed negative review cites poor responsiveness and a low success rate.

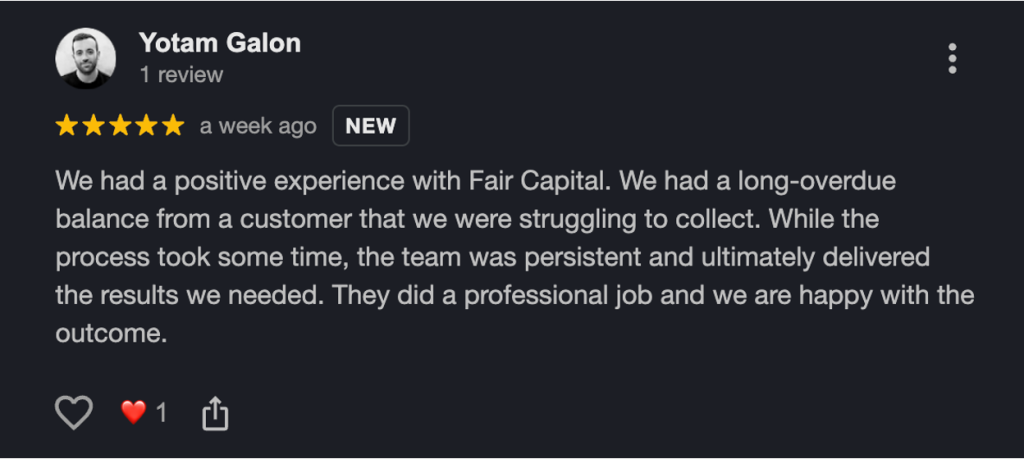

Fair Capital is a New York-based collection agency offering contingency-based services to Texas businesses statewide. They are an ACA International member and utilize skip-tracing technology and credit bureau reporting to locate debtors and encourage payment. Their web-based portal allows clients to track account status in real-time and submit new placements easily.

Mostly positive reviews from both businesses and debtors. Clients praise their efficiency, professionalism, and success in recovering long-overdue debts, including smaller balances that other agencies ignore.

Debt collection pricing varies based on several factors, and understanding these models helps you budget appropriately and evaluate potential partners.

When evaluating costs, remember that a reputable agency recovering 70% of your outstanding balance at 20% commission still puts significantly more money in your pocket than uncollected debts sitting on your books.

Selecting a debt collection agency requires careful consideration of several factors.

Once you place accounts with a collection agency, initial contact typically occurs within days. Collectors reach out through multiple channels, including phone, email, and mail, while documenting every interaction for potential legal action.

Professional agencies work to establish communication with debtors, verify debt validity, and negotiate payment arrangements when needed. Throughout this process, reputable agencies maintain professional conduct that reflects positively on your business.

| Feature | Southwest Recovery Services | The Kaplan Group | Fair Capital |

|---|---|---|---|

| Headquarters | Texas (12 offices across 7 states) | California | New York |

| Years in Business | 20+ years | 30+ years (founded 1991) | Not specified |

| Pricing Model | Contingency only (10–25%) | Not specified | Contingency-based |

| Industries Served | Trucking, logistics, contractors, oil & gas, construction | Various; significant energy sector expertise | Various |

When in-house collections stall, Southwest Recovery Services helps Edinburg businesses recover outstanding commercial accounts. We bring 20+ years of debt recovery experience.

Our contingency model means you pay nothing unless we recover funds. Fees typically range from 10% to 25% of the recovered amount.

We work with trucking and logistics, construction, oil and gas, and professional services. Our compliance-first approach follows FDCPA requirements to reduce legal risk while pursuing payment.

With 12 offices across seven states, we have the reach and resources to pursue recovery. Our AI-guided tracking monitors every promise-to-pay, and our founder stays involved in complex cases.

Consider professional help when accounts reach 60–90 days past due and internal efforts haven’t produced results. The longer debts remain unpaid, the harder they become to collect. If chasing payments consumes significant staff time or if you lack the expertise to navigate collection regulations, an agency can handle this specialized work while you focus on core operations.

Gather complete documentation, including original contracts, invoices, payment history, and all correspondence with the debtor. Accurate contact information and any relevant notes about previous collection attempts help agencies work more efficiently. The more detail you provide upfront, the faster they can begin recovery efforts.

Yes, Texas requires third-party debt collectors to register with the Secretary of State and maintain a surety bond. Legitimate agencies maintain strict compliance programs and train staff on these requirements.

Recovery timelines vary significantly based on debt age, amount, and debtor responsiveness. Fresh accounts under 90 days old often resolve within weeks, while older or disputed debts may take several months. Professional agencies provide regular status updates so you can track progress and make informed decisions about escalation.

At Southwest Recovery Services, we bring over 20 years of specialized B2B debt recovery experience with a relationship-preserving approach that protects your reputation. Working exclusively on contingency, you pay nothing unless we collect. Our veteran collectors use respectful, persistent communication across multiple channels, while AI-guided tracking ensures every promise-to-pay is monitored. With 12 offices across seven states and expertise in industries such as trucking, construction, and oil and gas, we deliver the resources and compliance-first practices that Edinburg businesses need for a successful recovery.

Note: Recovery rates mentioned are for general reference only and not guaranteed. Actual results vary by account and industry. Contact Southwest Recovery Services for a customized quote.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.