- Customer Service 866-837-3065 Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

Unpaid invoices create immediate cash flow bottlenecks for Katy businesses. When clients delay payment or ignore internal reminders, operational growth stalls and resources are wasted chasing money instead of generating it. Many business owners find themselves spending valuable time chasing payments instead of focusing on operations and customer relationships.

Professional debt collection agencies bring specialized expertise that most businesses lack internally. They understand Texas debt collection laws, including the Texas Debt Collection Act and federal standards like the Fair Debt Collection Practices Act. This knowledge helps avoid costly legal mistakes while maximizing recovery rates. For B2B companies dealing with commercial receivables, professional collectors can pursue unpaid invoices diplomatically, preserving valuable business relationships while still recovering what you’re owed.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

We are a nationally recognized full-service accounts receivable management company headquartered in Texas, with over 20 years of experience in commercial debt recovery. At Southwest Recovery Services, we specialize in B2B invoice recovery for companies with $10M to $100M in revenue, helping businesses nationwide recover past-due invoices while protecting client relationships.

Our agency operates on a contingency-only basis, meaning clients pay nothing upfront and only pay when we successfully collect. We maintain 12 offices across seven states and use AI-guided tracking software that monitors every promise to pay across phone, email, text, and mail communications. Our priority sectors include trucking, logistics, contractors, and oil & gas, though we serve businesses across multiple industries.

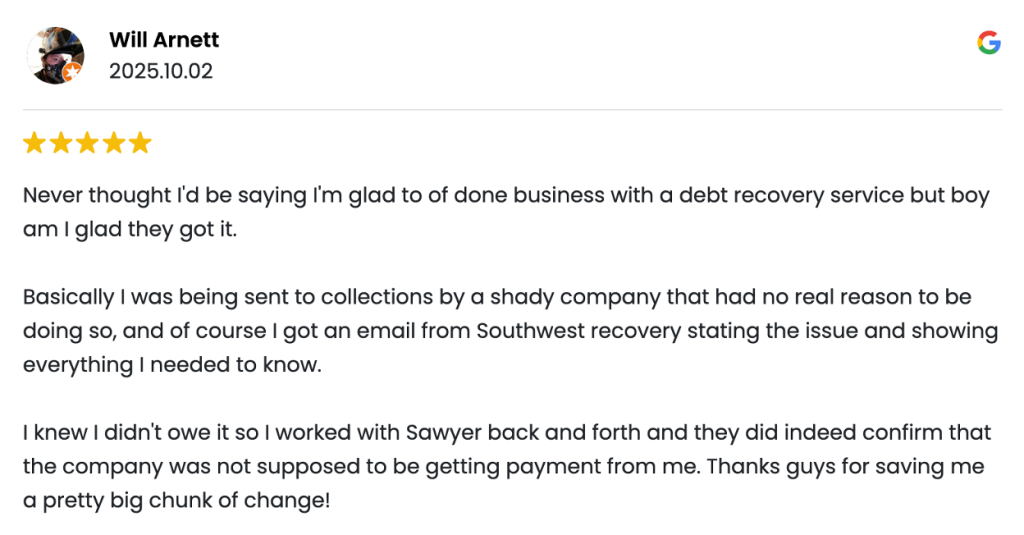

Clients consistently praise us for transparent pricing, professional communication, and effective results on commercial accounts. Business owners highlight the contingency-only model as a key benefit, allowing them to pursue collections without financial risk. Our relationship-preserving approach receives particular recognition from companies seeking to maintain long-term client partnerships.

Universal Fidelity LP is a woman-owned collection agency that has been in operation since 1991. The company is BBB-accredited and provides collection services to financial institutions, healthcare providers, and automotive lenders. The agency offers services including automotive loan and lease recovery, commercial receivables management, and outsourced call center solutions. They position themselves as consumer-focused collectors who prioritize respectful communication with debtors.

Universal Fidelity LP receives mixed feedback from both debtors and creditors. Several reviewers note the agency’s professional and respectful approach during collection calls, with some praising representatives for being informative and willing to work on payment arrangements. However, other reviewers report communication challenges and difficulties reaching the agency. The BBB accreditation indicates adherence to business standards.

Empire Credit and Collection is a full-service debt collection agency that serves the Houston metro area, including Katy. The company operates on a contingency basis and maintains a network of over 400 affiliate attorneys and agencies for nationwide coverage. Empire handles small business debt collections, commercial B2B debt, and judgment collections. The agency is BBB accredited and offers services throughout Texas and across the nation. They also provide legal escalation options for cases requiring court action, with upfront legal costs.

Empire Credit and Collection receives varied feedback from business clients. Some reviewers report positive experiences with quick collections and professional communication from account managers. Others express frustration with communication delays and a lack of progress updates on the accounts they have placed.

Most commercial debt collection agencies serving Katy businesses operate on a contingency fee basis. This pay-on-success model means you pay nothing upfront and only a percentage of the amounts successfully recovered. For B2B commercial collections, contingency rates typically range from 10% to 25% of recovered funds, depending on several factors:

Some agencies also charge flat fees, typically between $15 and $25 per account, for early-stage collection attempts. However, this model is less common for complex commercial debts where recovery isn’t guaranteed. Be cautious of agencies that charge both flat fees and contingency fees, as this can result in paying twice for the same service.

| Feature | Southwest Recovery Services | Universal Fidelity LP | Empire Credit and Collection |

|---|---|---|---|

| Years in Business | 20+ | 30+ | 45+ |

| Headquarters | Texas | Katy, TX | New York, NY |

| Pricing Model | Contingency only | Not Specified | Contingency |

| BBB Accredited | Yes | Yes | Yes |

| Attorney Network | Yes | Not Specified | 400+ affiliates |

| Notable Focus | Trucking, logistics, contractors, oil & gas | Automotive, healthcare, financial | Small business, commercial, judgments |

When your business needs to recover unpaid commercial invoices, Southwest Recovery Services delivers the expertise and results Katy companies require. With over 20 years of focused B2B debt recovery, we understand the unique challenges businesses face when clients don’t pay.

At Southwest Recovery Services, we operate on a contingency-only model, with fees ranging from 10% to 25%, you pay nothing unless we recover your funds. This aligns our interests directly with yours and eliminates financial risk while pursuing what you’re owed. Our AI-guided tracking system monitors every contact attempt across phone, email, text, and mail, ensuring no account falls through the cracks and every promise to pay gets documented.

We specialize in serving companies with $10M to $100M in revenue across industries, including trucking, logistics, contractors, and oil & gas. Our veteran collectors use respectful omnichannel outreach that preserves your business relationships while still recovering your money. With 12 offices across seven states and a compliance-first approach, we provide the reach and professionalism your accounts deserve.

Our clear reporting keeps you informed on account status and outcomes throughout the collection process. We believe in transparency and ethical practices; no threats, no guarantees, just professional, diplomatic collection services that get results.

Texas law provides a four-year statute of limitations for commercial debt collection. This means businesses have four years from the date the debt became due to pursue legal action if necessary. Acting sooner improves recovery chances, as collection rates decline with time.

A contingency fee is a percentage of the successfully recovered debt amount that you pay to the collection agency. Under this arrangement, you pay nothing upfront and nothing if the agency fails to collect. Rates vary but typically range from 10% to 25% for commercial debt.

Yes, for commercial B2B debt, collection agencies can contact the business that owes money via phone, email, or mail. Commercial collections operate under different rules than consumer collections, allowing for more direct communication with business debtors.

Most agencies require copies of invoices, contracts, proof of delivery, and records of your payment attempts and communications. Credit applications, personal guarantees, bounced checks, and any correspondence acknowledging the debt strengthen your case and improve the likelihood of recovery.

At Southwest Recovery Services, we focus exclusively on B2B commercial collections with over 20 years of experience and 12 offices across seven states. We use AI-guided tracking technology with daily founder involvement, operate on a contingency-only pricing model of 10% to 25%, and prioritize relationship-preserving approaches that maintain your company’s reputation with clients.

*Note: Recovery rates mentioned are for general reference only and not guaranteed. Actual results vary by account and industry. Contact Southwest Recovery Services for a customized quote.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.