- Make A Payment (866) 558-3328

- Client Portal

- Consumer Support

Midland sits at the heart of the Permian Basin oil boom, where economic prosperity creates substantial B2B transaction volume across drilling contracts, equipment rentals, and service provider agreements. However, this same volatility means local businesses regularly face unpaid invoices that threaten cash flow stability, particularly during industry downturns.

When internal collection efforts stall after 60–90 days, professional agencies bring specialized expertise that most in-house teams lack. These agencies understand Texas collection laws, employ skip tracing technology to locate transient workers common in the energy sector, and maintain the professional approach necessary to preserve valuable business relationships even while pursuing overdue payments.

|

Southwest Recovery Services: Get Your Money Back 20+ Years Experience | Texas-Based | Contingency Only – You Pay When We Collect

Built for Commercial Collections:

The Southwest Recovery Difference: ✓ Contingency only – no upfront costs ✓ Veteran collectors with respectful omnichannel outreach ✓ Priority sectors: trucking, logistics, contractors, oil & gas ✓ Clear reporting on account status and outcomes Trust & Results You Need: Nationally recognized ethical collections agency with 12 offices across six states. Compliance-first approach with no threats or guarantees. |

Top Debt Collection Agencies Serving Midland Businesses

Several capable agencies serve the Midland market, each offering distinct advantages for businesses facing collection challenges in the Permian Basin.

The Kaplan Group specializes exclusively in business-to-business debt recovery, with particular expertise in the energy sector, including major oil and gas clients. Founded in 1991 and headquartered in California with a Houston office, the firm operates on a contingency basis. They focus on larger commercial claims typically exceeding $10,000 and offer services including skip tracing, asset investigation, and litigation support through an in-house attorney. The agency holds an A+ BBB rating and is a member of the International Association of Commercial Collectors.

They receive positive reviews from business clients who appreciate the agency’s professionalism and communication throughout the collection process. While some reviewers note that settlements may involve compromise on the full amount owed, many feel the results exceed what they could have achieved independently.

Ryan & Jacobs specializes in business-to-business debt collection with particular expertise in Midland’s energy sector. Operating on a contingency-based fee structure, they serve diverse industries including oil and gas, construction, and manufacturing. The company offers comprehensive services such as skip tracing, asset investigation, and litigation support, with Texas-wide coverage that is particularly valuable for businesses operating in mobile industries.

Ryan & Jacobs receives very positive reviews from business clients who praise the agency for its fast results, clear communication, and professional service. Clients frequently mention specific representatives by name, commending them for being responsive, knowledgeable, and attentive.

At Southwest Recovery Services, we are a nationally recognized debt collection agency with over 20 years of experience, headquartered in Dallas, Texas, with additional locations throughout Texas and in Georgia, Missouri, Florida, Oklahoma, and Ohio. We provide comprehensive accounts receivable management solutions for businesses of all sizes, handling commercial debt recovery across multiple industries, including oil & gas, construction, healthcare, utilities, and professional services.

At SWRS, we operate exclusively on a contingency basis, meaning clients pay nothing unless their money is recovered, aligning our success directly with client outcomes. Our approach combines ethical, compliant collection methods with professional persistence and advanced technology. Full compliance with FDCPA, FCRA, HIPAA, CFPB, and state-specific regulations is maintained throughout all collection activities.

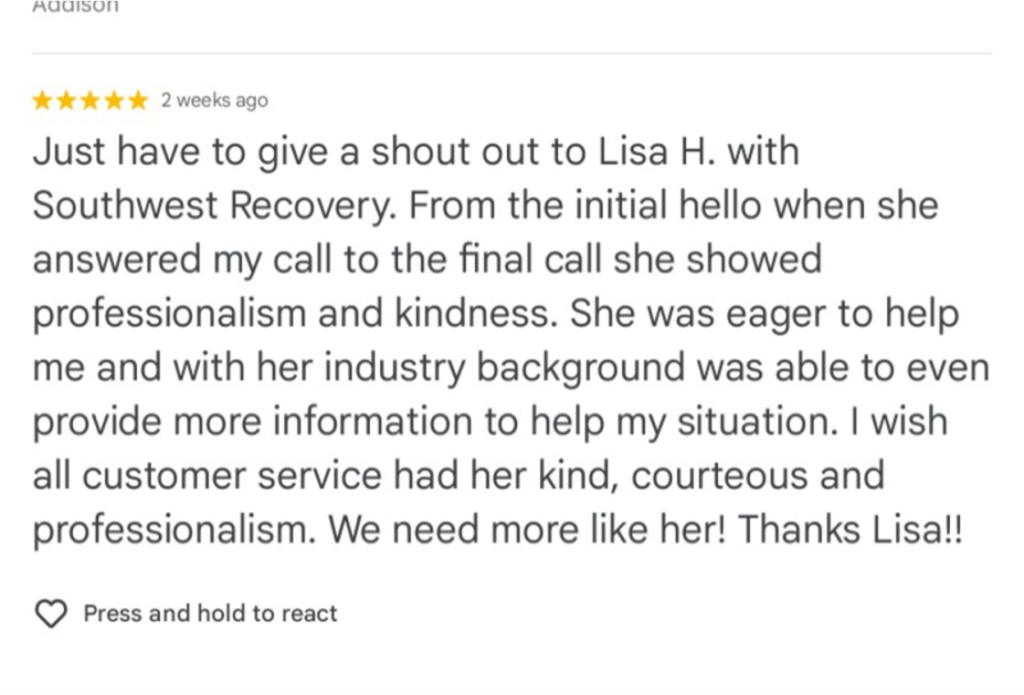

At Southwest Recovery Services, we receive positive reviews from both business clients and consumers. Business owners praise strong collection results and transparent reporting. At the same time, consumers consistently highlight the respectful, patient approach of our staff, who are frequently recognized for creating manageable payment plans and providing prompt documentation. Reviewers note feeling treated with dignity rather than pressure, with several expressing surprise at having a positive experience with a collection agency.

Most Midland collection agencies operate on a contingency basis, meaning they only get paid when you do. Commercial accounts typically incur fees between 10% and 25% of the amount recovered, with your rate depending on several factors.

Debt age plays a significant role—accounts under 90 days cost less to collect, while debts beyond 180 days command higher fees due to the added difficulty. Size matters too: larger balances often qualify for lower percentage rates since the dollar amount justifies the effort, whereas smaller debts tend to carry higher percentages. Businesses that place multiple accounts at once or maintain ongoing relationships with an agency can often negotiate volume discounts. Complexity also affects pricing: straightforward collections cost less than those that require skip tracing, legal action, or out-of-state work.

To illustrate, a $50,000 overdue drilling contract at a 20% contingency fee would return $40,000 to your business, far better than a write-off. Keep in mind that litigation, if needed, may add court filing fees, service of process charges, and attorney costs.

When selecting a collection agency, several critical factors deserve careful evaluation beyond simple pricing comparisons.

Verify that the agency is properly licensed, bonded, and insured, and registered with Texas’s Secretary of State. This ensures they operate legally within state boundaries and maintain adequate financial protections.

Most reputable agencies operate on a contingency basis, meaning you only pay when they successfully recover funds. Ask about their collection approach and request references from businesses similar to yours in size and industry to verify their proven results. Agencies that use professional and diplomatic methods are more likely to preserve client relationships while still achieving strong recovery outcomes.

Ensure the agency maintains full compliance with the Fair Debt Collection Practices Act (FDCPA) and demonstrates thorough knowledge of state laws like the Texas Debt Collection Act, along with adherence to all relevant federal and state regulations. Texas law provides a four-year statute of limitations for most commercial debts, making timely action essential.

Look for agencies offering access to real-time online portals for account monitoring, detailed reporting capabilities, and prompt payment remittance upon collection. Clear communication prevents surprises and keeps your finance team informed throughout the recovery process.

Finally, consider the agency’s industry experience and capacity, including their experience in your specific sector, adequate staffing and resources to handle your account volume, and specialized knowledge relevant to Midland’s unique business environment, particularly in oil, gas, and construction industries.

At Southwest Recovery Services, we deliver the comprehensive solution that Midland companies require. With over 20 years of Texas-based expertise and 12 strategically located offices across seven states, we combine regional understanding with nationwide collection capabilities essential for businesses operating across state lines.

Our AI-guided tracking system monitors every account across multiple communication channels, including phone, email, text, and mail, ensuring no collection opportunity goes overlooked while maintaining detailed documentation that protects your business legally. Our founder’s daily involvement brings seasoned judgment to complex cases that require strategic decision-making beyond standard collection protocols.

We use a contingency model charging between 10–25% of recovered funds, eliminating financial risk as you pay absolutely nothing upfront and only when debts are successfully recovered. This performance-based approach aligns our incentives directly with client goals, motivating maximum effort on every account.

We employ veteran collectors who use respectful, omnichannel outreach that pursues debts firmly while maintaining the professional tone essential for B2B relationships. They understand that today’s difficult accounts might become tomorrow’s valuable customers again once financial circumstances improve, making relationship-focused collection methods a strategic business advantage.

For Midland companies across oil & gas, construction, healthcare, logistics, and wholesale distribution sectors, we provide specialized industry knowledge that proves decisive in many cases. Our compliance-first approach protects clients from FDCPA violations and legal exposure while transparent reporting keeps businesses informed throughout the recovery process. We offer comprehensive services, including demand letters, skip tracing, asset investigation, credit reporting, and full litigation support when necessary.

Oil price volatility directly impacts collection outcomes in Midland. During downturns, many oilfield service companies, contractors, and suppliers experience cash flow constraints simultaneously, making recovery more challenging as debtors genuinely struggle to pay. Conversely, when prices rebound, businesses often have renewed capacity to settle outstanding obligations. Experienced collection agencies time their outreach strategically, understanding that aggressive pursuit during severe downturns may be counterproductive, while prompt action during recovery periods can yield substantial results. Working with an agency familiar with energy sector cycles helps Midland businesses maximize recovery.

Yes, you can maintain an active business relationship with a customer even while a collection agency pursues their past-due balance. Many businesses, particularly those serving ongoing drilling operations or construction projects, need this flexibility. Reputable agencies understand this dynamic and can pursue older debts while you require payment upfront (COD) for new transactions. Clear communication between your company and the collection agency ensures recovery efforts don’t inadvertently disrupt current revenue streams.

When a debtor company closes, collection becomes more complex but isn’t necessarily impossible. Options depend on the business structure: if personal guarantees were signed, the agency can pursue individual guarantors directly. For corporations and LLCs, asset investigation may reveal remaining equipment, receivables, or bank accounts that can satisfy the debt before final dissolution. If owners transferred assets improperly to avoid creditors, fraudulent conveyance laws may provide legal remedies. At Southwest Recovery Services, we conduct thorough asset investigations and work with affiliated attorneys to pursue all available recovery avenues, including successor liability claims if the business reopened under a new name.

Unlike consumer debt, commercial debt reporting operates differently and with fewer standardized channels. The impact on a debtor’s business credit profile can affect their ability to secure financing, establish vendor accounts, or win contracts, often providing strong motivation to resolve outstanding balances. Not all collection agencies offer commercial credit reporting as part of their services, so confirm this capability if credit reporting leverage is essential to your collection strategy.

Collecting from out-of-state contractors presents unique challenges common in Midland’s energy sector, where companies from across the country converge for Permian Basin projects. Key considerations include determining which state’s laws govern the contract, locating contractors who may have left Texas after project completion, and potentially pursuing legal action in multiple jurisdictions. Collection agencies with multi-state presence and licensing can pursue these debtors effectively regardless of where they relocate. This is precisely why at Southwest Recovery Services, we maintain 12 offices across seven states, ensuring seamless recovery capabilities when contractors return to their home states.

*Note: Recovery rates mentioned are for general reference only and not guaranteed. Actual results vary by account and industry. Contact Southwest Recovery Services for a customized quote.

We make it fast and easy to refer past due and delinquent accounts to our professional recovery agents. You decide the range on what you will accept on each case, and you ONLY pay a percentage of what we actually collect to resolve the case. Ready to get started, or want to learn more? Fill out this form and a dedicate account manager will call you to get started.