- Customer Service 866-837-3065 Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

Unpaid invoices drain resources and constrain growth, forcing business owners to spend valuable time on collection calls instead of revenue-generating activities. This internal approach rarely produces satisfactory results, as staff often lack the specialized training and legal knowledge required. Furthermore, direct pursuit of payment can damage professional relationships with clients experiencing temporary cash flow challenges.

Professional debt collection agencies change this entirely. They bring specialized tools, legal expertise, and negotiation skills that improve recovery outcomes. They understand Texas debt collection laws, protecting your business from compliance issues while pursuing what you’re owed. Perhaps most importantly, they serve as a neutral third party, separating the collection issue from your ongoing business relationship.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

Contingency-based pricing dominates the Conroe collection market, with agencies typically charging between 10% and 25% of successfully recovered amounts. This model eliminates financial risk since you pay absolutely nothing unless the agency collects your money.

Several factors influence where your fees fall within this range. Account age significantly affects pricing since fresher accounts under 90 days past due command lower percentages, often in the 10–15% range. Aged accounts over 180 days require more extensive work and result in fees toward the higher end.

Balance size also matters. Smaller debts under $1,000 often carry higher percentage fees because fixed effort remains similar regardless of the amount. Larger balances may qualify for reduced rates. Businesses placing multiple accounts simultaneously typically qualify for volume discounts.

Additional services may incur supplementary costs beyond the base contingency fee. Skip tracing, asset investigation, and legal action can add to overall expenses. Reputable agencies disclose all potential fees upfront before you commit to their services.

At Southwest Recovery Services, we have served Texas businesses since 2004, building a strong reputation across industries that drive Conroe’s economy.

We specialize in commercial collections for sectors prominent in the Conroe area, including oil and gas field services, trucking and logistics operations, general and specialty contractors, and property management companies. Our collectors receive specialized training in these industries, understanding the unique payment structures and business patterns involved. This expertise proves invaluable when tackling complex situations like disputed change orders, retention releases, or freight payment disagreements.

We operate exclusively on contingency, meaning Conroe businesses pay nothing unless collection is successful. There are no upfront fees, no monthly retainers, and no hidden charges. Our proprietary AI-guided tracking system monitors every communication and payment promise across phone calls, emails, text messages, and mail correspondence.

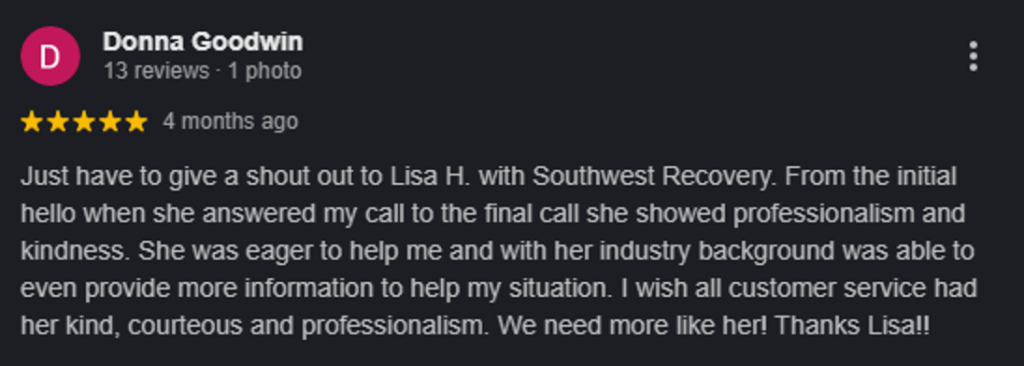

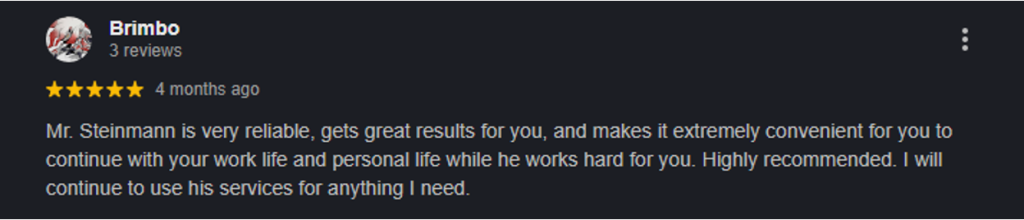

Customers frequently mention that we provide a more respectful experience than typical collection agencies. Reviewers note that staff members work toward resolutions that recover funds without permanently damaging business relationships.

Conroe Collection Services operates from its office in Conroe, specializing in judgment debt collection for Texas businesses.

The firm focuses on legal collection services, emphasizing expertise in Texas collection law and judgment enforcement. They provide free phone consultations to help businesses understand their options and develop appropriate strategies for their specific situations.

Clients appreciate the agency’s local knowledge and accessibility, noting that their understanding of Montgomery County court procedures streamlines the legal collection process. Business owners value the personalized service that comes with working with a locally-based firm, along with responsive communication throughout case progression.

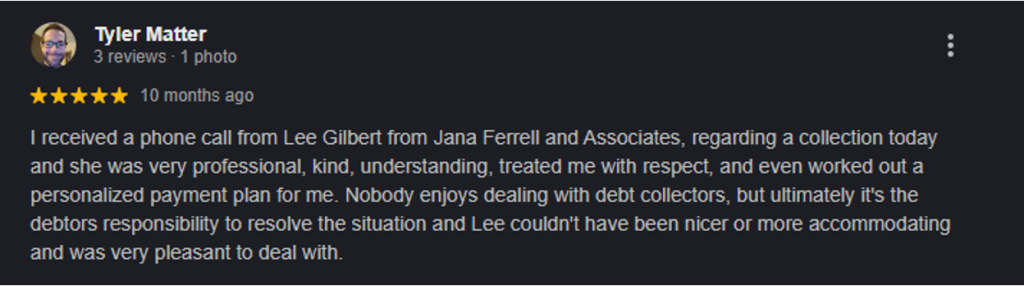

Jana Ferrell provides commercial collection services across Texas, including comprehensive coverage for Conroe businesses. The agency has operated since the turn of the century, developing expertise across multiple industries, including medical practices, manufacturing companies, distribution businesses, financial services firms, and municipal collections.

The firm emphasizes compliance with Texas collection laws and maintains thorough familiarity with both consumer and commercial debt regulations.

Clients from various industries report positive experiences with the agency’s broad expertise and technological capabilities. Business owners note the firm’s professional handling of accounts across different sectors, with particular appreciation for their compliance-focused approach and detailed tracking systems that keep clients informed throughout the collection process.

Select an agency that understands your specific industry and the Texas business environment. Collection approaches that work for consumer debt often fail in B2B situations involving contractors, energy companies, or commercial property managers. For Conroe businesses, this means finding agencies familiar with oil and gas payment cycles, construction retainage practices, freight billing disputes, and commercial lease collection procedures.

Texas debt collection laws establish clear boundaries for collection activities. Your agency must comply with the Texas Debt Collection Act and applicable federal regulations. Ethical agencies treat debtors professionally, protecting your reputation while pursuing recovery. Verify that any agency maintains proper bonding and insurance coverage.

Effective agencies provide regular updates without requiring constant follow-up. Look for client portals providing 24/7 access to account status, collection notes, and payment tracking. Clear communication also means honest assessments of collection probability rather than accepting every account regardless of collectability.

Many B2B relationships survive payment disputes when handled professionally. The best agencies understand that today’s slow-paying client might become tomorrow’s valuable customer. They recover funds through diplomatic negotiation rather than aggressive tactics that destroy future opportunities.

At Southwest Recovery Services, we bring over 20 years of commercial debt recovery expertise to Conroe’s business community. Our Houston location ensures local accessibility for Montgomery County businesses, while our network of 12 offices across Texas, Georgia, Missouri, Florida, Oklahoma, Ohio, and Colorado provides coverage wherever debtors operate.

Our agency’s contingency-only model eliminates financial barriers to professional collection. Rates typically range from 10–25%, depending on account age and complexity, with no upfront fees or hidden charges. You pay only when they successfully recover your money.

Our AI-guided tracking technology monitors every payment promise across all communication channels, ensuring consistent follow-through while creating detailed records. This system provides accountability that distinguishes us from larger, impersonal agencies.

Our veteran collectors specialize in respectful, omnichannel outreach that separates the collection issue from your ongoing business relationship. For Conroe companies in trucking, logistics, contracting, oil and gas, and property management, this industry-specific expertise translates into more effective recovery conversations and better outcomes.

Collection timelines vary based on account age, balance size, and debtor responsiveness. Accounts placed within 90 days of becoming past due typically show results within 30–60 days of agency placement. Complex situations involving disputes or unresponsive debtors may require several months. If litigation becomes necessary, court schedules in Montgomery County can extend timelines to 6–18 months.

Yes, reputable agencies serving Conroe maintain multi-state collection capabilities. At Southwest Recovery Services, we operate offices across seven states and hold credentials throughout the United States. We understand varying state laws regarding collection practices and statutes of limitations, ensuring compliance regardless of debtor location.

Comprehensive documentation strengthens collection efforts significantly. Provide copies of all contracts, purchase orders, and credit applications establishing the business relationship. Include itemized invoices, proof of delivery or service completion, and records of all previous payment attempts. Correspondence where debtors acknowledge the debt proves particularly valuable.

Not when you work with professional agencies that prioritize ethical practices. Reputable commercial collection agencies employ diplomatic communication strategies and work toward mutually acceptable resolutions. The agency serves as a neutral third party, often reducing tension by separating the payment issue from your direct business relationship.

We at Southwest Recovery Services deliver local Texas accessibility through our Houston office, combined with nationwide capability and deep expertise in industries prominent throughout Montgomery County. Our contingency-only pricing eliminates financial risk since you pay nothing unless we successfully collect. With over 20 years of commercial experience, AI-guided tracking systems, and daily founder involvement, we provide personalized attention unavailable from larger agencies. Our compliance-first approach and focus on relationship preservation make us ideal for businesses valuing long-term customer connections.

*Note: Recovery rates mentioned are for general reference only and not guaranteed. Actual results vary by account and industry. Contact Southwest Recovery Services for a customized quote.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.