- Customer Service 866-837-3065 Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

League City’s growth demands specialized debt recovery. When invoices stall, chasing payments pulls your team away from revenue-generating work. Local collection agencies offer a strategic edge by navigating Texas-specific regulations and leveraging regional networks to resolve disputes faster than national firms.

For B2B companies, the stakes are higher. Commercial recovery requires balancing firm collection with relationship management. A local expert understands your industry’s specific payment cycles and PO systems, ensuring you recover outstanding debt without burning bridges with long-term clients.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

At Southwest Recovery Services, we bring over 20 years of specialized debt recovery experience to League City businesses. Our contingency rates range from 10% to 25% based on account age and complexity. We handle commercial debt across industries critical to the League City economy, including healthcare, real estate, and commercial services. Our AI-guided tracking system monitors every promise to pay across phone, email, SMS, and formal letters, while our collectors use respectful, persistent communication to maximize recovery while preserving your ability to do future business.

Empire Credit and Collection is a New York-based debt collection agency claiming over 40 years of industry experience. They operate on a no-recovery, no-fee basis and maintain a network of over 400 affiliate attorneys and agencies for nationwide reach. They handle consumer, commercial, medical, and international collections, reporting an 82% success rate on B2B debts.

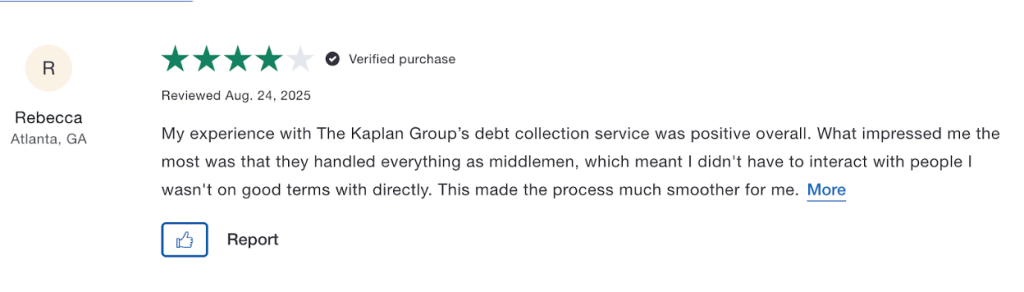

The Kaplan Group is a California-based commercial collection agency specializing in B2B debt collection, serving Texas businesses statewide. Founded in 1991, they bring over 30 years of experience and focus exclusively on commercial claims with a $10,000 minimum for first-time clients.

Client reviews reveal important insights beyond marketing claims. When evaluating collection agencies, look for consistent patterns in feedback regarding communication, professionalism, and actual recovery results.

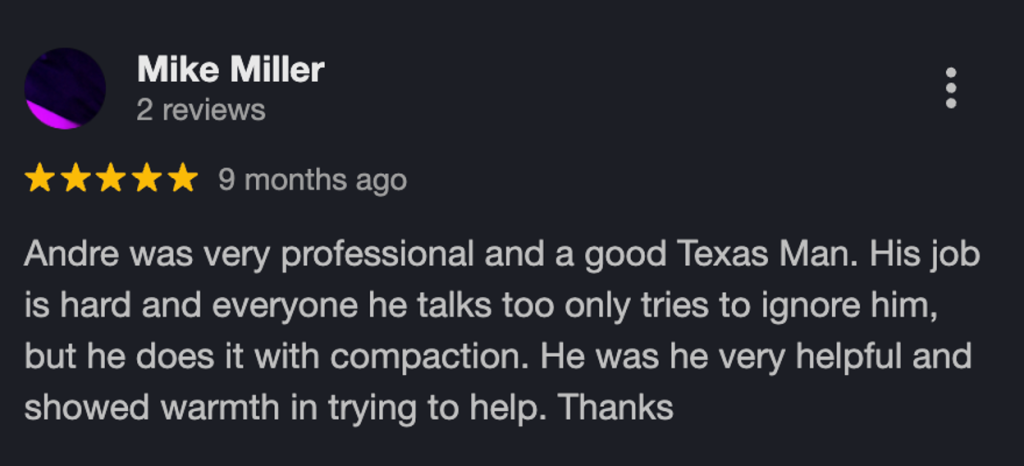

We consistently receive positive reviews, especially for individual staff members. Debtors consistently describe being treated with respect, patience, and compassion, and being offered flexible payment arrangements. Many reviewers note that our staff went above and beyond to help resolve situations, including providing paid-in-full letters immediately and assisting with housing applications. Business clients report strong results, and small business owners praise our ability to collect debts others couldn’t and their transparent online reporting portal.

Mostly positive reviews, especially regarding individual staff members. Business clients frequently praise specific representatives for their professionalism, clear communication, and quick results. However, a negative review cites initial effort followed by months of silence despite repeated follow-up attempts, suggesting inconsistent communication on some accounts.

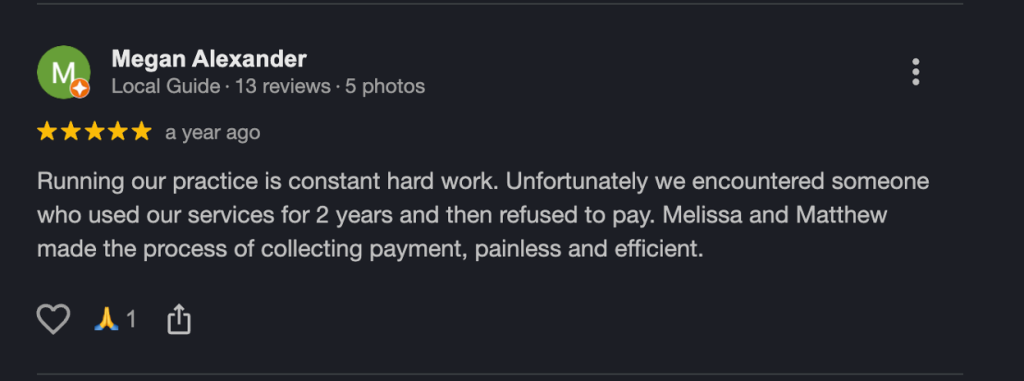

The reviews are mixed. Happy customers praise the fast results, clear updates, and professional guidance during the collection process. On the other hand, one in-depth negative review describes slow responses and failure to follow through on promised legal action.

| Feature | Southwest Recovery Services | Empire Credit and Collection | The Kaplan Group |

|---|---|---|---|

| Headquarters | Texas (12 offices across 7 states) | New York | California |

| Years in Business | 20+ years | 40+ years | 30+ years (founded 1991) |

| Pricing Model | Contingency only (10–25%) | No-recovery, no-fee | Not specified |

| Collection Type | Commercial (B2B) exclusively | Consumer, commercial, medical, international | Commercial (B2B) exclusively |

| Reviews | Consistently positive; praised for respect, flexibility, transparent reporting, and collecting debts others couldn’t | Mostly positive; some praise quick results, one complaint cites months of silence after initial effort | Mixed; some praise fast results, one detailed complaint cites slow responses and failure to follow through on legal action |

Most reputable agencies operate on a contingency basis, meaning you pay nothing unless they successfully recover your funds. This model aligns the agency’s incentives with your goals and eliminates financial risk.

Contingency fees typically range from 10% to 25% of the recovered amount, depending on several factors:

For a practical example, if you submit a $10,000 invoice that is 60 days past due and the agency successfully recovers the full amount at a 20% contingency rate, you would pay $2,000 and receive $8,000. Avoid flat-fee arrangements, as they can incentivize minimal effort. Always request transparent, itemized quotes before engaging any provider.

Beyond pricing comparisons, evaluate potential partners across several critical dimensions.

When internal collection efforts reach their natural limits, at Southwest Recovery Services, we deliver the expertise that transforms aging receivables into working capital. With over 20 years of specializing in commercial debt recovery across trucking, logistics, oil and gas, property management, and contractor services, we understand B2B collections inside and out.

We employ veteran collectors trained in diplomatic, relationship-preserving strategies. Our proprietary AI-guided tracking software monitors every communication touchpoint across phone, email, SMS, and formal letters, ensuring no commitment falls through the cracks. Our founder, Steven Dietz, maintains daily involvement in operations, providing consistent leadership that drives results.

Operating exclusively on a contingency basis means League City businesses face zero upfront costs and no financial risk. You only pay when invoices are successfully recovered, aligning our incentives perfectly with yours. This performance-based model makes professional B2B invoice recovery services accessible even for smaller invoices where traditional hourly legal fees would be cost-prohibitive.

With 12 offices across seven states, we combine national reach with the personalized attention of a regional partner. Our compliance-first approach delivers recovery results while protecting your business reputation throughout the process.

Most commercial collections resolve within 30 to 90 days, though timing depends on factors such as the age of the debt, the quality of the documentation, and the debtor’s financial situation. Early intervention generally produces faster results, as recovery rates decline significantly after accounts age beyond 90 to 120 days.

Prepare complete documentation, including the original contract or agreement, all invoices with specific amounts and due dates, a record of previous communication attempts, and any relevant purchase orders or delivery confirmations. Thorough documentation strengthens the collection effort and helps resolve disputes quickly.

A professional B2B collection agency actually helps preserve relationships by serving as a neutral third party. This separates the financial dispute from your ongoing business operations. Agencies employing respectful, diplomatic communication strategies can often maintain positive client relationships while still recovering their funds.

Commercial or B2B debt collection involves business-to-business transactions rather than consumer debts. The regulatory framework differs significantly, with the federal Fair Debt Collection Practices Act primarily covering consumer debts. Commercial collections require specialized knowledge of business contracts, industry practices, and corporate structures.

At Southwest Recovery Services, we bring over 20 years of commercial collection expertise with specialized knowledge of industries vital to the League City economy, including logistics, energy, and contractor services. Our contingency-only pricing eliminates financial risk, while AI-guided tracking ensures transparent progress monitoring. With veteran collectors trained in relationship-preserving strategies and 12 offices across seven states, we combine national capabilities with personalized service.

Note: Recovery rates mentioned are for general reference only and not guaranteed. Actual results vary by account and industry. Contact Southwest Recovery Services for a customized quote.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.