- Customer Service 866-837-3065 Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

Pasadena sits at the heart of the Houston metropolitan area’s industrial economy. This industrial ecosystem creates complex B2B payment relationships. When a contractor fails to pay a supplier, the ripple effects spread quickly. Internal collection efforts often prove ineffective because your staff lacks specialized training, and customers may simply ignore calls from the same company they already owe money to.

Professional collection agencies serve as neutral third parties, removing emotional tension that prevents successful payment negotiations. They understand debtor psychology and negotiation tactics that accelerate recovery while freeing your team to focus on revenue-generating activities.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

Several reputable agencies serve businesses in Pasadena and the greater Houston area.

At Southwest Recovery Services, we bring over 20 years of debt collection experience to Pasadena businesses. Headquartered in Dallas, Texas, with offices across seven states, including a Houston location, we work exclusively on a contingency basis; you only pay when we successfully recover funds. Our team handles commercial debt recovery, utilizing AI-guided tracking and multiple communication channels, including phone, email, and mail.

We receive very positive reviews, especially regarding individual staff members. Debtors consistently describe being treated with respect, patience, and compassion, and being offered flexible payment arrangements. Business clients report strong results—one reviewer noted our proven effectiveness. Several small business owners praise our revenue cycle management and ability to collect debts that others couldn’t.

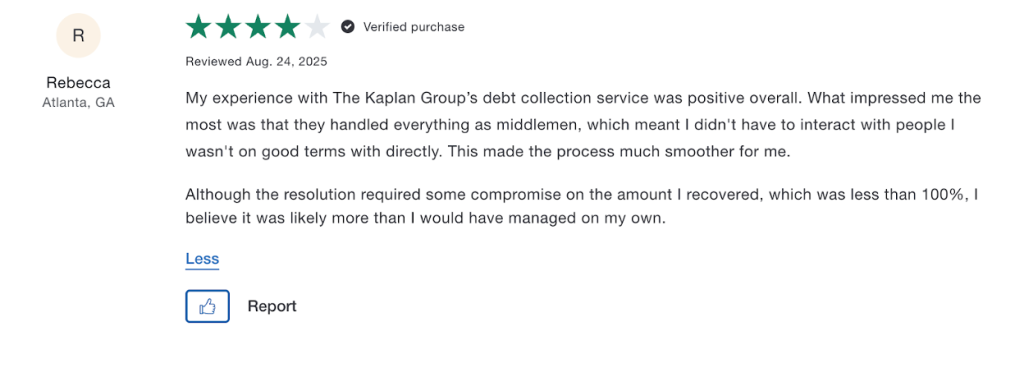

The Kaplan Group is a California-based commercial collection agency specializing in B2B debt collection, serving Texas businesses statewide. Founded in 1991, they bring over 30 years of experience and focus exclusively on commercial claims with a $10,000 minimum for first-time clients.

Mixed reviews. Satisfied clients highlight quick recoveries, clear communication, and professional support throughout the collection process. Multiple business owners report successfully collecting on debts they thought were unrecoverable within weeks. However, one detailed negative review cites poor responsiveness, with delays of weeks to months in communication.

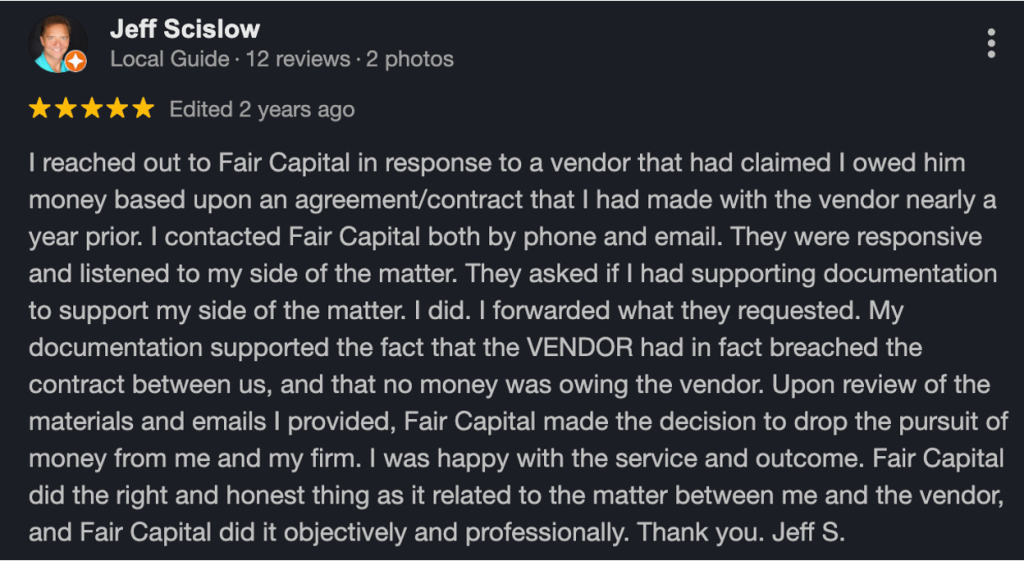

Fair Capital is a New York-based collection agency offering contingency-based services to Texas businesses statewide. They are an ACA International member, BBB A+ rated, and utilize skip-tracing technology and credit bureau reporting to locate debtors and encourage payment. Their web-based portal allows clients to track account status in real-time and submit new placements easily. They handle consumer, commercial, and medical debt.

Consistently positive reviews from both businesses and debtors. Business clients praise their efficiency, professionalism, and success in recovering long-overdue debts—including smaller balances that other agencies ignore.

When comparing agencies, prioritize those offering contingency-only pricing, transparent reporting, and experience in your specific industry. For larger B2B claims, consider agencies with demonstrated expertise in commercial collections rather than those focused primarily on consumer debt.

| Feature | Southwest Recovery Services | The Kaplan Group | Fair Capital |

|---|---|---|---|

| Headquarters | Dallas, Texas (12 offices across 7 states, including Houston) | California | New York |

| Years in Business | 20+ years | 30+ years (founded 1991) | Not specified |

| Collection Type | Commercial (B2B) exclusively | Commercial (B2B) exclusively | Consumer, commercial, and medical |

| Industries Served | Trucking, logistics, oil & gas, construction, property management | Not specified | Various |

Most reputable commercial collection agencies operate on a contingency basis. This means you pay nothing upfront and only owe fees when the agency successfully recovers your money. For commercial B2B collections, contingency fees typically range from 10% to 25% of recovered amounts.

Several factors influence your actual rate. Debt age matters significantly because older debts require more effort to collect. Fresh receivables under 90 days typically command lower percentages, while accounts over six months may require higher fees. Balance size also plays a role, with larger debts often qualifying for lower percentage rates. Volume matters, too, as businesses placing multiple accounts may negotiate better terms.

The contingency model eliminates financial risk for your business. If the agency collects nothing, you owe nothing. This structure aligns the agency’s incentives directly with your recovery goals and ensures they invest genuine effort in each account.

Understanding Texas regulations helps you evaluate whether potential collection partners operate compliantly. Importantly, commercial B2B debt collection operates under different rules than consumer debt collection.

The federal Fair Debt Collection Practices Act (FDCPA) applies specifically to consumer debts incurred for personal, family, or household purposes. It does not cover business-to-business transactions. This means B2B collectors have more flexibility, though reputable agencies voluntarily adopt ethical standards mirroring FDCPA principles.

Texas state law governs commercial collections through the Texas Finance Code and Uniform Commercial Code. These frameworks regulate B2B transactions, secured lending, and enforcement of contractual obligations. Agencies serving Texas businesses should register appropriately with state authorities and carry adequate insurance coverage.

Choosing a collection agency requires evaluating several factors beyond just the fee structure. Start by confirming the agency specializes in commercial B2B collections rather than consumer debt. The strategies, regulations, and relationship dynamics differ substantially between these areas.

At Southwest Recovery Services, we deliver proven results through relationship-focused collection strategies, offering the specialized expertise that commercial B2B businesses in Pasadena need. With over 20 years dedicated exclusively to commercial debt recovery, we understand the unique challenges facing businesses in the $10M–$100M revenue range.

Our team specializes in industries prevalent throughout the Pasadena area and the Gulf Coast region. We prioritize sectors including trucking and logistics, oil and gas field services, commercial construction, and property management. This industry-specific knowledge helps our collectors handle common disputes and apply appropriate urgency while maintaining professional courtesy.

We operate on a contingency-only model with fees typically ranging from 10–25% of recovered amounts. You pay nothing upfront, no monthly retainers, and no fees unless we successfully recover your money. Our AI-powered platform tracks every communication and logs every payment commitment, ensuring consistent follow-up across phone calls, emails, texts, and traditional mail.

With 12 offices spanning seven states, we combine nationwide reach with personalized service. Our founder’s daily involvement provides accountability that larger impersonal agencies cannot match.

Any business experiencing cash flow challenges due to unpaid invoices can benefit from professional collection services. Companies in industries common to Pasadena, including petrochemical services, construction, logistics, and manufacturing, often face extended payment cycles that strain working capital. Businesses in the $10M–$100M revenue range typically experience the most significant impact from unpaid receivables, as these outstanding amounts directly affect growth potential and operational flexibility.

Most B2B collection experts recommend engaging professional agencies when invoices reach 60–90 days past due, and your internal collection efforts have produced no concrete payment commitments. Waiting too long reduces the likelihood of recovery because debtor circumstances deteriorate over time. However, if a customer stops responding to your calls and emails, that clear signal indicates professional intervention is needed, regardless of how many days have passed.

Not when you partner with a professional B2B agency that prioritizes relationship preservation. Specialized commercial collection agencies understand that today’s slow-paying customer might become tomorrow’s profitable account. They serve as neutral buffers, allowing you to maintain positive business relationships while the agency handles collection conversations. Professional collectors employ respectful communication strategies that apply firm pressure without resorting to aggressive tactics that damage your brand.

Comprehensive documentation helps agencies succeed. Provide original invoices, purchase orders, contracts, delivery confirmations, email correspondence, payment history, prior collection attempts, debtor contact information, and any customer disputes or concerns. The more context you share, the better equipped the agency is to develop effective collection strategies. Thorough documentation also protects you legally by demonstrating the debt’s validity and your good-faith collection efforts.

At Southwest Recovery Service, we provide Texas-wide coverage through our network of 12 offices across seven states. Our B2B invoice recovery services target companies with $10M–$100M in revenue, recovering past-due business invoices nationwide while protecting client relationships. Our AI-guided tracking software monitors every promise-to-pay across phone, email, text, and mail channels. With contingency-only pricing, no upfront costs, and specialization in priority sectors like trucking, logistics, contractors, and oil and gas, we deliver the expertise Pasadena’s industrial businesses need.

Note: Recovery rates mentioned are for general reference only and not guaranteed. Actual results vary by account and industry. Contact Southwest Recovery Services for a customized quote.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.