- Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

Cash flow problems can strangle even the most promising businesses. When clients don’t pay their invoices on time, the domino effect hits fast. Vendors go unpaid, payroll becomes strained, and growth opportunities are postponed. Yet many companies continue trying to handle collections internally, burning valuable time and resources while recovery rates remain disappointingly low.

The reality is harsh: payment delays and defaults have become increasingly common across all industries. Small and mid-sized businesses feel this pain most acutely. While large corporations can absorb delayed payments, smaller operations often face existential threats when major invoices go unpaid for months.

Economic challenges amplify these issues. Payment timelines have stretched longer, with businesses reporting increasing delays from their B2B customers. What was once a 30-day payment standard now frequently extends 60, 90, or even 120 days past due. This makes professional debt collection essential for businesses fighting to maintain operational viability and protect their bottom line.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

Managing collections internally diverts valuable staff time from revenue-generating activities. Your team spends hours making phone calls, sending emails, and tracking down unresponsive clients—time better spent serving paying customers and growing your business. Professional agencies handle this burden completely, freeing your team to focus on what they do best.

Collection agencies employ specialists who understand debtor psychology, negotiation tactics, and legal leverage points. They know which communication approaches work for different debtor types and can quickly escalate strategies when softer approaches fail. This specialized knowledge consistently produces better results than internal collection efforts.

One of the biggest fears businesses have about collections is damaging client relationships. Professional agencies provide a critical buffer. They can apply appropriate pressure while your company maintains the “good cop” role. When handled correctly, you can recover your money and potentially resume business relationships once the debt is resolved.

Faster debt recovery directly impacts your bottom line. Money sitting in accounts receivable cannot pay bills, purchase inventory, or fund expansion. Professional collectors accelerate the recovery timeline, converting those aging receivables into working capital.

Commercial collections must still comply with general business regulations and contract law because mistakes can expose your business to costly litigation. Professional agencies maintain comprehensive compliance programs, protecting you from legal risks while pursuing debts within legal boundaries.

Most reputable Dallas collection agencies operate on contingency-based fee structures. You pay nothing up front and monthly. The agency only receives payment when it successfully recovers funds for you. Contingency rates typically range from 15% to 40% depending on account age, balance size, and complexity.

At Southwest Recovery Services, we have established ourselves as a leading commercial collection agency serving businesses in Dallas for over 20 years. Our approach focuses specifically on B2B invoice recovery, working with companies ranging from $10 million to $100 million in annual revenue across priority sectors such as trucking, logistics, contractors, and oil and gas.

Our experienced collectors use respectful omnichannel outreach across phone, email, text, and mail, guided by proprietary AI-powered software that tracks every promise to pay with daily founder involvement. This approach maintains professional communication that recovers funds without burning bridges.

We operate exclusively on contingency-based pricing with no upfront costs or hidden fees. You pay only when they successfully collect, and our compliance-first approach avoids threats or unrealistic guarantees, instead focusing on persistent professionalism backed by 12 offices across six states.

Established in 2011, Williams Rush & Associates brings compliance-focused collection services to Dallas businesses. They maintain national licensing, allowing them to pursue debtors across state lines, which is valuable for Dallas companies with customers throughout the United States. Their emphasis on quality service and personalized attention appeals to businesses seeking a consultative collection partner.

Since 2009, Foster & Morris LLC has specialized exclusively in commercial B2B debt collection. Their focus on business-to-business (B2B) accounts means they are exempt from certain FDCPA consumer protection provisions, allowing more direct collection approaches appropriate for commercial contexts. This specialization makes them particularly knowledgeable about corporate payment decision-making processes.

The best collection agency for your business understands your industry’s unique characteristics. Payment practices, terminology, and challenges vary significantly across sectors. An agency specializing in healthcare collections understands insurance payments. Oil and gas specialists understand joint interest billing complexities. Ask potential agencies about their experience in your specific industry and request references from similar clients.

While contingency pricing dominates commercial collections, rates vary considerably. Typical fees range from 15% for large, recent accounts to 40% for small, very old accounts. Understand exactly when fees apply and clarify whether there are any circumstances where you might owe fees without successful collection.

Request information about the agency’s compliance program. How do they train collectors on legal requirements? Have they faced regulatory actions? Determine whether the agency employs or partners with attorneys specialized in creditors’ rights. Legal resources become critical when collections require escalation to litigation or judgment enforcement.

When you place accounts with a collection agency, you’ll provide documentation, including invoices, contracts, proof of delivery, and records of your collection attempts. Comprehensive documentation strengthens the agency’s position and increases recovery likelihood.

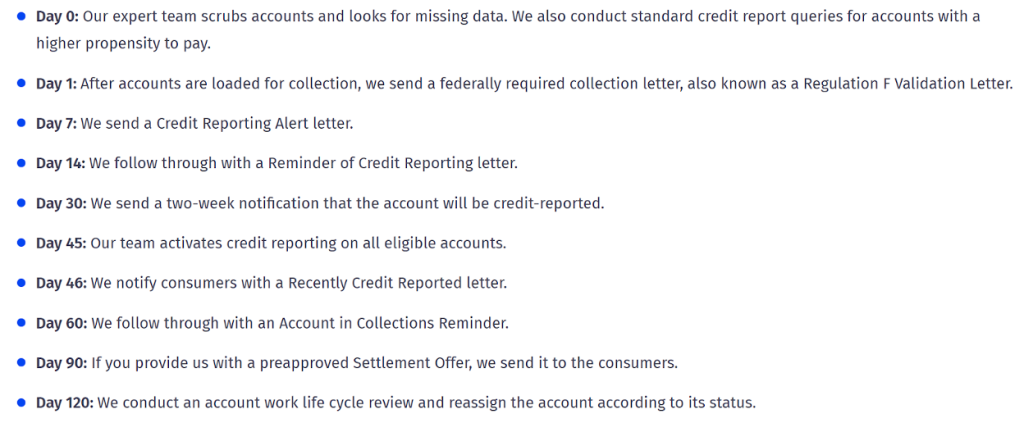

Professional collectors initiate contact through letters, phone calls, emails, and text messages. They present your claim, explain the consequences of non-payment, and negotiate payment arrangements. This phase typically lasts 30–90 days for responsive debtors. Skilled collectors balance firmness with professionalism.

For unresponsive debtors, agencies escalate their approach. This might include demand letters from attorneys, asset investigations, or recommendations to file lawsuits. In Texas, the statute of limitations for commercial debt is four years, providing an extended timeframe to pursue legal action.

When your cash flow is at stake, you need a collection partner combining expertise, persistence, and professionalism to get you paid while protecting your business reputation. At Southwest Recovery Services, we bring 20+ years of proven experience specifically in commercial B2B debt recovery, working with Dallas businesses across diverse industries, including oil and gas, trucking, logistics, construction, and professional services.

Our contingency-only pricing model means zero financial risk; no upfront costs, no monthly fees, just results. You pay only when we successfully recover your funds. What truly distinguishes us is our ethical, relationship-preserving approach. Unlike aggressive tactics that can damage your reputation, we use diplomatic strategies that separate the collection process from your ongoing business relationships.

Our AI-guided tracking software monitors every promise to pay, ensuring no detail falls through the cracks. Daily founder involvement means your accounts receive senior-level attention. This systematic approach produces particularly strong results on accounts under 90 days old, helping you minimize aging receivables before they become uncollectible.

With 12 offices across six states, we bring national reach backed by local Dallas market expertise. Our compliance-first approach protects your business from legal risks, maintaining your reputation while recovering maximum funds.

Contact Southwest Recovery Services Now

Recovery timelines vary based on account age and debtor responsiveness. For accounts less than 90 days past due, you can typically expect initial results within 30–45 days of agency placement.

Fresh accounts often respond quickly to professional collector contact. Accounts aged 180 days or older generally require 60–120 days of collection efforts. If litigation becomes necessary, the timeline extends 6–18 months, depending on court schedules and debtor response.

Comprehensive documentation strengthens your collection position considerably. Provide copies of all invoices showing amounts owed and due dates, contracts or purchase orders, proof of delivery or service completion, and records of your collection attempts, including emails and phone logs.

Additional helpful documentation includes signed credit applications, personal guarantees, and any correspondence where the debtor acknowledged the debt.

Yes, reputable Dallas agencies maintain multi-state licensing and can pursue debtors throughout the United States. They understand varying state laws regarding statute of limitations and collection practices, ensuring compliance across jurisdictions.

When legal action becomes necessary in another state, agencies partner with local attorneys familiar with that jurisdiction’s procedures.

Commercial collection agencies specialize in B2B debt and operate under different legal frameworks than consumer collectors. While consumer collectors face strict FDCPA regulations, commercial collectors have more flexibility since businesses receive fewer protections.

Commercial agencies understand corporate payment decision-making involving multiple stakeholders and employ sophisticated business analysis focused on preserving business relationships.

At Southwest Recovery Services, we stand out among Dallas collection agencies because we combine 20+ years of specialized B2B collection experience with an ethical, relationship-preserving approach that recovers funds without damaging valuable business connections.

Our contingency-only pricing eliminates financial risk, and we have veteran collectors who use respectful, compliance-first strategies. With 12 offices across six states, we bring national reach backed by deep Dallas market expertise and clear reporting throughout the collection process.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.