- Customer Service 866-837-3065 Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

Garland’s economy thrives on manufacturing, logistics, and distribution, thanks to its strategic location near Dallas. This commercial activity inevitably entails unpaid invoices. When clients fall behind on payments, internal collection efforts often prove insufficient. Your accounting team has other priorities, and chasing delinquent accounts takes time, resources, and specialized knowledge your staff may not have.

Professional collection agencies bring expertise in B2B recovery, compliance with the Fair Debt Collection Practices Act (FDCPA), and proven strategies for locating and negotiating with debtors. They understand Texas debt collection laws and can pursue recovery without damaging the business relationships you’ve worked hard to build.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

Several established agencies serve businesses in the Garland area. When selecting a partner, look for Texas licensing, strong BBB ratings, and experience with commercial collections.

We are a nationally recognized full-service accounts receivable management company headquartered in Dallas, Texas. With over 25 years of debt recovery and account servicing experience, we serve businesses throughout the DFW Metroplex, including Garland.

We specialize in commercial collections across multiple industries, including transportation, logistics, manufacturing, and commercial real estate. Our team employs a client-forward recovery approach that prioritizes existing business relationships and reserves legal action as a last resort. Our seasoned collection staff has the expertise to recover the money owed to your business while treating your customers with the respect they deserve.

We work on a contingency-only basis, meaning we don’t get paid unless you do. We also offer nationwide credit reporting at no additional cost to increase the probability of successful collection. Your reputation is as important to us as it is to you.

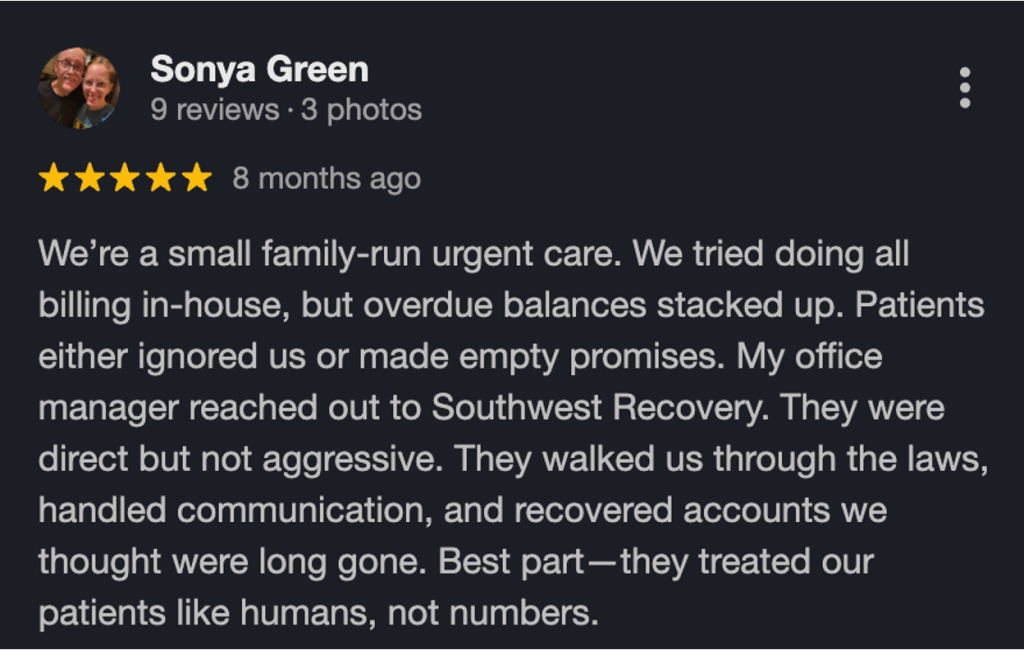

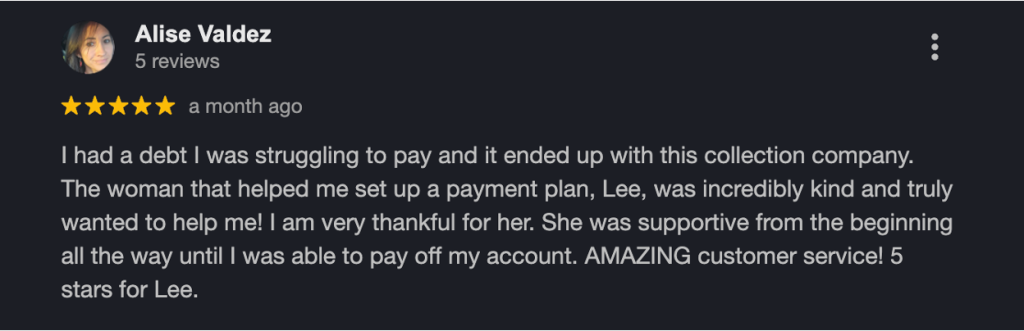

Reviews consistently highlight our team’s professionalism and compassion. Business clients praise our revenue cycle management services for streamlining processes and improving collections with clear reporting. Debtors frequently commend staff members for being respectful, understanding, and going above and beyond to find workable payment solutions. Multiple reviewers describe their experience as “totally different than most businesses that collect debts,” noting genuine listening and dedication to helping both companies and customers.

Jana Ferrell & Associates, L.L.C. is a third-party collection agency specializing in commercial and consumer collections, serving clients across Texas, including Garland. They have served business owners and municipalities for over 20 years, offering expertise in medical, distribution, manufacturing, and municipal collections.

Reviews reflect mixed experiences typical of collection agencies. Many reviewers praise specific staff members for being kind, understanding, and willing to set up personalized payment plans. However, some reviewers report frustrations with repeated calls or communication issues, common complaints in the collections industry.

Most commercial collection agencies charge contingency fees, meaning you pay nothing upfront and only pay the agency when they successfully recover funds. This model aligns the agency’s interests with yours and eliminates financial risk for your business.

Contingency rates typically range from 10% to 25% of the amounts recovered. Several factors determine where your accounts fall within that range. Account age plays the biggest role—fresh receivables under 90 days command lower fees because they’re easier to collect. Accounts aged beyond 180 days require more intensive work, including skip tracing and potentially legal action, which justifies higher rates.

Balance size also matters. Larger accounts may qualify for lower percentage fees because the potential recovery justifies the collection effort. Additionally, businesses that place multiple accounts regularly often negotiate better rates than those that place only sporadic accounts.

Selecting the right collection partner can make the difference between recovering your money and writing off bad debt. Knowing what to look for helps you make an informed decision.

Recognizing warning signs early protects your business from partnering with an agency that could damage your reputation or expose you to legal risk.

Be wary of any agency that guarantees specific recovery percentages. Legitimate agencies understand that outcomes depend on numerous variables—debtor financial situations, account age, and documentation quality. Promises to recover 90% or more likely indicate overstated capabilities or questionable tactics.

Reputable commercial collection agencies work on contingency, earning only when you do. Agencies requesting large upfront payments or monthly retainers before beginning work may be more interested in collecting from you than from your debtors.

If an agency cannot provide its Texas registration number or hesitates when asked about licensing, walk away. Operating without proper credentials violates state law and indicates the agency may cut corners elsewhere.

Professional agencies understand that selecting a collection partner is a significant decision. High-pressure sales tactics or reluctance to provide contracts for review suggest an agency that prioritizes closing deals over building client relationships.

| Feature | Southwest Recovery Services | Jana Ferrell & Associates |

|---|---|---|

| Years in Business | 20–25+ years | Since ~2000 (~25 years) |

| Collection Type | Commercial (B2B) focus | Commercial and consumer |

| Industries Served | Trucking, logistics, manufacturing, commercial real estate, contractors, oil & gas | Medical, distribution, manufacturing, municipal |

| Additional Services | Nationwide credit reporting (free), revenue cycle management, AR management, consulting | Not specified |

| Reviews | Consistently positive; praised for professionalism, compassion, and respectful debtor treatment | Mixed; some praise for kind staff and flexible payment plans, some complaints about repeated calls |

At Southwest Recovery Services, we bring over 20 years of specialized B2B collection experience to Garland businesses. With 12 offices across seven states and headquarters in Dallas, we combine local market knowledge with national reach.

Our contingency-only model means zero financial risk for your business. You pay nothing upfront, no monthly retainers, and no fees unless we successfully recover your money. At Southwest Recovery Services, we focus on commercial collections and understand the unique challenges B2B creditors face. Our multi-channel outreach combines phone calls, emails, formal correspondence, and skip tracing when necessary. We maintain a compliance-first approach that protects your business from legal exposure while preserving the customer relationships essential to your operations.

We stand out due to our commitment to ethical and professional recovery. We treat debtors with respect and work to find solutions rather than simply demanding payment. This relationship-focused approach often results in payment arrangements that recover your money while keeping the door open for future business.

We offer debt recovery, revenue cycle management, accounts receivable management, and consulting services tailored to each client’s needs. Whether you’re dealing with a handful of delinquent accounts or need comprehensive receivables management, we have solutions that scale to your business.

Most Garland collection agencies operate on contingency fees of 10% to 25% of the amounts recovered. You pay nothing upfront—fees are only charged when collections succeed. Rates vary based on account age, balance size, and volume of placements.

Ideally, businesses should engage a collection agency after 90 days of non-payment, following documented internal collection attempts. Before placing accounts, send payment reminders at 30 and 60 days past due, attempt direct contact with accounts payable, and issue a final notice. Accounts placed earlier typically see higher recovery rates.

Reputable agencies follow the Fair Debt Collection Practices Act and Texas debt collection regulations. Always verify that any agency you consider holds proper Texas licensing through the Secretary of State and maintains good standing with the BBB. Compliance protects both you and your customers from improper collection practices.

Most B2B collections resolve within 30 to 90 days when placed with a proactive agency. Timeframes vary based on the debtor’s responsiveness, whether skip tracing is needed, and whether legal action is necessary. Early placement typically results in faster resolution.

At Southwest Recovery Services, we have over 20 years of commercial collection expertise with a proven track record in Texas markets. Our contingency-only pricing eliminates financial risk, and our compliance-first approach protects your reputation. With 12 offices across seven states and AI-guided tracking technology, we provide the infrastructure and expertise to recover Garland business debts efficiently while maintaining the professional relationships your business depends on.

*Note: Recovery rates mentioned are for general reference only and not guaranteed. Actual results vary by account and industry. Contact Southwest Recovery Services for a customized quote.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.