- Customer Service 866-837-3065 Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

When clients don’t pay, your entire business suffers. Unpaid invoices mean limited cash flow, which impacts your ability to pay vendors, employees, and invest in growth. Many Houston businesses simply lack the time, expertise, and legal knowledge to effectively pursue commercial debt on their own.

Commercial collection agencies bring specialized tools and techniques that dramatically increase recovery rates. Their sole focus is getting you paid, allowing you to concentrate on running your business rather than chasing payments.

Late payments among businesses have reached crisis levels in Texas. Many Houston businesses report increasing payment delays from their B2B customers, with payment times extending weeks past the due date.

Small and medium businesses feel this pain most acutely. While larger corporations can absorb delayed payments, smaller operations often face existential threats when significant invoices go unpaid.

The COVID-19 pandemic exacerbated these issues, with many businesses still struggling to recover from pandemic-related payment disruptions. This new economic reality has made professional debt collection services not just helpful but essential for many Houston businesses fighting to maintain healthy cash flow.

Using a professional collection agency provides significant legal advantages for Houston businesses. Collection agencies understand Texas debt collection laws, including the Texas Debt Collection Act and federal regulations like the Fair Debt Collection Practices Act. This expertise helps avoid costly legal mistakes that could expose your company to litigation.

Commercial collection agencies often employ or work closely with attorneys specialized in creditors’ rights. These legal professionals can quickly escalate collection efforts when necessary, including filing lawsuits, obtaining judgments, and pursuing post-judgment remedies like liens or garnishments. Many Houston agencies maintain relationships with the courts and understand local judicial procedures, streamlining the legal collection process.

Additionally, third-party collectors create a buffer between your business and the debtor, preserving valuable client relationships. While your company maintains the “good cop” role, the collection agency can apply appropriate pressure, keeping your business relationship intact for potential future dealings once the debt issue is resolved.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

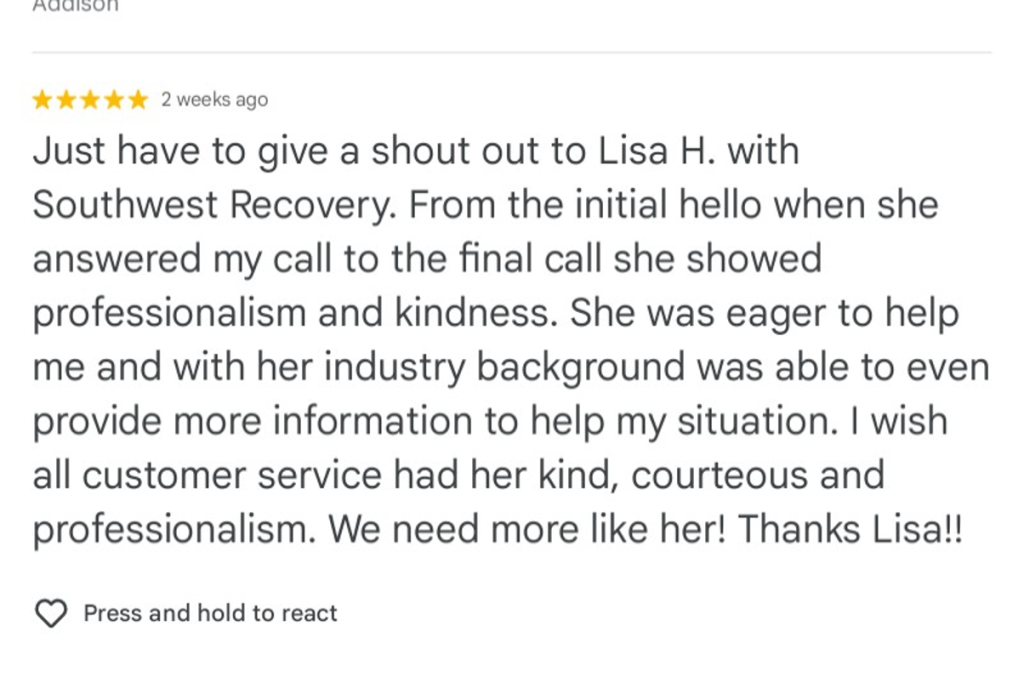

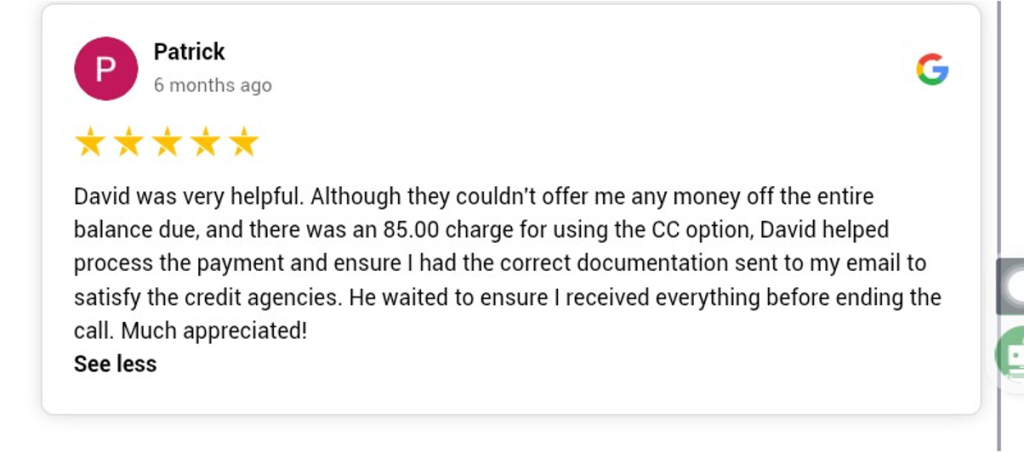

With over 20 years of experience, Southwest Recovery Services specialize in commercial collections across multiple industries including oil and gas, medical, and professional services. Our team employs a methodical approach combining persistent communication, skip-tracing expertise, and legal intervention when necessary, achieving an impressive recovery rate for accounts less than 90 days old.

What sets us apart is our commitment to relationship preservation. Our collectors are trained to maintain professional communication that recovers funds without burning bridges between you and your clients.

We work on a contingency-only basis, so clients pay only when we successfully recover funds. There are no upfront fees or complex fee structures. Our client portal provides real-time updates on collection activities and recovery status, giving you complete transparency throughout the process.

Cedar Financial has been serving Houston businesses since 1991, building a solid reputation for debt recovery across various industries. Their team focuses on negotiating settlements that aim to balance cash recovery with relationship preservation.

Cedar Financial offers global collection services through their network of international partners, allowing them to pursue debtors beyond Texas borders, which can be valuable for Houston’s internationally connected business community.

While the positive reviews are glowing, an article by Manta Law on Cedar Financial’s debt collection process highlights one potential drawback for the company. The article addresses potential debt collection harassment concerns and outlines consumer rights protections, which could raise questions about their collection practices for some prospective clients.

Nelson, Cooper & Ortiz provides commercial debt recovery services with customizable corporate collection options for Houston businesses with specific collection needs.

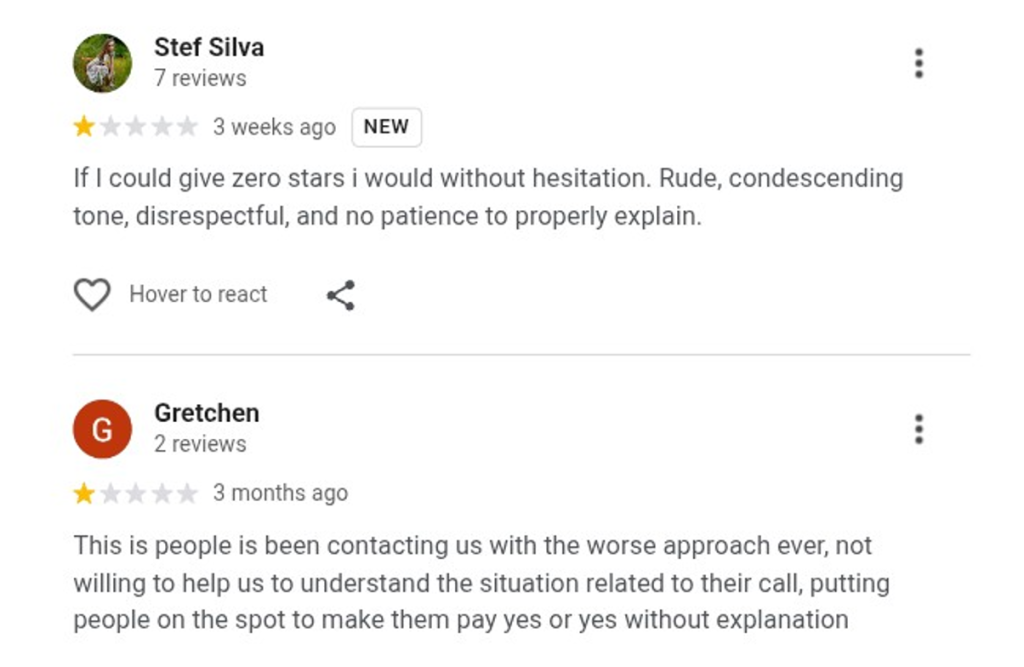

Their approach involves detailed account analysis to determine collection strategies, followed by escalating communication attempts. However, their debt collection methods have received several negative reviews on Google that potential clients may want to consider.

For resistant accounts, they use advanced skip-tracing and asset investigation to identify collection opportunities. Their contingency fees typically vary based on account age and difficulty, with no upfront or monthly fees regardless of recovery outcomes.

When selecting the right Houston collection agency, industry specialization should be a primary consideration. Agencies with experience in your specific sector understand the unique payment practices, terminology, and challenges you face.

An agency specializing in oil and gas collections, for example, will understand joint operating agreements and the complexities of operator/non-operator payment disputes that general collection agencies might miss.

Houston collection agencies typically offer several fee structure options, each with distinct advantages. Contingency fees, the most common arrangement, involve the agency receiving a percentage of recovered funds, typically ranging from 15–50% depending on account age, balance size, and complexity. This model aligns the agency’s interests with yours, they only get paid when you do.

Flat fee structures involve paying a set amount regardless of recovery outcomes. While this approach is less common for commercial collections, it may be appropriate for high-probability recoveries or when consistent budgeting is a priority. Some agencies offer hybrid models combining lower contingency rates with modest upfront fees, potentially providing better overall value for accounts with high recovery probability.

Modern collection agencies leverage sophisticated technology to improve recovery rates and provide transparent reporting. Look for agencies offering secure client portals with real-time updates on collection activities, payment receipts, and account status.

The best Houston agencies provide 24/7 access to your portfolio, including detailed notes on collection attempts, debtor responses, and recovery projections.

The debt collection industry operates under strict regulations at both state and federal levels. Reputable Houston collection agencies maintain comprehensive compliance programs and stay current with evolving legal requirements.

Ask potential agencies about their compliance procedures, including how they document collection activities, train their staff, and handle consumer protection laws even in B2B collections.

At Southwest Recovery Services, we understand the unique challenges facing Houston businesses when clients fail to pay their invoices. For over 20 years, we’ve helped Houston companies across diverse industries—from oil and gas to medical and healthcare—recover millions in outstanding receivables while preserving valuable business relationships.

Our contingency-based model means we only succeed when you do, no upfront fees, no monthly charges, just results.

When your cash flow is at stake, you need a collection partner with the expertise, persistence, and professionalism to get you paid while protecting your business reputation. Our proven approach combines persistent professionalism with deep industry knowledge, achieving a remarkable recovery rate on accounts under 90 days old.

Unlike aggressive collection tactics that can damage your reputation, we employ diplomatic strategies that separate the collection process from your ongoing business relationships, allowing you to maintain professional bridges even after debt resolution.

Choose Southwest Recovery Services and experience why Houston businesses trust us to convert their collection challenges into recovered revenue.

Contact Southwest Recovery Services Now

For accounts less than 90 days past due, expect initial results within 30–45 days of agency placement. Fresher accounts often respond to first or second contact from professional collectors. Older accounts (180+ days) typically require 60–120 days, while litigation cases can extend 6–18 months depending on court schedules and debtor response.

Yes, reputable Houston agencies maintain multi-state licenses and partner with local attorneys when necessary. They navigate varying state laws regarding statute of limitations and collection practices, ensuring compliance across jurisdictions. For international collections, agencies work through established global networks while maintaining consistent communication throughout the process.

Provide copies of all invoices, contracts, proof of delivery, and records of payment attempts and communications. Additional helpful documentation includes credit applications, personal guarantees, bounced checks, and correspondence acknowledging the debt. Comprehensive documentation significantly increases collection success rates and strengthens your legal position.

Commercial agencies specialize in B2B debt and operate under different regulations than consumer collectors. They employ sophisticated business analysis, understand corporate payment decisions involving multiple stakeholders, and maintain professional approaches focused on preserving business relationships while achieving maximum recovery through industry-specific expertise.

Southwest Recovery Services brings 20+ years of Houston market expertise with an impressive recovery rate on accounts under 90 days old. Our relationship-preserving approach maintains professional communication while recovering funds, and we operate exclusively on contingency with no upfront fees. Our team understands diverse Houston industries including oil & gas, medical, and professional services, providing specialized knowledge that delivers superior results.

*Note: Recovery rates mentioned are for general reference only and not guaranteed. Actual results vary by account and industry. Contact Southwest Recovery Services for a customized quote.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.